Over 50 Trillion Won Flows Out of Five Major Banks in Just 10 Business Days

Record-High KOSPI Index Accelerates Capital Inflows into Stock Market

Securities firms are racing to raise their forecasts for the upper limit of the KOSPI, and as a result, the pace of 'money move' is expected to accelerate even further. This is deepening concerns within the banking sector. As demand deposits, which allow banks to procure funds at low cost, decrease, banks are left with no choice but to secure funds by issuing bank bonds, which come with funding costs dozens of times higher. In this scenario, upward pressure on lending rates and a decline in bank profitability are inevitable.

As the KOSPI index continues to hit all-time highs and maintains its rally, market liquidity is rapidly flowing into the stock market. Since the beginning of the year, more than 50 trillion won has left the banking sector, signaling the full onset of the 'money move' phenomenon. With the KOSPI index approaching the 5,000-point mark for the first time in history, there are projections that the pace of capital outflows may accelerate even further.

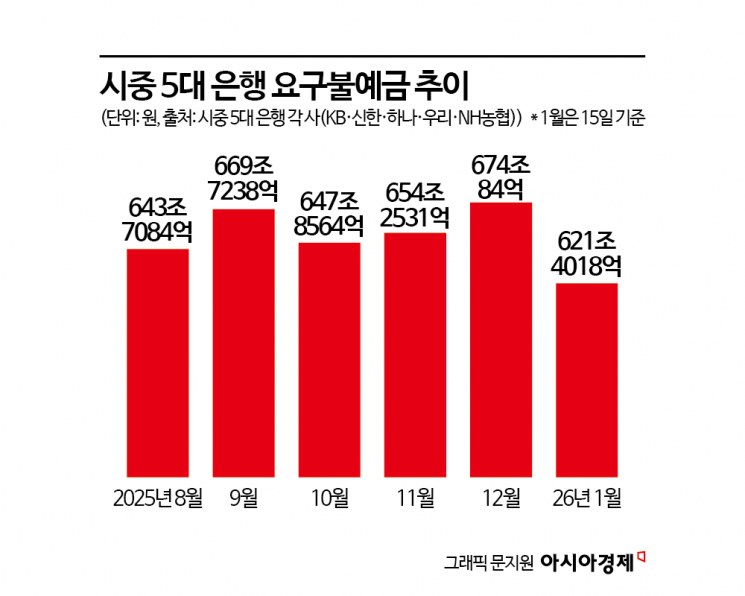

According to the financial sector on January 19, as of January 15, the balance of demand deposits at the five major commercial banks (KB, Shinhan, Hana, Woori, and NH Nonghyup) stood at 621.4018 trillion won. This represents a sharp drop of 52.6066 trillion won compared to the end of last year (674.0084 trillion won). In just 10 business days since the start of the new year, more than 50 trillion won has flowed out of banks. The average daily outflow amounts to 5 trillion won.

This trend becomes even more pronounced when compared with past figures. In January last year, the decrease in demand deposits at the five major banks was only 3.8268 trillion won compared to the previous month. Even in October last year, when the KOSPI surpassed the 4,000-point mark for the first time and large-scale capital outflows occurred, the decrease was 21.8674 trillion won (an average of 1.2148 trillion won per day). If the current trend continues, the decline in demand deposits in January this year is expected to set a new all-time record.

The financial sector considers this outflow unusual, even taking into account the typical increase in capital demand at the start of the year. Usually, demand deposits increase at the end of the year due to accounting factors such as bonus payments, and then decrease at the beginning of the year. In fact, demand deposits in December last year increased by about 20 trillion won compared to the previous month. However, the fact that demand deposits-which are classified as 'investment standby funds' due to their low interest rates of 0.1-0.2% and high liquidity-are leaving banks at such a rapid rate is clear evidence of the strong shift toward the stock market.

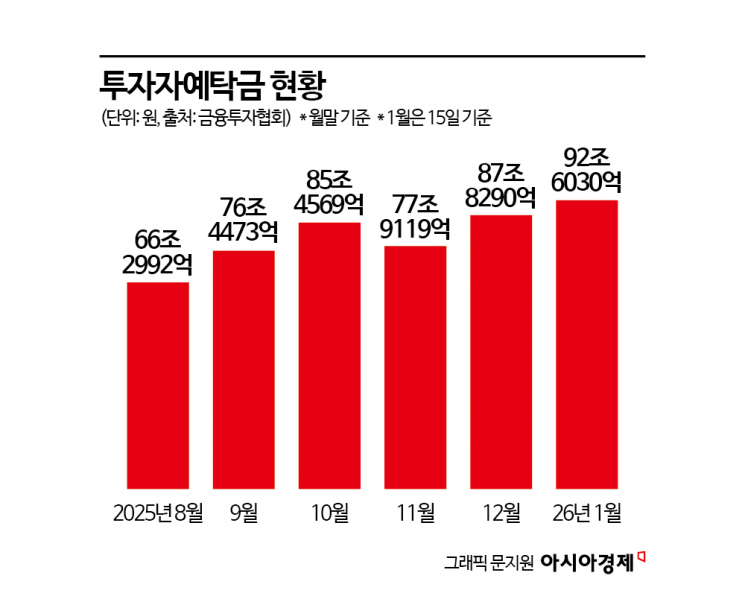

The funds leaving banks are flowing directly into the stock market. According to the Korea Financial Investment Association, as of January 15, investor deposits stood at 92.603 trillion won. After hitting an all-time high of 92.8537 trillion won on January 8 and undergoing a slight correction, the figure still remains above the 90 trillion won level. Investor deposits refer to money deposited in accounts for stock purchases or funds not withdrawn after selling stocks, serving as a key indicator of stock market sentiment. Another indicator of standby funds, the balance of Comprehensive Asset Management Accounts (CMA), also surpassed 100 trillion won for the first time at the end of last year and has remained above that level, recording 102.1328 trillion won as of January 15.

In fact, the KOSPI index has been setting new records day after day. The index closed at 4,214.17 on the last trading day of last year, December 30, and surpassed the 4,300-point mark on the first trading day of this year, January 2. It continued its rally by breaking through the 4,400-point mark on January 5 and the 4,500-point mark on January 6. On January 16, it surpassed the 4,800-point mark for the first time ever, bringing the so-called '5000pi' era within reach.

Market participation is also at a fever pitch. The number of active stock trading accounts has reached nearly 100 million, marking an all-time high. An active account refers to an account with deposits of at least 100,000 won and at least one transaction in the past six months. This is the largest number since the Korea Financial Investment Association began compiling statistics in June 2007.

The stock market boom has also led to a surge in 'bit-too' (investing with borrowed funds). As of January 15, the balance of margin loans stood at 28.7455 trillion won, setting a new record high. By market, the Korea Exchange market accounted for 18.2906 trillion won, and the KOSDAQ market for 10.4549 trillion won.

Securities firms are racing to raise their forecasts for the upper limit of the KOSPI, and as a result, the pace of 'money move' is expected to accelerate even further. This is deepening concerns within the banking sector. As demand deposits, which allow banks to procure funds at low cost, decrease, banks are left with no choice but to secure funds by issuing bank bonds, which come with funding costs dozens of times higher. In this scenario, upward pressure on lending rates and a decline in bank profitability are inevitable.

Ahn Seonghak, a research fellow at Hana Institute of Finance, analyzed, "Capital inflows will continue, supported by policies to vitalize the capital market and expanded liquidity. In particular, the use of securities firms is increasing in major asset management channels such as retirement pensions and Individual Savings Accounts (ISA), and with the continued launch of related financial products, the movement of funds into the capital market is expected to accelerate."

A banking sector official stated, "We are closely monitoring the situation, as this year has seen an unusual outflow of funds that exceeds the usual seasonal effect. Given the structure in which deposit rates are determined in line with market rates, it is not easy to respond to the outflow of funds with dramatic interest rate benefits at this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)