SNE Research Cathode Material Report for January?November 2025

Solid 29.3% Growth Even Outside China

"Building Non-Chinese Supply Chains in North America and Europe Becomes Crucial This Year"

The rapid growth of lithium iron phosphate (LFP) cathode materials in the global electric vehicle battery market has pushed their market share above 60%. Going forward, non-price factors such as the establishment of local supply chains are expected to play a crucial role in the cathode material market.

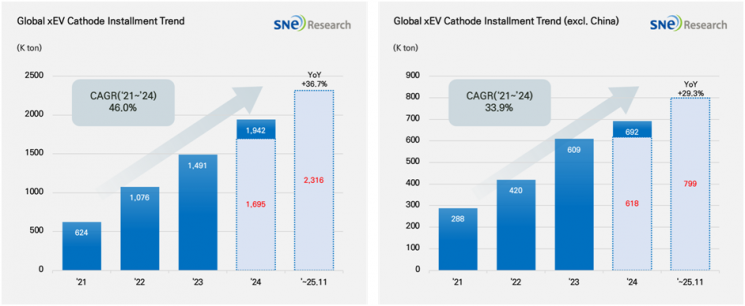

According to SNE Research, a secondary battery market research firm, the total amount of cathode materials loaded into electric vehicles (including battery electric vehicles, plug-in hybrids, and hybrids) worldwide from January to November 2025 reached 2,316 kilotons (Kton), marking a 36.7% increase compared to the same period the previous year.

Even in markets outside of China, the figure reached 799 kilotons, up 29.3% year-over-year, demonstrating solid growth.

Cathode materials are key components that are directly linked to the capacity and output of lithium-ion batteries. Currently, ternary cathode materials such as nickel cobalt manganese (NCM) and nickel cobalt aluminum (NCA), along with LFP cathode materials, are dividing the market.

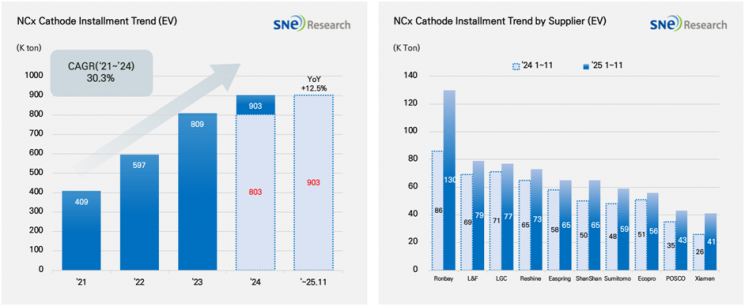

Market Status of Ternary Cathode Materials for Electric Vehicle Batteries from January to November 2025. SNE Research

Market Status of Ternary Cathode Materials for Electric Vehicle Batteries from January to November 2025. SNE Research

By type, the amount of ternary cathode materials loaded stood at 903 kilotons, a 12.5% increase from the same period last year.

In the ternary cathode material market, China's Ronbay maintained the top position with 130 kilotons. South Korea's L&F (79 kilotons, 2nd place), LG Chem (77 kilotons, 3rd place), Ecopro (56 kilotons, 8th place), and POSCO Future M (43 kilotons, 9th place) were also ranked among the leaders. However, overall, the growth of Chinese companies has been even more pronounced.

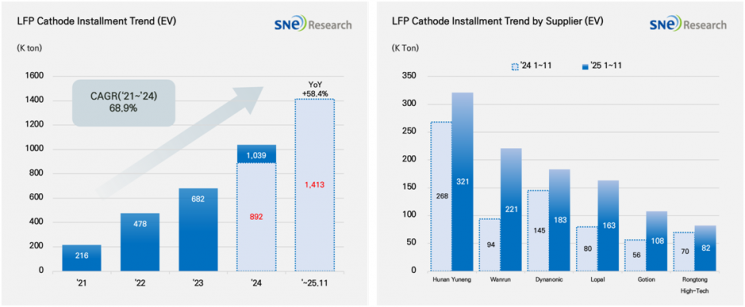

During the same period, the LFP cathode material market surged to 1,413 kilotons, a 58.4% jump from the previous year. The share of LFP in total cathode material loading also rose to about 60% (by weight), further expanding its influence. This trend is attributed to the expansion of entry-level electric vehicles in China, a deepening preference for LFP due to its high price competitiveness, and the increasing adoption of LFP by global automakers.

In the LFP cathode market, China's Hunan Yuneng and Wanrun ranked first and second, respectively, while Dynanonic and Lopal also increased their market share compared to the previous year, ranking third and fourth.

SNE Research explained that as China strengthens its export control system for battery cathode and anode materials, as well as related equipment and technology, the criteria for sourcing materials are changing. Factors such as customs clearance lead time, contract stability, and the possibility of alternative sourcing are becoming more important than simple price competitiveness.

These changes are driving the importance of non-Chinese supply chains, particularly the establishment of local cathode material production systems, especially in North America and Europe.

On the raw material side, expectations for increased power demand from energy storage systems (ESS) and data centers are heightening the volatility of lithium prices. As a result, in 2026, the ability to absorb rising costs and manage margins is expected to be a key factor distinguishing the performance of cathode material companies.

In terms of regulations, while the European Union (EU) battery regulation has postponed the application of mandatory due diligence on critical raw materials to 2027, requirements for traceability and the establishment of verification systems are expected to begin in 2026. SNE Research predicted, "In 2026, the cathode material market will be reshaped based on how transparently companies can manage their supply chains and respond to risks, beyond just performance or cost."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)