The Era of a "2030 Platform" Is Over: Danggeun Now Led by Users in Their 40s

MAU on the Rise, but User Retention Time Is Declining

No Recovery Despite Integrated Brand Campaign: Warning Signs Emerge

Recently, users in their 40s have emerged as the core demographic on the secondhand trading platform Danggeun. The platform has successfully expanded its user base to include middle-aged adults with strong purchasing power, thereby strengthening its role as a local lifestyle community that connects shops and users. However, the decrease in average app usage time has been highlighted as a challenge.

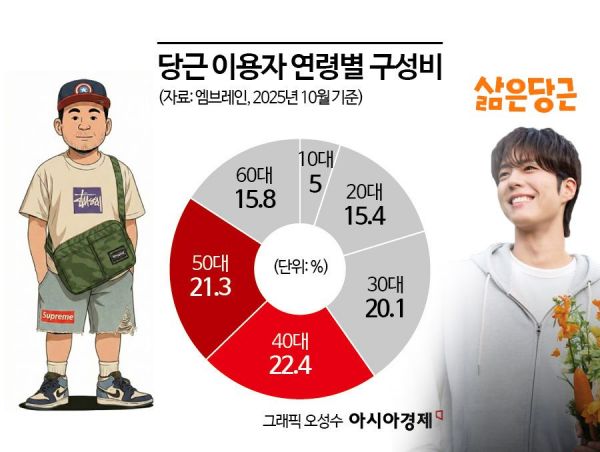

According to an analysis of 'secondhand trading platforms' by market research firm Embrain Deep Data released on January 23, as of October 2025, the largest share of Danggeun app users were in their 40s (22.4%), followed by those in their 50s (21.3%), indicating a significant presence of middle-aged users. Similar trends were observed in other indicators. According to Mobile Index by IGAWorks, an analysis of monthly active users (MAU) by generation for November and December 2025 showed that users in their 40s accounted for the largest proportion at 25.7%, followed by those in their 30s (25%) and 20s (22.9%).

Industry experts believe that Danggeun’s expansion beyond simple secondhand trading to include local lifestyle services such as community groups, used cars, real estate, and job postings has naturally led to an increase in middle-aged users who are economically active and have strong purchasing power. Some also note that the platform has absorbed part of the demand previously met by local mom cafes, as its local information exchange features have been strengthened.

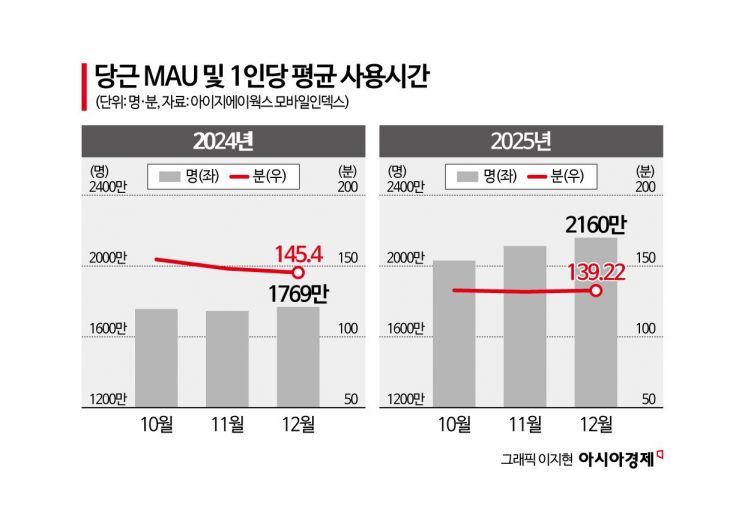

The effects of user growth and enhanced community features are also evident in the data. According to Mobile Index, the average usage time per person on the Danggeun app reached an all-time high of 154.67 minutes in October 2024, and the MAU surpassed 20 million in October 2025. The company’s performance also improved significantly. In 2024, Danggeun recorded consolidated revenue of 189.2 billion won, operating profit of 2.5 billion won, and net profit of 8.4 billion won, achieving its first-ever consolidated operating profit and net profit since its founding in 2015.

However, starting in 2025, Danggeun began to face a new challenge as user app engagement time continued to decline. After peaking, the average usage time dropped by 13.4% to 134.02 minutes in September 2025, one year later. At the end of October 2025, Danggeun selected actor Park Bogum as its new model and launched its first integrated brand campaign, "Life is Danggeun," replacing the previous approach of separately promoting secondhand trading, part-time jobs, community groups, and payments. The intent was to leverage Park Bogum’s youthful and trustworthy image to highlight the brand’s overall scalability.

However, there was no reversal in the trend. In November, the first month of the campaign, average usage time fell further to 131.8 minutes. The quarterly average for the fourth quarter also dropped sharply to 136.8 minutes, compared to 149.4 minutes in the same period of the previous year. As 99% of Danggeun’s revenue comes from advertising within the platform, changes in user engagement time have a direct impact on profitability. For Danggeun, which has experienced rapid growth by expanding from local to corporate advertising, this is a significant concern.

Lee Eunhee, a professor in the Department of Consumer Science at Inha University, commented, "I do not believe Park Bogum’s image has a strong direct association with secondhand trading. Rather than relying solely on a clean image, a model who can demonstrate how secondhand goods are actually used in daily life would be more persuasive." She added, "Ultimately, securing user engagement time depends less on model recognition and more on developing proprietary content that can draw users back to the platform."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)