From Processed Foods to Raw Ingredients...

Export Strategies Differ by Country

K-Culture Is Spreading, But Price and Regulatory Barriers Remain

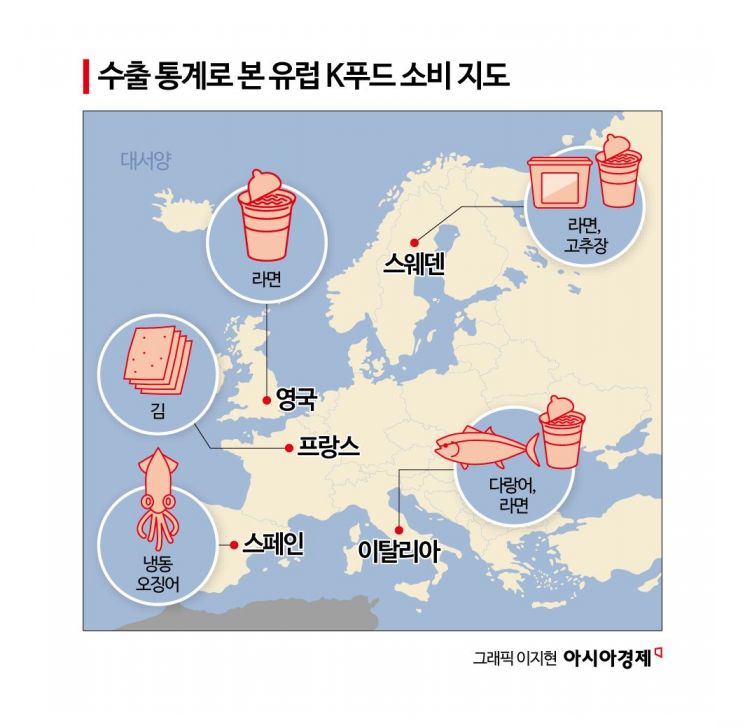

As the European market, often described as a "battleground for global food companies," sees the growing presence of K-Food, it has been found that the types of export items vary significantly by Eurozone country.

According to the food industry on January 25, exports of Korean food to Europe are on the rise. The "Status of Korean Food Distribution in Major European Retail Stores" report, released earlier this month by the Korea Agro-Fisheries & Food Trade Corporation (aT), showed that Korean agro-fisheries food exports to Europe in 2024 reached $904.6 million (about 1.3389 trillion won), up 22.8% from the previous year. The average annual growth rate over the past five years has reached 13.1%. Among the top 10 export items, instant noodles accounted for the largest share at 22.2%, followed by frozen tuna (11.1%), dried seaweed (7.0%), lysine, and kimchi (2.5%). However, there are clear differences in which items sell best by country.

United Kingdom: "Instant Noodles" vs. France: "Tuna"

The United Kingdom is the largest export market for Korean food in Europe. In 2024, Korean agro-fisheries food exports to the UK totaled $130 million (about 192 billion won), a 26.4% increase from the previous year. The average annual growth rate over the past five years has reached 14.6%. By item, instant noodles accounted for $51.2 million, making up 39.4% of the total and taking a dominant first place. Dried seaweed (12.4%) and kimchi (5.6%) followed. It is assessed that exports of Korean food to the UK are mainly focused on processed foods, especially instant noodles.

The situation is different in France. In 2024, Korean food exports to France totaled $105.93 million (156.4 billion won), up 22.2% from the previous year, but the most exported item was not instant noodles but frozen tuna. Frozen tuna accounted for about 48% of the total export value. Dried seaweed (5.8%), instant noodles (4.2%), and kimchi (1.0%) followed. In France, the structure of Korean food exports is centered more on seafood and ready-to-eat household food products rather than noodles. The distribution of Korean products such as frozen bibimbap, japchae, and kimchi, which can be cooked or eaten immediately at home, is also increasing.

In Southern Europe, Spain's growth stands out. In 2024, Korean food exports reached $68.69 million (about 101.4 billion won), a 29.8% increase from the previous year. Looking at the top export items, seafood such as frozen squid and tuna are central. More than half of the top 10 export items were seafood. While dried seaweed and beverages were included among the top items, the proportion of kimchi was not significant. Instead, gochujang (Korean chili paste), seasoning sauces, and other condiments have established themselves as major export items, being used as cooking ingredients. In Spain, Korean food tends to be consumed more as ingredients for existing dishes rather than as ready-made meals.

Italy also has a clear seafood-centered export structure. In 2024, Korean food exports totaled $72.26 million (106.7 billion won), up 26.8% from the previous year. Frozen tuna accounted for 43.7% of the total export value. Exports of instant noodles were $2.4 million, ranking fifth among export items. In Italy, where traditional food culture is strong, raw ingredient-type items are spreading first rather than processed foods. While demand for instant noodles, kimchi, and tteokbokki-related products is increasing, it is still considered to be in the early stages.

Sweden, a representative market in Northern Europe, has a relatively high proportion of Korean processed foods. In 2024, Korean food exports reached $20.27 million (2.99 billion won), up 9.7% from the previous year. Instant noodles accounted for 48.4% of the total export value, ranking first, followed by beverages, gochujang, and dried seaweed. Notably, the share of gochujang exports (4.6%) is higher than in other European countries. This indicates that Korean food is being consumed not only as noodles but also as seasoning products.

In the UK, France, and Spain, 9 out of 10 people have "purchased Korean products"

The proportion of consumers who have purchased Korean products or services in the past year was 93.6% in Spain, 93.5% in the UK, 92.6% in France, and 87.6% in Italy. This suggests that awareness and experience of Korean food are spreading across Europe.

The reasons Korean food is gaining attention in the European market include its healthy image and high level of trust in its quality. Among European consumers, Korean cuisine is recognized as a relatively healthy diet, centered on fermented foods such as sauces and vegetable-based dishes. In major countries such as the Netherlands, the UK, and France, interest in Korean food is growing alongside the spread of Korean culture.

The relatively low tariff burden is also a positive factor. Thanks to the Korea-EU Free Trade Agreement (FTA) and the Korea-UK Free Trade Agreement, Korean food can enter the European market under relatively favorable conditions.

Europe is one of the world's largest food consumption markets. According to market research firm Statista, the size of the European food market expanded from $1.55 trillion (about 2,289 trillion won) in 2020 to $2.02 trillion (about 2,983 trillion won) in 2024. Its share of the global food market reaches 23.1%. As of 2024, per capita food consumption in Europe is 518.02 kg, the highest in the world. This indicates significant growth potential for K-Food.

However, there are also considerable challenges. Compared to Chinese or Southeast Asian foods, the range of Korean export items is still not very diverse, and price competitiveness is relatively low. In some Northern and Southern European countries, the low population of Asian immigrants means that awareness of Korean culture and food remains limited.

An official from the Paris branch of the Korea Agro-Fisheries & Food Trade Corporation said, "To export Korean food to the European market, thorough compliance with composite food regulations is necessary." He added, "The European Union strictly manages composite foods, which are classified as products containing both animal and plant-based ingredients. Processed foods containing animal ingredients can only use ingredients produced at approved facilities." He continued, "Currently, Korean animal-based ingredients that meet European import conditions are limited to poultry and seafood that have been heat-treated at 70°C or higher, as well as gelatin and collagen," emphasizing that "strategic decisions are needed from the product planning stage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)