KOSPI Fails to Hold Above 5,000 for Two Consecutive Days

Foreigners Net Buy 2.5 Trillion Won This Month

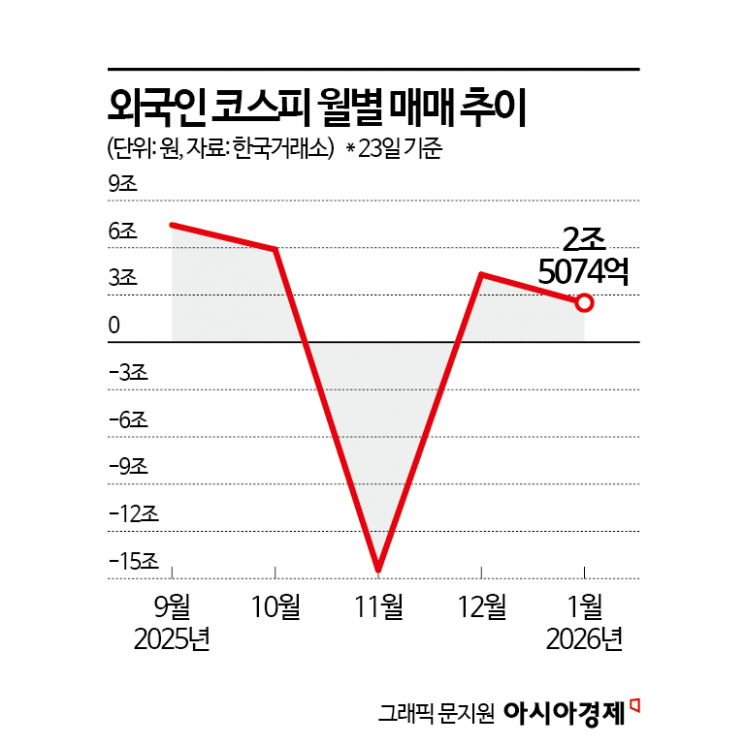

Nearly 50% Decrease Compared to Previous Month

Foreign Investors Still Have Room for Additional Buying

As the KOSPI attempts to settle above the 5,000 mark, it appears that a revival of foreign buying momentum is necessary for the index to firmly establish itself at this level.

According to the Korea Exchange on January 26, foreigners recorded a net purchase of 2.5074 trillion won in the main stock market this month. This figure represents nearly a 50 percent decrease compared to the previous month, when foreigners made net purchases of 4.2984 trillion won.

Although the KOSPI has surpassed the 5,000 mark, it has failed to consolidate its position due to insufficient supply and demand support. On January 22, when the KOSPI first crossed 5,000 intraday, foreigners recorded a net sale of 247.7 billion won, and institutions sold 156.8 billion won. Only individuals recorded a net purchase of 155.5 billion won. On January 23, the KOSPI again broke through 5,000 intraday but failed to hold above the level. That day, individuals recorded a net sale of 725.6 billion won, while foreigners and institutions recorded net purchases of 134.5 billion won and 491.2 billion won, respectively.

Foreign investors have not been actively buying since making net purchases of over 2 trillion won on January 5. While they have made net purchases of around 2.5 trillion won in the spot market, they have recorded net sales of 1.7727 trillion won in the futures market.

There has also been a shift in the stocks foreigners are buying this month. Last month, they made net purchases of semiconductor stocks such as SK Hynix and Samsung Electronics, as well as automotive stocks like Hyundai Motor and Kia. However, this month, they have been selling these stocks. The top stocks purchased by foreigners this month include Hanwha Ocean (926.8 billion won), Doosan Enerbility (815.8 billion won), Samsung Heavy Industries (558.7 billion won), HD Hyundai Heavy Industries (537.1 billion won), and Celltrion (517.3 billion won). In contrast, they recorded net sales of 3.6771 trillion won in Hyundai Motor, 3.5024 trillion won in Samsung Electronics, and 1.7652 trillion won in SK Hynix.

Heo Jaehwan, a researcher at Eugene Investment & Securities, analyzed, "Foreign investors remain calm despite the domestic stock market setting new all-time highs day after day. Since January, foreigners have shown a selling bias toward the hot semiconductor and automotive sectors, while their buying strength is concentrated in industrials such as utilities, trading companies and capital goods, and shipbuilding." He added, "Foreigners appear to be diversifying into sectors that are sensitive to the economy but where their current holdings are relatively low, rather than sectors where they already hold a high proportion."

Although the foreign ownership ratio has increased, some believe there is still room for additional inflows. Yeom Dongchan, a researcher at Korea Investment & Securities, commented, "As the foreign ownership ratio has reached its highest level since 2021, there may be questions about whether further improvement in foreign inflows is limited. However, the overall increase in foreign ownership is due to the rising proportion of Samsung Electronics and SK Hynix. Excluding these two stocks, the foreign ownership ratio in the KOSPI has actually declined. Therefore, I believe there is still potential for additional foreign buying."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)