KakaoBank announced on January 14 that its "Target Conversion Fund" product, launched in November last year, achieved its target return early, just 45 days after its release.

The Target Conversion Fund is a product that shifts managed assets from stocks to bonds-or from relatively risky assets to safer ones-once a preset "target return" is reached. This structure allows investors to realize profits while minimizing risk in response to market volatility, which has recently attracted significant interest from investors.

The first Target Conversion Fund product introduced by KakaoBank in November, titled "Achieving Target Returns Together Through Policy Beneficiaries," focused on investing in domestic policy beneficiary stocks. This strategy proved successful, achieving the 6% target return in just 45 days after launch.

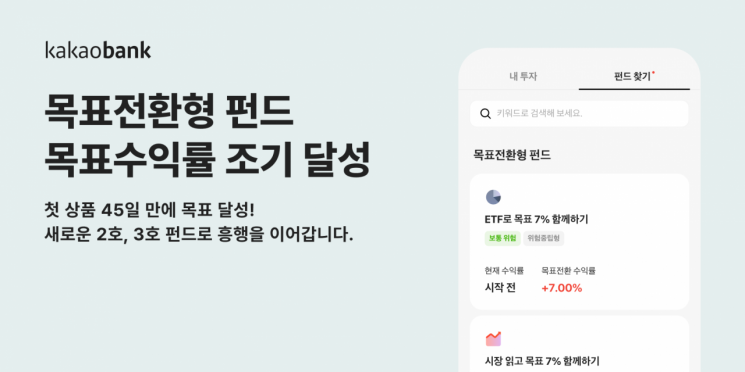

Building on the successful achievement of its first product, KakaoBank will sequentially introduce its second and third Target Conversion Fund products.

The second Target Conversion Fund is called "Achieving a 7% Target Together with Exchange-Traded Funds (ETFs)." This fund pursues diversification by utilizing ETFs, investing more than 50% of its assets in bond-type ETFs and less than 50% in equity-type ETFs until the target is achieved, aiming to balance stability and profitability.

This product is available for subscription until 5:00 p.m. on January 16, with a target return set at 7%, higher than the previous product. The minimum subscription amount is 1 million won, and upon achieving the target, the assets are converted into short-term financial instruments to enhance stability.

Starting January 19, KakaoBank will also launch its third Target Conversion Fund product, "Reading the Market and Achieving a 7% Target Together."

Since becoming the first internet-only bank to launch fund services in January 2024, KakaoBank has consistently strengthened its competitiveness as an investment platform. In particular, the growth of the "Money Market Fund (MMF) Box," introduced in June last year, and the effects of service upgrades have pushed the combined balance of funds and MMFs to exceed 1 trillion won.

Meanwhile, investors should note that financial investment products carry the risk of principal loss, and past performance does not guarantee future returns.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)