Emphasizing Both Industrial and Store-of-Value Functions

"Structural Metal Supporting the Global Economy"

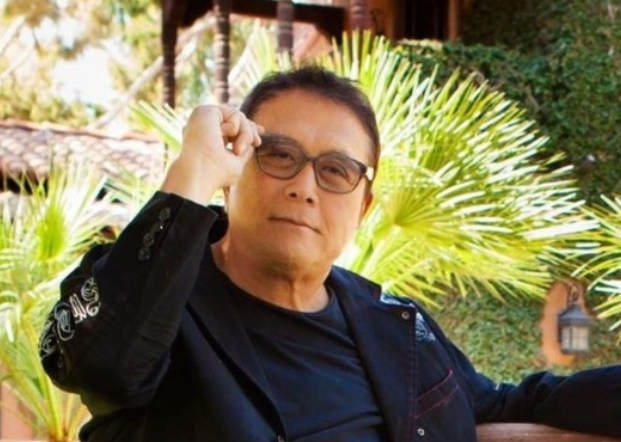

Robert Kiyosaki, author of the investment book "Rich Dad Poor Dad," has reiterated his forecast that silver prices will strengthen again this year. Recently, on social media, he claimed that silver could rise to $200 per ounce, explaining that silver's role is expanding beyond that of a simple precious metal to an asset with both industrial and monetary functions.

Robert Kiyosaki, author of the investment book "Rich Dad Poor Dad," reiterated his forecast that silver prices will strengthen again this year.

Robert Kiyosaki, author of the investment book "Rich Dad Poor Dad," reiterated his forecast that silver prices will strengthen again this year.

On January 23 (local time), cryptocurrency-focused media outlet Finbold reported on Kiyosaki's post on X (formerly Twitter) the previous day, stating, "Silver prices could reach $200 per ounce this year." In his post, Kiyosaki said, "Precious metals have served as money for thousands of years," and added, "Silver now plays a key role, much like iron did during the Industrial Revolution." He pointed out that at the time, the price of silver was about $92 per ounce, and noted that in the early 1990s, it was only around $5 per ounce.

Kiyosaki cited rising industrial demand and the growing perception of silver as both a store of value and an alternative currency as the background for the increase in silver prices. He emphasized, "Silver is becoming increasingly important as a structural metal supporting the future of the global economy, a store of value, and even as money."

However, he also said, "I still believe silver will reach $200 per ounce in 2026," but added, "I cannot guarantee it will definitely happen," leaving open the possibility that his prediction may not come true.

Kiyosaki also criticized the U.S. Federal Reserve and Treasury Department's policies in January, arguing that they are increasing national debt and eroding the purchasing power of the dollar, and recommended consistently buying Bitcoin, gold, and silver. He added that tangible assets are the safest long-term choice.

This outlook is attracting investor attention as gold and silver prices have recently surged together. Data analytics platform Santiment analyzed that, even as Bitcoin remains weak, mentions related to cryptocurrencies have surged and surpassed those of gold and silver.

On January 23 (local time), the spot price of silver on the New York Mercantile Exchange surpassed $100 per ounce for the first time ever during trading. Gold prices also climbed to an all-time high of $4,979 per ounce, coming close to breaking the $5,000 mark.

The background for the rise in gold prices includes expectations of a weaker dollar and the fact that the U.S. Department of Justice has launched a criminal investigation into Federal Reserve Chair Jerome Powell. As doubts about the Fed's independence grow in the market, there is increased speculation on currency devaluation. Michael Haigh, Head of Commodities Research at Societe Generale, told Reuters, "If political pressure continues, we cannot rule out the possibility of gold prices surpassing $5,000 per ounce."

Additionally, instability in the Middle East is being cited as another factor driving up gold prices. Analysts attribute this to growing global uncertainty stemming from tensions over the crackdown on anti-government protests in Iran, indications of U.S. military pressure, and the situation in Venezuela.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)