Hanwha to Undergo Spin-Off

Launch of Hanwha Machinery & Service Holdings Centered on Hanwha Vision

New Tech and Life Entity Led by Vice President Kim

Advanced Technology Integration Expected in Hotels, Resorts, and Catering

Kim Dongseon, the third son of Hanwha Group Chairman Kim Seungyeon and Vice President of Hanwha, is stepping out on his own. The distribution, service, and technology businesses led by Vice President Kim are set to be spun off from the group and reorganized under a newly established holding company. As the group's succession plan for the third generation of the founding family accelerates, Vice President Kim is now being tested as an independent business leader.

According to industry sources on January 15, Hanwha held a board meeting the previous day and approved a plan to split off its business, creating a new entity called Hanwha Machinery & Service Holdings, which will oversee the group's tech and life solution businesses, while the remaining company will continue to focus on defense and energy. The new holding company, Hanwha Machinery & Service Holdings, will encompass the 'Tech Solution' segment-comprising Hanwha Vision, Hanwha Momentum, Hanwha Semitec, and Hanwha Robotics-and the 'Life Solution' segment-including Hanwha Galleria, Hanwha Hotels & Resorts, and Ourhome.

All of these businesses are affiliates that Vice President Kim has led under the previous holding structure, holding titles such as Head of Future Vision. He has especially focused on the food and beverage (F&B) sector, integrating advanced technologies such as robotics into the restaurant business, and has expanded the group's reach through mergers and acquisitions (M&A). These efforts were aimed at discovering new growth engines to offset the sluggish performance of the core department store business, which has struggled due to deteriorating market conditions.

For example, in 2023, Hanwha introduced the American burger brand Five Guys to Korea, achieving sales of 46.5 billion won and an operating profit of 3.4 billion won within just over a year, turning the business profitable. Just two years after its launch, Five Guys signed a memorandum of understanding (MOU) last month with private equity firm H&Q Equity Partners for a stake sale. The estimated sale price is between 60 and 70 billion won, more than three times the initial investment of around 20 billion won.

In 2024, Hanwha acquired the American robot pizza brand Stella Pizza, and the following year, launched the premium ice cream brand Benson. Furthermore, in May of last year, Hanwha Hotels & Resorts re-entered the catering market by acquiring a 58.62% stake in Ourhome, the second-largest institutional catering company, for 869.5 billion won. The company also made aggressive moves by acquiring the urban luxury resort Paraspara and the catering division of Shinsegae Food. Most recently, Hanwha has been considering the acquisition of the resort company Phoenix Jungang.

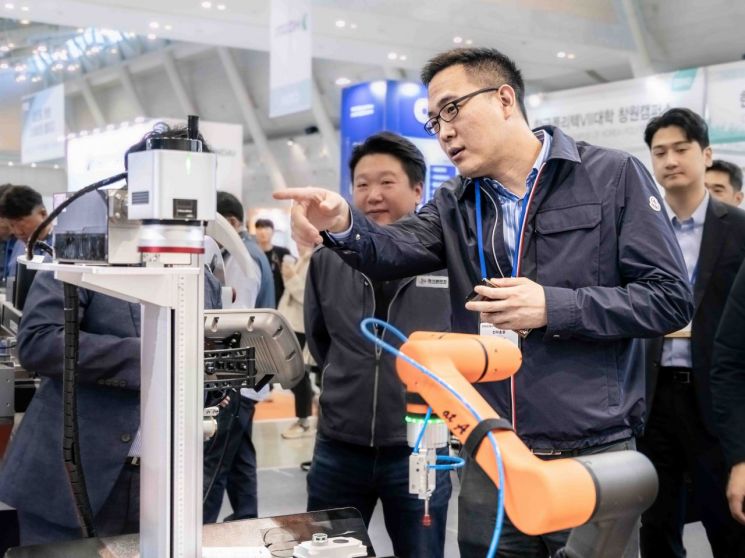

The new holding company plans to create synergy in the F&B and retail sectors through strategic collaboration and investment between its tech and life divisions. According to Hanwha, the next-generation growth engine for Hanwha Machinery & Service Holdings will be 'Physical AI' solutions, which apply artificial intelligence (AI) to hardware such as robots, autonomous vehicles, and drones. For instance, Hanwha is considering deploying Hanwha Robotics' collaborative robots in department stores, hotels and resorts, and catering businesses to enhance work efficiency in F&B services and automate logistics operations.

The key challenge is securing sufficient capital. An industry insider commented, "With the spin-off, Vice President Kim's responsibilities and authority will increase, while support from the group level is expected to decrease. He will need to prove his capabilities in business segments that have been relatively less prominent." In the immediate future, Hanwha Vision-which operates security and industrial equipment businesses such as CCTV-will likely serve as a cash cow for the new holding company. As of the third quarter of last year, Hanwha Vision posted sales of 422.7 billion won and operating profit of 31.2 billion won, up 203% and 268.2% year-on-year, respectively, maintaining steady profitability.

Additionally, last month, Vice President Kim secured 825 billion won in cash by selling 15% of the shares in Hanwha Energy-an affiliate owned by the three Hanwha brothers. Including proceeds from the Five Guys sale, he will have about 1.5 trillion won in available funds. The company plans to invest this capital in the reconstruction of the Galleria Department Store's Seoul luxury branch and to strengthen its business portfolio by developing new growth engines.

A Hanwha representative stated, "We expect that restructuring our business through the establishment of a separate entity covering both tech and life divisions will greatly enhance each company's expertise and management efficiency. By fostering collaboration among affiliates within each division, we will strengthen our business portfolio and competitiveness, while maximizing synergy between divisions to drive growth and increase shareholder value."

Meanwhile, Hanwha's spin-off is scheduled to be completed in July, following an extraordinary general meeting of shareholders and other related procedures in June. This move is expected to further solidify the succession structure centered around Hanwha Group Vice Chairman Kim Dongkwan, the eldest son. Currently, direct shareholdings in Hanwha Corporation are as follows: Chairman Kim Seungyeon holds 11.33%, Vice Chairman Kim Dongkwan 9.77%, President Kim Dongwon 5.37%, and Vice President Kim Dongseon 5.37%. Previously, President Kim and Vice President Kim sold part of their stakes in Hanwha Energy-the group's top holding company-to financial investors (FIs), thereby reinforcing Vice Chairman Kim's position as the largest shareholder with a 50% stake.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)