Decline in Redevelopment Project Feasibility Increases Burden on Association Members

Concerns Over Raising Contributions and Relocation Costs, Housing Instability for Elderly

Need for New Housing Pension to Address Current Housing Pension Drawbacks

Incorporating Development Gains and Allowing Individual Withdrawal of Contributions

As construction costs soar, maintenance projects are facing setbacks, threatening the housing stability of elderly union members. There are calls for the introduction of a 'Maintenance Project-Type Housing Pension' product to help cover contributions and relocation expenses.

On the 18th, the Korea Construction Industry Research Institute released a report titled "Proposal for the Introduction of a Maintenance Project-Type Housing Pension That Allows Continuous Residence in One's Home." Lee Tae-hee, a senior research fellow at the institute, explained, "It is expected that construction costs, interest rates, and the housing market situation will not return to the conditions of the past. Considering the high proportion of elderly union members in maintenance project areas, including first-generation new towns, it is urgent to seek ways to facilitate smooth financing of maintenance projects and enhance housing stability for the elderly."

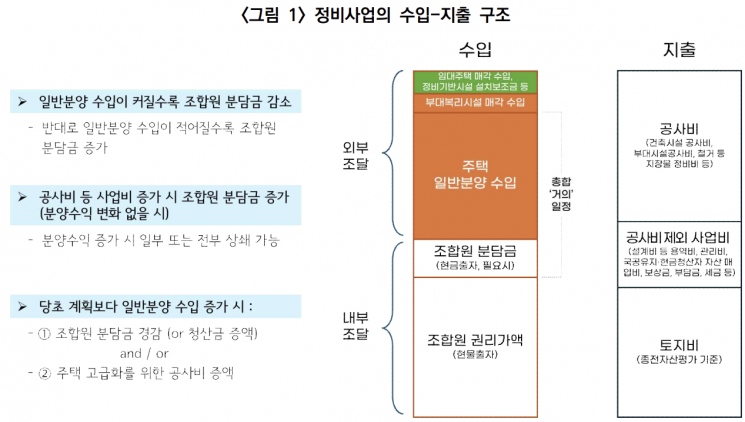

Union members with insufficient cash assets take out mortgage loans at the time of moving in to repay the principal and interest on contribution loans and relocation loans (hereafter referred to as contribution loans, etc.). Elderly union members with low income may face restrictions when obtaining mortgage loans to repay contribution loans and others. Due to the financial burden, they are expected to be unable to live in the completed housing and may have to rent it out or dispose of it.

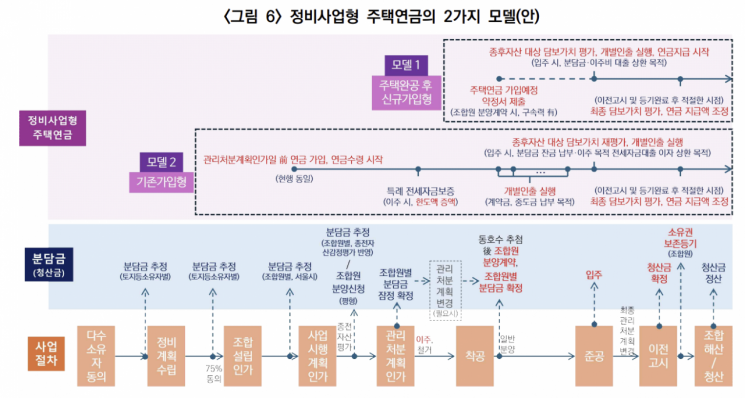

The institute proposed the introduction of a 'Maintenance Project-Type Housing Pension' to address these issues. Lee pointed out, "Currently, the products operated by the Korea Housing Finance Corporation are available only up to the stage before management disposition approval, or after the previous notification or registration of ownership preservation is completed. If joined before the management disposition approval stage, development gains are not properly reflected, and there are restrictions on relocation and contribution loans."

The current housing pension operates by recalculating the collateral value by simply adding the contribution amount to the existing collateral value without re-evaluating the value of the housing purchased after the maintenance project, and then adjusting the monthly payment accordingly. There are also restrictions on securing relocation loans. Since the Korea Housing Finance Corporation sets a senior mortgage on the collateral housing, union members who have joined the housing pension face limitations in obtaining relocation loans. Although the corporation provides special lease guarantees, the limit is capped at 300 million KRW.

The institute presented five measures to supplement the current housing pension system. One is to introduce a structure that can reflect development gains in the collateral housing price after housing completion. They also suggested improving issues related to relocation and contribution financing, including contribution loans in the usage of individual withdrawals, resolving inconsistencies between the repayment timing of contribution loans and the timing of housing pension enrollment and individual withdrawals, and eliminating uncertainties regarding eligibility for housing pension enrollment due to price increases during the project process.

The institute proposed two 'Maintenance Project-Type Housing Pension' product models that can compensate for the shortcomings of the current housing pension products. The first is the 'New Enrollment After Housing Completion' model. It does not allow individual withdrawals for contribution purposes and can improve the mismatch between the repayment timing of contribution loans and the timing of housing pension enrollment and individual withdrawals, as well as the uncertainty of eligibility caused by price increases during the project process.

The second is the 'Existing Enrollment' model. It is a product that improves the shortcomings of not reflecting development gains realized after housing completion in the collateral housing value, difficulties in securing relocation and contribution financing, and the inability to make individual withdrawals for contribution purposes.

Lee explained, "In the current housing pension system, re-evaluation of the collateral value for the same housing after enrollment is generally not allowed. Considering the special characteristics and public benefits of maintenance projects, exceptions need to be recognized. Maintenance projects have the unique feature of incurring costs and risks to improve residential environments and increase asset values, enhancing value through efforts to create new housing complexes and infrastructure."

The institute forecasted that if a housing pension suitable for maintenance projects is introduced, it would facilitate the financing of contributions by elderly union members, thereby increasing the agreement rate. This could reduce disputes, contribute to the swift promotion of maintenance projects, and expand housing supply. The housing pension can help not only the housing stability but also the living stability of the elderly.

Lee asserted, "It is unlikely that the era when construction costs, interest rates, and housing market conditions allowed for securing profitability in maintenance projects will return. In the 'new normal' environment for maintenance project promotion, the introduction of a maintenance project-type housing pension is necessary as a measure to achieve smooth project progress and improve the displacement of the elderly simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.