Following the China-originated deep-sea shock, an analysis has emerged that the AI-led stocks are shifting from AI semiconductors and infrastructure to AI software. This differentiation is being observed not only among the so-called 'Magnificent 7 (M7)'?which have led the New York Stock Exchange?but also in AI-related exchange-traded funds (ETFs).

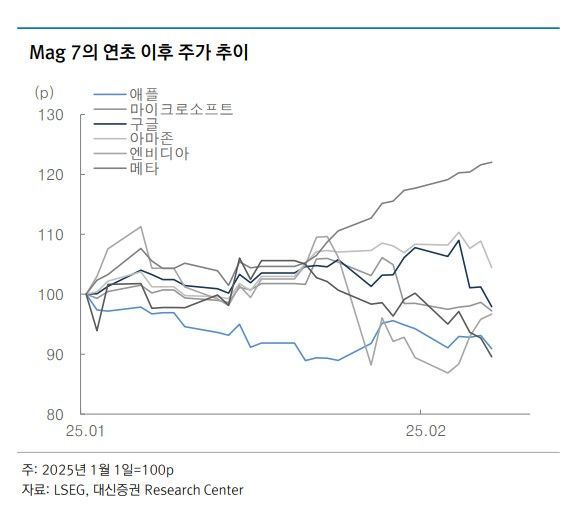

On the 11th, Hyunjung Park, a researcher at Daishin Securities, revealed this in a report titled "Differentiated AI Performance by Stock after Deep-Sea Shock. Replacement of AI Leading Stocks?" Park noted, "Among the M7, Nvidia was by far the best performer last year, but it has shown a sluggish trend since the beginning of the year," adding, "Following the deep-sea shock and earnings announcements, the stock prices of the seven companies have continued to show differentiated trends."

Among the M7, only two stocks?Meta Platforms and Amazon?have risen since the beginning of the year. Based on the closing prices of the New York Stock Exchange on the 10th (local time), their gains were 22.52% and 6.27%, respectively. In contrast, Nvidia, the AI leader that surged 171% last year alone, remained nearly flat, while Tesla fell by 13% and Apple dropped more than 9%.

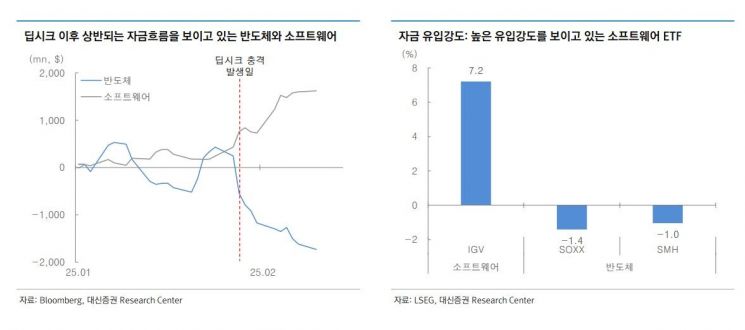

This differentiation trend is similarly confirmed in AI-related ETFs. Among nine ETFs, three products?WISE (Generative AI), AIQ (Global AI), and IGV (Software)?showed greater gains in early February compared to the losses at the end of January. They all share the commonality of having a high proportion of AI software-related companies, accounting for 52.2%, 25.3%, and 86.6%, respectively. Park explained, "On the other hand, the U.S. power equipment ETF ZAP fell 3.5% in the week following the deep-sea shock and has hardly recovered since," adding, "This leads to the judgment that AI leading stocks have shifted to AI software after the deep-sea shock."

In particular, Park emphasized that investment funds are also moving from AI semiconductors to AI software. He pointed out, "The AI market broadly connects AI semiconductors (computing), AI infrastructure (data and cloud systems), software (development, deployment, and operation of AI models), and applications (end-user services). After the deep-sea shock, the semiconductor and software sectors have shown opposite capital flow trends." He added, "While capital outflows continue in semiconductors, capital inflows persist in software."

Accordingly, Park suggested expanding interest in software products in addition to semiconductor and infrastructure ETFs when investing in AI. He analyzed that the semiconductor EPS growth rate will shrink to 38.1% in 2025 and 23.1% in 2026, whereas the software EPS growth rate will expand to 11.8% and 14.9% during the same period.

As a key ETF of interest, he presented IGV, a product that diversifies investment in large North American software companies. Most of its sectors, 86.6%, are software, with computer (6.8%) and internet (5.1%) also included. The top holdings in the portfolio are Oracle (8.7%), Microsoft (7.9%), Salesforce (7.9%), Palantir (7.0%), and ServiceNow (6.6%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.