Technological Edge in Rare Metal Extraction and Rising Exchange Rates

Status as a 'Strategic Mineral Production Base' Reaffirmed

Retirement of Treasury Shares Acquired During Management Dispute

Korea Zinc has achieved significant performance growth, overcoming the ongoing management dispute with Young Poong and MBK Partners since last year, as well as the challenging non-ferrous smelting market conditions. In particular, rising prices of strategic minerals such as antimony and indium, along with an increase in exchange rates, have driven profit improvements.

Chairman Yoonbeom Choi of Korea Zinc (center) is visiting the Onsan Smelter to tour the product manufacturing site. Photo by Korea Zinc

Chairman Yoonbeom Choi of Korea Zinc (center) is visiting the Onsan Smelter to tour the product manufacturing site. Photo by Korea Zinc

On May 9, Korea Zinc announced that it recorded sales of 1.458 trillion won and an operating profit of 271.1 billion won in the first quarter of this year. These figures represent increases of 61.4% and 46.9%, respectively, compared to the same period last year. For the first quarter, the operating profit is the second highest in the company’s history, while sales reached an all-time high.

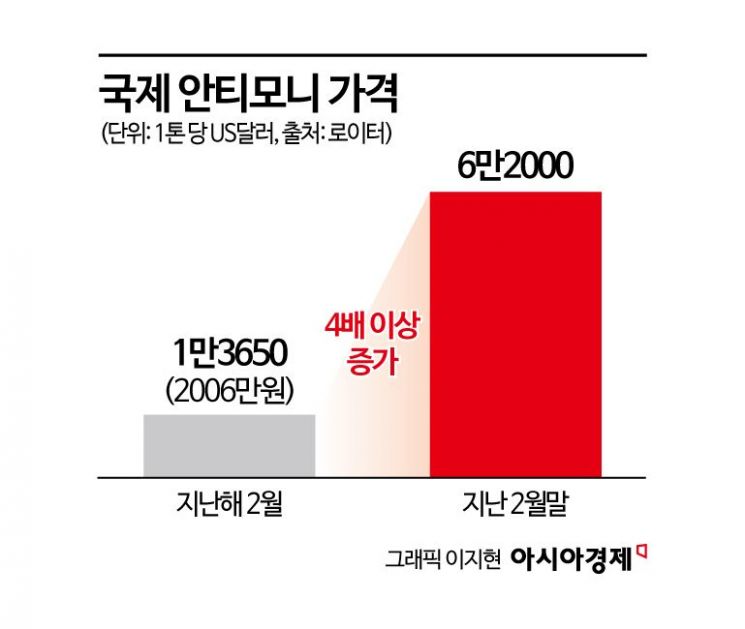

The strong performance is attributed to the rise in prices of strategic minerals. In September last year, China, which accounts for more than half of the world’s production, began full-scale export controls on rare metals, causing global prices of strategic minerals such as antimony, indium, and bismuth to surge. Korea Zinc is the only company in Korea that produces and supplies rare metals such as antimony. The price of antimony, which stood at $13,650 (19.18 million won) per ton in February last year, soared to $62,000 by the end of February this year, more than quadrupling in a year. The prices of indium and bismuth also rose by 1.5 times and 5 times, respectively, during the same period. In addition, the increase in exchange rates contributed to higher selling prices, which was reflected in this quarter’s performance.

A representative from Korea Zinc stated, "The improvement in first-quarter results this year is due to the rise in metal prices and exchange rates, increased sales volume of rare metals, and the stable expansion of new businesses. In particular, sales in the strategic minerals segment, including antimony, indium, and bismuth, increased by more than 3.5 times, further solidifying our position as the only domestic production base for strategic minerals." Korea Zinc plans to further improve its performance in the strategic minerals segment by increasing the recovery rate of rare metals.

At the board meeting held the previous day, Korea Zinc resolved to retire all of its treasury shares acquired last year to defend against the acquisition attempt by Young Poong and MBK Partners, by the end of this year. The shares to be retired amount to 2,040,030 shares, which represents 9.85% of the total 20,703,283 shares issued. Korea Zinc plans to carry out the retirement in three phases in June, September, and December.

At the same board meeting, Deoknam Hwang was appointed as chairman of the board as an outside director, and Gideok Park was reappointed as CEO. Chairman Hwang, a former judge, is a legal expert with 40 years of experience, having served at the Seoul District Court, Seoul High Court, and the Office of Civil Affairs at the Blue House. He has also been active in the Committee for the Improvement of Gender Discrimination, the Central Labor Relations Commission, the National Human Rights Commission, UNICEF, and has served as an outside director and board chairman at Hana Bank. With Chairman Hwang’s appointment, the independence and autonomy of Korea Zinc’s board are expected to be further enhanced.

CEO Park has served as CEO for two years, from March 2023 to March this year, and has been at the forefront of promoting Korea Zinc’s new business strategy, the 'Troika Drive.' He has contributed to expanding Korea Zinc from a smelting-focused company into the renewable energy, secondary battery materials, and resource recycling sectors, and is credited with laying the foundation for growth, including achieving record-high sales in the first quarter of this year.

A Korea Zinc official stated, "By retiring all treasury shares and appointing an outside director as board chairman, Korea Zinc’s board and management are faithfully fulfilling the promises made to shareholders, investors, and the market. We will continue to make various efforts to become a model company that enhances shareholder value along with management performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.