HD Hyundai Construction Equipment and Infracore Surge 13% on Merger News

Unified Decision-Making, R&D, and Supply Chains Expected to Cut Costs

Multiples of Both Companies Projected to Align by the Second Half of This Year

With the announcement of the merger between HD Hyundai Construction Equipment and HD Hyundai Infracore, the market is closely watching the future direction of their stock prices. Securities firms are focusing on the synergies the two companies will generate and are racing to raise their target prices.

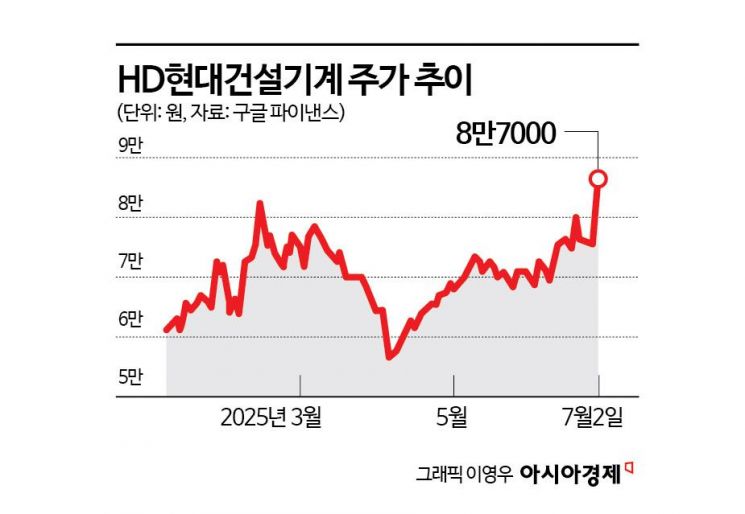

According to the Korea Exchange on July 3, HD Hyundai Construction Equipment closed at 87,000 won the previous day, up 15.23% (11,500 won). This represents a 55% increase from its low of 55,900 won in April. Investor sentiment was boosted by the news on July 1 that the company, as the surviving entity, would absorb HD Hyundai Infracore (up 5.52%) through a merger.

The securities industry has a positive outlook on the merger between the two companies. This is because, as the construction equipment industry passes its bottom, the merger is expected to strengthen both cost competitiveness and market responsiveness in advance. The merged entity, tentatively named HD Construction Equipment, is projected to achieve sales of 8.6 trillion won and operating profit of 400 billion won in 2025, with expectations of entering the global top 10 in the construction equipment market.

Han Youngsoo, a researcher at Samsung Securities, said, "Since the company will retain both existing brands (Hyundai and Develon), it may take some time to confirm business synergies, but positive effects are expected from a financial market perspective." He raised his target price from 76,000 won to 86,000 won. He also diagnosed that, once the industry recovers, the unique position of HD Hyundai Construction Equipment as the only large construction equipment manufacturer listed on the domestic stock market will act as a premium factor for its share price.

The high multiples that HD Hyundai Infracore (HDI) has enjoyed by supplying engines to the power and defense sectors are also expected to benefit HD Hyundai Construction Equipment (HCE). Choi Kwangsik, a researcher at Daol Investment & Securities, said, "By the second half of this year, HDC's price-earnings ratio (PER, 11 times) will catch up to HDI's (17 times), and from 2026, HD Construction Equipment will also enjoy the value of HDI's engine business and its high multiples." He raised his target price from 70,000 won to 130,000 won.

HD Hyundai Infracore also retains share price momentum, such as K-defense engine orders and large-scale bulk orders from Ethiopia. However, experts generally agree that any aggressive increase in holdings should be decided cautiously, taking the merger ratio into account. The merger ratio is set at approximately 0.16 shares of HD Hyundai Construction Equipment for each share of HD Hyundai Infracore, with HD Hyundai Construction Equipment to issue 30.63 million new shares to be allocated to HD Hyundai Infracore shareholders.

Shareholders opposed to the merger must submit their objections in writing between August 29 and before the start of the extraordinary general meeting on September 16, and exercise their appraisal rights between September 16 and October 10. However, if the scale of appraisal rights exercised exceeds 150 billion won for HD Hyundai Construction Equipment or 250 billion won for HD Hyundai Infracore, the merger may be reconsidered. The company is reportedly planning to cancel any treasury shares acquired through the exercise of appraisal rights.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.