Overcoming Event of Default Crisis, Transitioning to Project Financing

Licensing Procedures Near Completion... Construction to Begin in the First Half of This Year

Benefiting from Station Area Revitalization Project, Floor Area Ratio Raised to 800%

Shinsegae Group is accelerating the development of the former Prima Hotel site in Cheongdam-dong, Gangnam-gu, Seoul. This project, which will create a luxury hotel and residential complex on one of Gangnam's most coveted plots, received a building permit at the end of last year and is set to break ground in the first half of this year.

According to the retail industry on January 14, Shinsegae Cheongdam PFV, a project finance investment company (PFV) led by Shinsegae Property, the real estate development subsidiary of Shinsegae Group, received the building permit for the Cheongdam Prima Hotel site in December last year. Typically, urban development projects proceed in the following order: ▲ Establishment and decision of urban management plan ▲ Public announcement and collection of resident opinions ▲ Review by the Urban Architecture Joint Committee ▲ Decision and notification of district unit plan ▲ Licensing procedures ▲ Building permit (detailed procedures) ▲ Submission of construction commencement report ▲ Groundbreaking.

Building Permit Obtained in December... Construction to Begin in the First Half of This Year

With most of the major licensing procedures completed, Shinsegae Group plans to finalize detailed pre-construction processes, such as ground excavation review, within the first quarter of this year, and submit the construction commencement report in the second quarter.

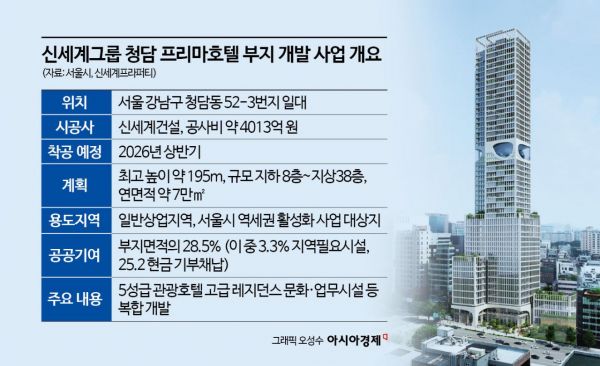

This project will develop a complex facility with eight underground floors and 38 above-ground floors, spanning a total floor area of about 70,000 square meters on the former Prima Hotel site in Cheongdam-dong, Gangnam-gu, Seoul. It is planned as a premium mixed-use space combining a five-star hotel, high-end residences, and cultural facilities.

Currently, Shinsegae Property is raising funds for the main project financing (PF). To this end, the company extended the maturity of a bridge loan that was due on November 16 last year. The bridge loan, a short-term fund for land acquisition and initial project promotion, will be repaid once the main PF funding is secured. A Shinsegae Property official stated, "The major licensing procedures have been completed, and we plan to begin construction in the first half of this year once the remaining permits are finalized," adding, "There are no significant difficulties in securing PF funding."

Last month, Shinsegae Cheongdam PFV signed a construction contract worth 401.3 billion won with Shinsegae Construction for the new complex facility. This main contract, signed after the design and construction scope were finalized, stipulates that construction payments will be made based on progress, reviewed approximately every two months.

There has also been a public contribution. To meet the requirements for development incentives, Shinsegae donated land worth about 120 billion won to Gangnam-gu. This measure, linked to Seoul City's station area revitalization project, is intended to qualify for urban planning incentives such as increased floor area ratio.

Previously, in February last year, Seoul City held the third Urban Architecture Joint Committee meeting and designated the site as a target for the station area revitalization project. The site, which previously contained both Type 3 General Residential and General Commercial zones, was converted entirely to a General Commercial zone. As a result, the maximum floor area ratio was raised to 800%, and the maximum building height allowed is now 195 meters. However, Seoul City mandated that at least 50% of the total floor area ratio must be used for hotels (tourist accommodation facilities), and 28.5% of the site area must be allocated for public contribution.

Shinsegae Group is working to attract a global premium hotel brand to the facility. In the industry, Aman, the top-tier brand of the global luxury hotel and resort group Aman Group, is being mentioned as a strong candidate. Shinsegae Property stated, "We are considering all global hotel brands, but nothing has been decided yet."

The Cheongdam-dong Site on the Brink... Transforming into a Luxury Hotel and Ultra-High-End Residential Space

Overview of the Development Project for the Cheongdam Prima Hotel Site by Shinsegae Group Location. Provided by Seoul City.

Overview of the Development Project for the Cheongdam Prima Hotel Site by Shinsegae Group Location. Provided by Seoul City.

The Cheongdam Prima Hotel site was once a project at risk of collapse. Initially, the developer Miraein established Le Pierre Cheongdam PFV to create the high-end residential facility 'Le Pierre Cheongdam' and acquired the site for about 410 billion won. Subsequently, Miraein secured a bridge loan of about 464 billion won from a syndicate consisting of Saemaul Geumgo, Woori Financial Capital, BC Card, Shinhan Bank, and Shinhan Capital, and pushed forward with the development.

However, the real estate PF market rapidly tightened following the Legoland incident in 2022, leading to a crisis. In 2023, the bridge loan could not be extended, resulting in an event of default (EOD). Saemaul Geumgo opposed the loan extension, and the site was subsequently classified as a high-risk project in the market, effectively halting development.

In May 2024, with the participation of Shinsegae Group, the development gained momentum. Shinsegae Property acquired a 50% stake in the project company Hyper Cheongdam PFV (formerly Le Pierre Cheongdam PFV), taking the lead in the project. The plan was to jointly develop the site with Miraein. Immediately after joining, the shareholding structure was reorganized to Shinsegae Property 50%, Demons (an affiliate of Miraein) about 44.9%, Mugunghwa Trust 5%, and Mirae Development 3 at 0.01%.

Meanwhile, Miraein recently adjusted the project structure. Last month, Shinsegae Cheongdam PFV announced that the shares held by Demons, an affiliate of Miraein, were transferred to Basic General Private Real Estate Investment Trust No. 1. This move is seen as an effort to reduce project risk and improve investment efficiency by shifting to indirect participation through a fund.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)