Many Deductions Not Reflected in Simplification System

Check Monthly Rent, Medical Expenses, Education Costs, and Disability Deductions

As the year-end tax settlement season approaches, office workers are focusing their attention on the refund, often referred to as the "13th month's salary." Experts advise caution, noting that relying solely on the National Tax Service's Hometax "Year-End Tax Settlement Simplification Service" materials could result in missing out on certain deductible items.

According to the financial industry on January 18, Hanwha Life recently introduced eight deductible items that are often overlooked during year-end tax settlement, stating, "For items that are not automatically collected by the system, securing supporting documents yourself is the key to saving on taxes."

One of the most commonly missed items is the monthly rent tax credit. Employees without a home and with an annual salary of 80 million won or less, who pay rent for a residence that is either below the size of a national housing unit or has a standard market price of 400 million won or less, can receive a deduction of 15-17% within an annual limit of 10 million won. However, because these cases are often not reflected in the simplification service, it is necessary to submit a copy of the lease contract and bank transfer receipts to the company.

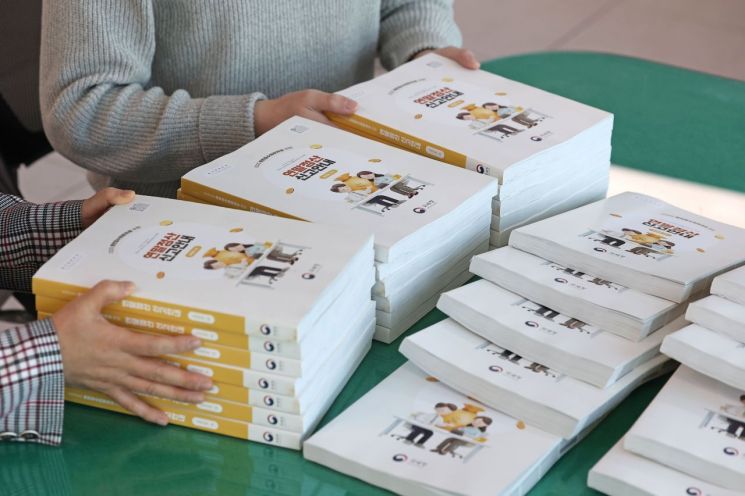

On the 14th, corporate tax department employees are organizing year-end tax settlement guidebooks at Jongno Tax Office in Seoul. Photo by Yonhap News

On the 14th, corporate tax department employees are organizing year-end tax settlement guidebooks at Jongno Tax Office in Seoul. Photo by Yonhap News

Medical expenses are also easy to overlook. Vision correction glasses and contact lenses are deductible up to 500,000 won per dependent per year, and a receipt from the optical store specifying that the item is for vision correction is required. Assistive devices for people with disabilities, such as hearing aids and wheelchairs, are also deductible, provided that receipts are issued in the user's name.

There is also a deduction for people with disabilities. Under tax law, this includes not only registered persons with disabilities but also individuals with severe illnesses such as cancer or dementia that make daily life difficult. If you submit a "disability certificate" issued by a hospital, you can receive an additional income deduction of 2 million won per person. The same deduction applies to veterans with injuries, provided that relevant supporting documents are submitted.

The education expense category is particularly prone to omissions. Costs for pre-school children attending academies or arts and sports facilities at least once a week, as well as the purchase of school uniforms or gym clothes for middle and high school students, are often not displayed in the simplification service, so relevant receipts should be prepared separately. Tuition for children studying abroad may also be eligible for deductions, provided that you submit documentation proving eligibility for studying abroad and payment certificates, and report the amount based on the won exchange rate standard.

Income tax reductions for employees of small and medium-sized enterprises are not applied automatically. The employee must apply directly. For young workers, benefits such as a 90% income tax reduction for up to five years are available.

Jung Wonjun, a tax accountant at Hanwha Life Financial Services, said, "Since the simplified data is updated sequentially after mid-January, it is advantageous to check it once more before the company's submission deadline." He also noted that if you have missed any items in the past five years, you can apply for a refund through the National Tax Service Hometax "Request for Correction" service.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)