Seoul Re-Tech Project Collaboration

Lecture on Preventing Financial Fraud and Asset Management

Enhancing Financial Literacy for the Financially Marginalized

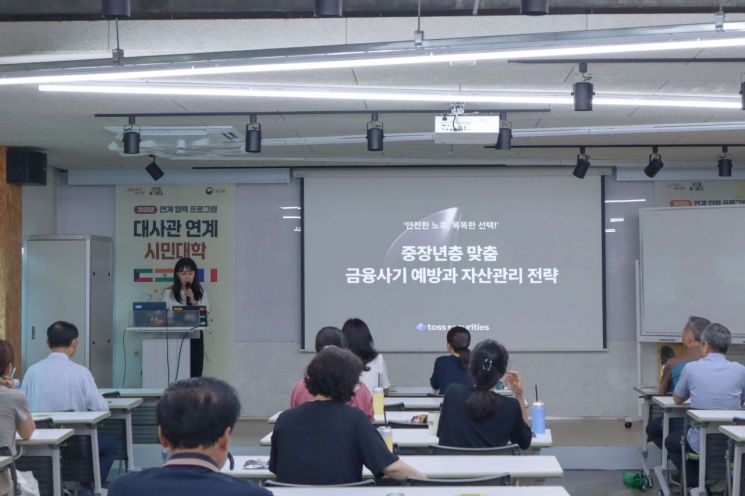

Toss Securities announced on July 2 that it successfully concluded a customized financial education program for middle-aged and older adults, which was held in collaboration with the Seoul Metropolitan Lifelong Education Promotion Institute on June 25.

This program was a social contribution initiative jointly organized by Toss Securities and the Seoul Metropolitan Government through public-private cooperation. It was designed to enhance financial literacy and strengthen asset protection capabilities among financially marginalized groups. As part of the "Seoul Re-Tech" project, the program was held under the theme "Safe Retirement, Smart Choices" at the Seoul Citizens' University Central Campus, with a total of 31 citizens in their 40s to 60s participating.

Toss Securities is conducting a customized financial education program for middle-aged and older adults in collaboration with the Seoul Metropolitan Lifelong Education Promotion Institute on June 25. Toss Securities

Toss Securities is conducting a customized financial education program for middle-aged and older adults in collaboration with the Seoul Metropolitan Lifelong Education Promotion Institute on June 25. Toss Securities

The lecture was divided into two parts. In the first part, Moon Changyeop, Manager of the Consumer Protection Team at Toss CX, introduced recent types of increasingly sophisticated financial fraud and real-life cases of damage, and shared practical prevention strategies and response measures that can be applied in everyday life.

In the second part, Lee Jiseon, an analyst at the Toss Securities Research Center, presented realistic asset management strategies and financial investment methods tailored to different life stages for middle-aged and older adults. After the lecture, there was an active Q&A session and discussion with the participants, which demonstrated the high level of interest and enthusiasm for financial education among the middle-aged and older demographic.

A representative from Toss Securities stated, "Although investment and asset management have become essential skills in today's world, there are still marginalized groups who do not have sufficient access to financial education opportunities. We want to continue expanding educational opportunities in collaboration with various partners and contribute to the popularization of financial education."

Since last year, Toss Securities has been engaged in a variety of social contribution activities targeting groups with limited access to financial education, such as young adults, those new to the workforce, and middle-aged and older adults. In November of last year, the company successfully operated a financial mentoring program for self-supporting youth in cooperation with Toss CX and ChildFund Korea.

The Seoul Metropolitan Government, through the "Seoul Re-Tech" project, provides economic education and one-on-one financial counseling to Seoul citizens aged 40 and older, offering practical support to help them prepare for a stable retirement after leaving the workforce.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.