"Network Usage Fees Labeled as Digital Trade Barrier"

USTR Trade Barrier Report Points Out Issue

Korean Telecom Companies Criticize: "Ignoring Reality... Portraying Domestic Operators as Monopolists"

Parker, CEO of Hyundai Motor America,

Notifies Dealers of Possible Car Price Increases

Cover of the 2025 Trade Barriers Report released on the 31st (local time) by the U.S. Trade Representative (USTR). Photo by USTR

Cover of the 2025 Trade Barriers Report released on the 31st (local time) by the U.S. Trade Representative (USTR). Photo by USTR

The United States Trade Representative (USTR) criticized the bill under discussion in the National Assembly that requires overseas content providers like Google and Netflix to pay network usage fees in South Korea as "anti-competitive," prompting backlash from the South Korean government and telecom companies. They argue that it is premature to raise concerns since the related bill has not yet been passed into law, and other domestic content providers are already paying network usage fees. Additionally, 60% of domestic companies foresee direct or indirect impacts as reciprocal tariffs imposed by the Trump administration approach imminently, with negotiations expected to begin to reduce mutual tariffs between the South Korean and U.S. governments.

On the 31st of last month (local time), USTR pointed out South Korea's imposition of network usage fees as a digital trade barrier in its "2025 National Trade Barrier Report." On the 1st, Ryu Je-myung, Director of the Network Policy Office at the Ministry of Science and ICT, stated, "During the legislative process, U.S. content providers can raise issues as stakeholders, but they are criticizing a bill that has not even been implemented yet," adding, "The bill does not directly impose any obligation on how much network usage fees must be paid."

Telecom operators such as SK Broadband, KT, and LG Uplus also criticized the report. A representative from the domestic telecom industry said, "The Korean media market is effectively dominated by global big tech companies, but this reality is ignored, and it is portrayed as if domestic operators have a monopoly," adding, "Other Korean content providers are already paying network usage fees."

The report also took issue with South Korea's Online Platform Act (Platform Act), which is being promoted by the Fair Trade Commission. This law regulates online platforms to prevent unfair practices when dealing with tenant companies or consumers. The report pointed out, "While it appears to apply to several major U.S. companies operating in the Korean market and two Korean companies, many other major Korean companies and companies from other countries are excluded."

Domestic tech companies expressed concerns that if the Platform Act passes amid opposition from U.S. companies, only domestic companies might suffer. A representative from the Korea Internet Corporations Association said, "Even if the law passes, since the U.S. has raised issues, the Korean government will inevitably feel burdened regulating foreign companies," adding, "If the legislation is pushed through, the regulations may ultimately apply only to domestic companies, not U.S. big tech."

The report also pointed out 'offset trade' in the defense sector as a trade barrier in South Korea. Offset trade refers to a trade practice where, when purchasing weapons, military supplies, or services worth over $10 million from abroad, the contracting party receives technology transfer, parts manufacturing/export, or military support in return. However, this practice is also declining. According to the Korea Institute for Industrial Economics & Trade's report "Recent Trends and Development Tasks of K-Defense Offset Trade," over the past five years (2016?2020), South Korea's weapon imports from overseas amounted to 13.6 trillion won, but the value of offset trade acquired was only 1 trillion won, about 7% of total weapon imports.

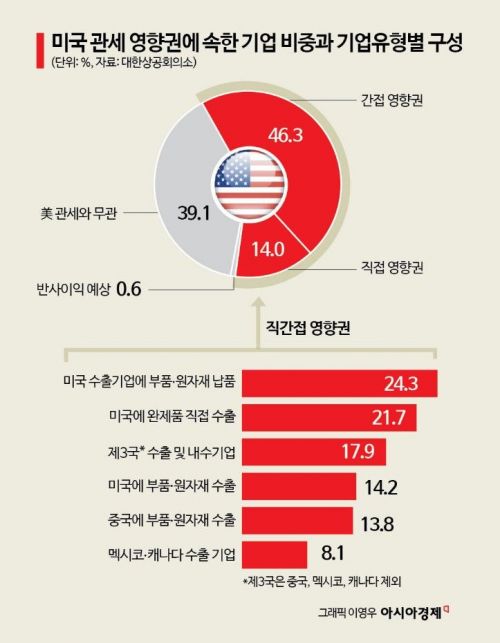

Alongside the U.S. government's criticism of non-tariff barriers, corporate anxiety over reciprocal tariffs is growing. According to a "U.S. Tariff Impact Survey" conducted by the Korea Chamber of Commerce and Industry targeting 2,107 manufacturing companies nationwide, 60.3% of respondents said they are affected by U.S. tariff policies. Among them, 14.0% responded they are "directly affected," and 46.3% said they are "indirectly affected."

The types of companies expected to be hit hardest by tariff policies were those supplying parts or raw materials to U.S. exporters at 24.3%, followed by companies exporting finished products to the U.S. at 21.7%. Companies exporting to third countries and domestic companies (17.9%), companies exporting parts/raw materials to the U.S. (14.2%), and companies exporting parts/raw materials to China (13.8%) were also analyzed to be affected by tariffs.

Some companies are considering price increases in the U.S. market due to tariffs. According to Reuters, Randy Parker, CEO of Hyundai Motor's U.S. sales division, recently notified dealers in a letter that "current car prices are not guaranteed and may change for products wholesaled after April 2." Parker indicated that "tariffs are not easy," suggesting that the potential price changes are a response to tariffs imposed by the Trump administration. On March 26, U.S. President Donald Trump announced that starting April 3, a 25% tariff would be imposed on automobiles imported into the U.S.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.