"Volatility Could Surge in a 'Rush to Hedge'"

On the 14th, an employee is monitoring the stock market and exchange rates in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. On this day, the won/dollar exchange rate continued its upward trend for the tenth consecutive day amid a weak Japanese yen, approaching 1,480 won closely. At 9:05 a.m. in the Seoul foreign exchange market, the won exchange rate against the US dollar was 1,478.3 won, up 4.6 won from the previous day's weekly closing price (as of 3:30 p.m.). January 14, 2026 Photo by Cho Yongjun

On the 14th, an employee is monitoring the stock market and exchange rates in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. On this day, the won/dollar exchange rate continued its upward trend for the tenth consecutive day amid a weak Japanese yen, approaching 1,480 won closely. At 9:05 a.m. in the Seoul foreign exchange market, the won exchange rate against the US dollar was 1,478.3 won, up 4.6 won from the previous day's weekly closing price (as of 3:30 p.m.). January 14, 2026 Photo by Cho Yongjun

The International Monetary Fund (IMF) has issued a warning highlighting the structural vulnerabilities of South Korea's foreign exchange market. The IMF pointed out that the scale of dollar-denominated assets exposed to currency risk is excessively large compared to the size of the foreign exchange market, which could lead to increased won-dollar exchange rate volatility amid periods of global financial uncertainty.

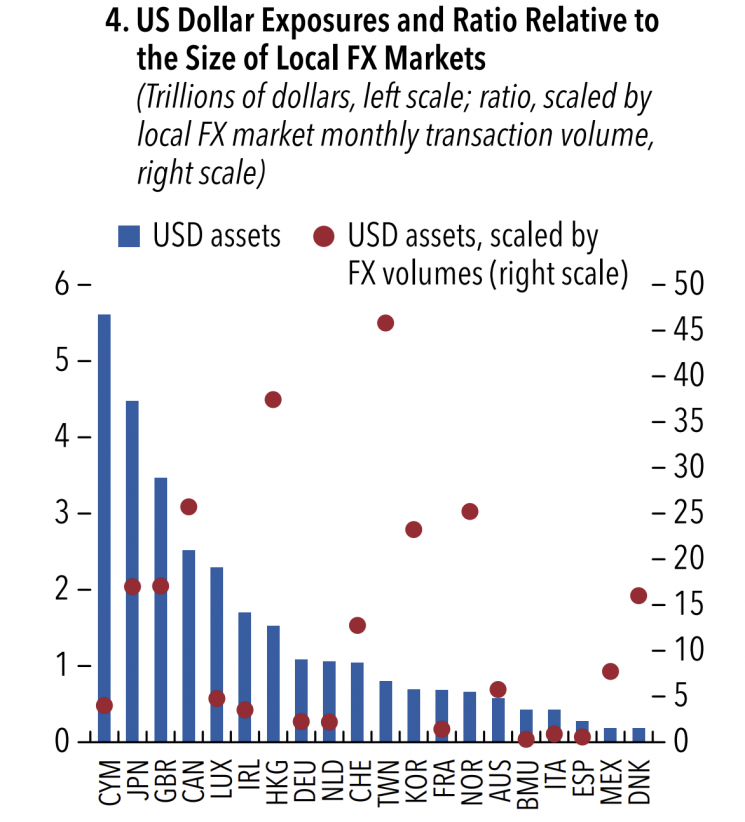

According to the IMF's Global Financial Stability Report released on January 18, the amount of dollar-denominated assets exposed to currency risk in South Korea's foreign exchange market is about 25 times the monthly trading volume of the market. This indicator is used as a structural metric to assess how much a country's foreign exchange market can absorb exchange rate shocks.

Among major economies, South Korea was classified at a similar level as Canada and Norway. Norway is also considered a country with a high proportion of overseas investment, mainly through its sovereign wealth fund. Taiwan had the highest ratio of foreign currency exposure to market size, at about 45 times. While Taiwan's dollar-denominated asset scale is similar to that of South Korea, its foreign exchange market is smaller, resulting in a higher ratio.

In contrast, Japan has the largest absolute amount of dollar-denominated assets, but because its foreign exchange market is large, the ratio is less than 20 times. Major European countries such as Germany, France, and Italy recorded single-digit ratios.

The IMF noted, "In some countries, the exposure to dollar-denominated assets is disproportionately large relative to the depth of the foreign exchange market." For non-reserve currency countries like South Korea and Taiwan, this serves as a warning signal, as their foreign exchange markets may struggle to absorb shocks from dollar value fluctuations in a short period of time.

Exposure to foreign currency dollar assets and the ratio compared to the foreign exchange market (red dot). IMF Global Financial Stability Report

Exposure to foreign currency dollar assets and the ratio compared to the foreign exchange market (red dot). IMF Global Financial Stability Report

The report particularly highlighted the potential for a so-called "rush to hedge," where global investors simultaneously seek currency hedging. If there is a sudden wave of forward dollar selling in countries with significant currency exposure, foreign exchange market volatility could spike sharply.

The recent move by the National Pension Service to actively pursue strategic currency hedging is also aimed at preemptively managing these exchange rate volatility risks. On the other hand, for individual investors-commonly referred to as "Seohak Ants"-who invest in overseas stocks without hedging their currency exposure, there is a growing need to manage macroeconomic risks in addition to personal asset management.

In response, the government announced at the end of last year that it would launch forward dollar selling products for individual investors through securities firms as part of the "Domestic Investment and Foreign Exchange Stabilization Tax Support Plan."

If individuals buy spot dollars for hedging purposes while simultaneously selling forward dollars, banks will, in turn, sell spot dollars in the market to offset the forward purchases. This is expected to help manage currency risk and stabilize the foreign exchange market at the same time.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)