Gold Bar Sales at Five Major Banks

More Than Double From Previous Month

Gold Banking Balances Also Surpass 2 Trillion Won

"All-in" Investing Requires Caution

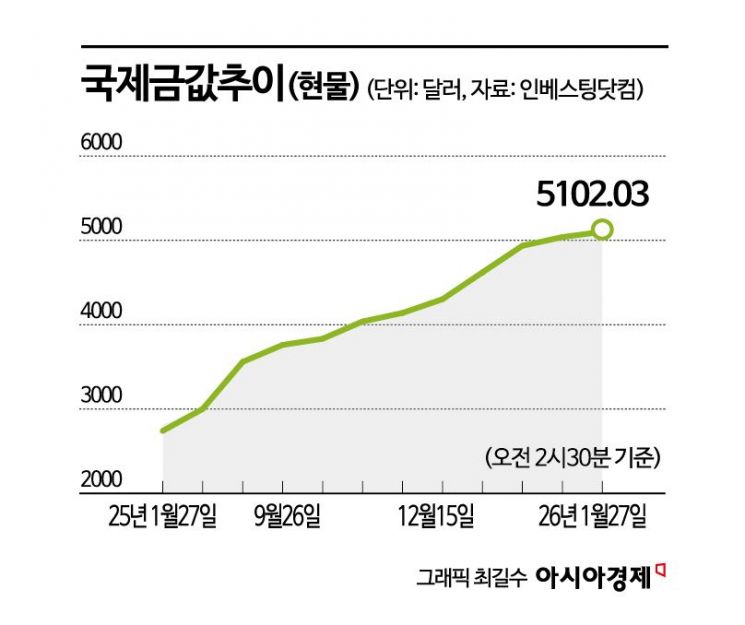

As international gold prices surpassed $5,100 per troy ounce (31.1g) for the first time ever, domestic sales of gold bars and gold banking products are also surging. This is due to expectations that the rally in gold prices will continue, driven by U.S. President Donald Trump's attempts to reshape the international order, the weakening of the U.S. dollar, and a growing preference for safe-haven assets. However, some caution that "all-in" investments-concentrating a significant portion of assets in gold-may be risky given the recent increase in short-term volatility.

Sales Double in a Month... Gold Banking Balances Surpass 2 Trillion Won

According to the financial sector on January 27, the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) sold 73.3 billion won worth of gold bars from January 1 to 23, more than double the previous month's 35 billion won. This figure far exceeds last year's monthly average of 57.5 billion won. Excluding Nonghyup, which does not disclose sales volume, the four other banks sold 291kg of gold bars, up 120.45% from the 132kg sold in the previous month.

Gold banking balances-deposit-type products allowing gold to be bought and sold in 0.01g increments-also surpassed 2 trillion won for the first time. As of January 26, the gold banking balances at three major banks (Kookmin, Shinhan, and Woori) stood at 2.2049 trillion won, showing a sharp increase since the end of last year (1.932 trillion won). There has also been a strong inflow of funds into gold exchange-traded funds (ETFs). As of the previous day, the total net assets of the ten gold ETFs reached 7.1768 trillion won, increasing by 607.1 billion won in one month and by 3.4299 trillion won in six months.

Geopolitical Instability and Dollar Weakness... Beware of Chasing the Rally

Multiple external factors are driving gold prices to unprecedented heights. According to Investing.com and other sources, on January 26 (local time), the international spot gold price closed at $5,102 per ounce, up 2.4% from the previous session and reaching an all-time high. Gold futures for February delivery on the New York Mercantile Exchange also closed strong at $5,082.50 per ounce. The domestic gold price (based on the KRX Gold Market) also rose 1.67% from the previous trading day, setting a new record high.

Experts analyze that the surge in U.S. government debt and the resulting decline in the dollar's value, as well as controversies such as the indictment of Federal Reserve Chair Jerome Powell-which undermines central bank independence-are pushing gold prices higher. In addition, geopolitical uncertainties, such as President Trump's attempts to secure control over Greenland, are prompting central banks around the world to increase their gold reserves. The expansion of the artificial intelligence (AI) industry, which is driving up industrial demand for gold (accounting for 7-10% of total demand), is also cited as a factor in the price increase.

While international investment banks (IBs) are raising their gold price targets to the $5,500-$6,000 range, the financial sector is warning against speculative approaches by individual investors. A commercial bank official said, "Recently, more customers are inquiring about allocating over 90% of their assets to gold after the sharp price surge," warning, "This is a very risky move in the current environment of heightened price volatility." The official added, "To manage risk, it is advisable to use gold ETFs or staggered purchases and allocate gold to about 20-30% of your portfolio."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)