Weakened Confidence in the U.S. Dollar and

Rising Industrial Demand from Advanced Technology Development

Supply-Demand Imbalance from Growing Demand and Stagnant Production

Expansion of Private Investment

Impact of Rising Metal Prices on Inflation Under Scrutiny

Diversification of Supply Sources Needed

to Counter Strategic Asset Controls by Major Countries

There is growing analysis that the recent surge in the prices of major metals such as gold, silver, and copper is likely to continue rising this year. This outlook is based on the expectation that the factors which have driven up metal prices so far-namely, persistent inflation and weakened confidence in U.S. dollar assets, increased industrial demand due to advanced technology development, supply-demand imbalances resulting from stagnant production, and the expansion of private investment and speculative demand-will persist throughout the year.

On January 13, the Bank of Korea’s New York Office released a report titled "Key Drivers and Implications of the Recent Surge in Major Metal Prices," stating, "In particular, industrial metals like copper are mostly used as intermediate goods across industries, which can drive up producer prices and potentially impact consumer prices." The report emphasized, "It is necessary to closely monitor the impact of rising metal prices on inflation and the resulting changes in the U.S. Federal Reserve’s monetary policy trajectory."

Regarding the recent moves by the United States, China, and others to treat key metals as strategic assets-by implementing export controls, expanding stockpiles, and strengthening supply chain policies-the report noted, "Given the high external dependency of Korean manufacturing on major metals, it is essential to diversify supply sources and expand local investments."

Silver and Gold Break Through Ceilings... Persistent Inflation, Weakened Dollar Confidence, and Rising Industrial Demand Are Key Drivers

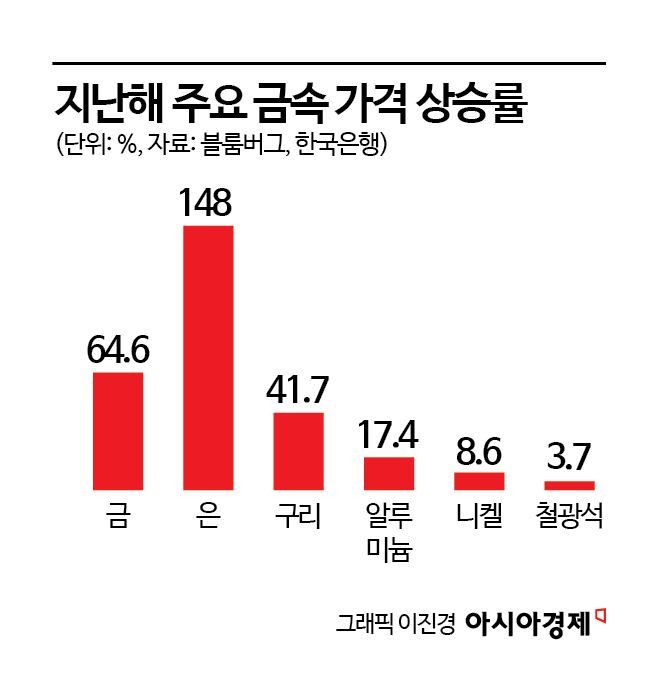

The prices of major metals such as gold, silver, and copper have recently reached all-time highs, continuing their upward trajectory. Last year, the price increases for silver (148.0%), gold (64.6%), and copper (41.7%) far outpaced those of base metals such as aluminum (17.4%) and nickel (8.6%). While metal prices typically move in tandem with oil prices, since 2024, oil prices have declined while major metal prices have continued to rise.

Market participants cite four main factors behind the recent sharp rise in metal prices. Kim Ji-hyung, Senior Manager at the Bank of Korea’s New York Office, explained, "Inflation remained elevated due to U.S. tariff policies, and the continuation of accommodative monetary and expansionary fiscal policies in major economies sustained inflationary concerns." He added, "As a result, demand for tangible assets such as precious metals as an inflation hedge has expanded."

There are also market expectations that the dovish monetary policy stance could be further strengthened after the change of the Federal Reserve Chair in May this year. With tax cuts set to take effect and the possibility of additional fiscal policy measures ahead of the November midterm elections, there are concerns that inflation could rise again.

The status of U.S. Treasury bonds and the dollar as safe-haven assets has also weakened due to concerns over the U.S. fiscal deficit and excessive tariff policies, further fueling the rise in gold and silver prices. Moody’s has estimated that if there are no meaningful adjustments to revenue and expenditure structures, the U.S. fiscal deficit could reach 9% of GDP by 2035 (compared to 6.4% in 2024).

Additionally, the global expansion of renewable energy policies and the proliferation of artificial intelligence (AI) have increased electricity demand, which in turn has driven up demand for silver and copper needed for power infrastructure. Kim noted, "As the deployment of highly efficient solar power facilities has expanded, demand for silver used in solar panels has increased." He added, "As of 2024, 29% of industrial silver is used in solar power generation." Since 2022, large-scale investments in data centers have also led to increased copper demand.

Rising Demand but Stagnant Production... Surge in Private Investment Further Fuels Price Increases

Supply-demand imbalances have also contributed to the rise in metal prices. While industrial demand for silver has steadily increased, supply has stagnated due to structural limitations, resulting in persistent excess demand since 2021. Kim explained, "About 70% of silver is produced as a byproduct during the mining of copper, zinc, and lead, making it difficult to rapidly expand silver mining solely to increase silver production." Copper also saw supply disruptions last year due to mining accidents, resulting in demand outstripping supply for the first time in three years.

The expansion of private investment and speculative demand through exchange-traded funds (ETFs) and derivatives is also cited as a factor in rising prices. According to Citi, from June to November last year, there was a net purchase of 88 million ounces (about 3.5 billion dollars) in the global silver ETF market, bringing the total silver ETF investment for the year to approximately 110 million ounces.

The market expects the upward trend in major metal prices to continue this year, driven by expansionary fiscal policies, increased investment in advanced technologies, and the designation of key minerals as strategic assets by major countries. The United States is set to implement tax cuts in earnest this year, while Europe is expanding fiscal spending, particularly in the defense industry. China is also expected to maintain expansionary fiscal policies to stimulate domestic demand, supporting robust industrial demand.

However, Kim pointed out, "There has been an excessive short-term surge in major metal prices, which could lead to heightened volatility, with prices swinging sharply even in response to minor shocks." He emphasized that, especially for industrial metals like copper, which are primarily used as intermediate goods, rising metal prices can significantly impact consumer prices via producer prices. Therefore, it is important to closely monitor the potential changes in the Federal Reserve’s monetary policy in response to metal price increases.

He also noted the need for supply chain strategies to respond to situations where major countries treat metals as strategic assets and implement export controls. According to the National Assembly Futures Institute, China accounts for more than 90% of the supply of key minerals such as lithium, nickel, and cobalt, which are essential for the four major industries: secondary batteries, semiconductors, future vehicles and mobility, and hydrogen. Kim stated, "To ensure stable supply and minimize the impact of price increases, it is necessary to expand local investments, build resource recycling infrastructure, and strengthen supply chain cooperation with major countries through a multifaceted approach."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)