Despite Industry Slump, Employee Numbers Continue to Rise at Seven Major Card Companies

Card Expenses Increase Despite Lower Procurement Rates... "Evidence of Expanded Future Investments"

Strengthening Core Competitiveness with Overseas Travel a

Despite facing challenges such as economic recession, lower preferential commission rates, and cyber risks, credit card companies strengthened their foundations last year by increasing the number of employees. This marks a successful rebound in securing human resources, which are considered the "core competitiveness" of credit card companies, and breaks the conventional wisdom that companies cut staff during downturns. Notably, even though funding costs for card bonds decreased, operating expenses increased, indicating that companies focused on investing for future growth and expanding credit sales.

The number of employees at seven major credit card companies nears 12,000... "Expansion of credit sales operations and investments"

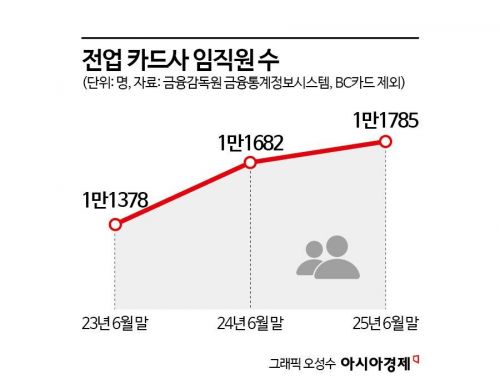

According to the Financial Supervisory Service's Financial Statistics Information System on January 16, the number of employees at seven major credit card companies, excluding BC Card, has been steadily increasing. The figure rose from 11,378 at the end of June 2023 to 11,682 at the end of June 2024, and further increased to 11,785 at the end of June last year.

Although Shinhan Card, which implemented a voluntary retirement program, saw its workforce decrease by 80 employees (3%) year-on-year, Lotte Card (6%), Hyundai Card (5.4%), and Samsung Card (3%) all expanded their staff. In particular, Lotte Card continued hiring even amid crises such as recovering from a cyber incident and a management reshuffle including the replacement of former CEO Cho Joajin, earning recognition for focusing on organizational stability and maintaining competitiveness.

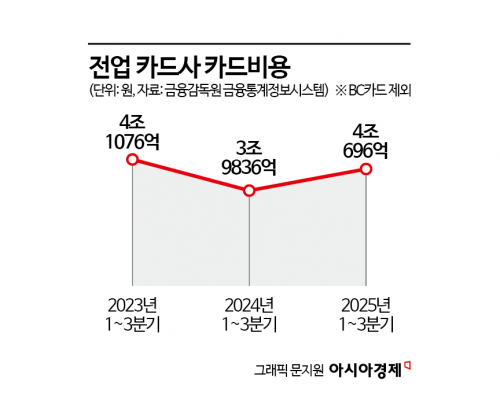

The effort to strengthen their core business of credit sales is also reflected in "card expenses." Card expenses refer to costs incurred in the process of credit sales operations, including development and investment expenses. An analysis of the first to third quarter figures for the past three years through the Financial Supervisory Service's Financial Statistics Information System shows that card expenses, which had decreased by 3% year-on-year to 3.9836 trillion won in 2024, rebounded by 2.2% to 4.0696 trillion won last year.

Excluding BC Card, whose credit sales performance remains minimal, card expenses increased at Hana Card, Hyundai Card, Shinhan Card, and Samsung Card. Hana Card's expenses rose 11.5% from 449.4 billion won in 2024 to 501.3 billion won last year. During the same period, Hyundai Card's expenses increased 7% from 696.8 billion won to 745.5 billion won, and Shinhan Card's rose 6% from 691 billion won to 732.3 billion won. What is noteworthy is that the funding cost for card bonds actually declined during this period. According to the Korea Financial Investment Association, the interest rate for three-year card bonds (AA+) at the end of June last year was 2.833% per annum, down 74 basis points (1bp = 0.01 percentage point) from 3.573% a year earlier. Normally, when funding costs fall, expense indicators also decrease. Nevertheless, the increase in card expenses demonstrates that credit card companies invested the savings from lower funding costs into system development, marketing, and infrastructure, pursuing aggressive business operations.

Targeting overseas travel and premium markets... Securing new business drivers

Last year, major credit card companies focused on the overseas travel and premium card markets. Hana Card is leading the market with "Travelog," the top travel-specialized card in the overseas travel sector, while Hyundai Card concentrated on strengthening its premium lineup, led by "Amex." Shinhan Card also launched "The Best X," a premium card with an annual fee in the 300,000 won range, to enhance profitability.

The credit card industry views positively the fact that companies have maintained their core business competitiveness and human infrastructure, even in an environment where pioneering new businesses such as stablecoins is challenging. An industry official explained, "Credit card companies are continuing to invest in artificial intelligence (AI) and secure talent related to future technologies, even under difficult business conditions," adding, "Rather than focusing solely on short-term performance, they are putting everything on the line to maintain their fundamental competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)