Reflecting MSCI Concerns with Measures Like Opening the Foreign Exchange Market...

Experts Give Positive Reviews, but Concerns Remain Over Policy Consistency and Regulatory Rationality on Short Selling

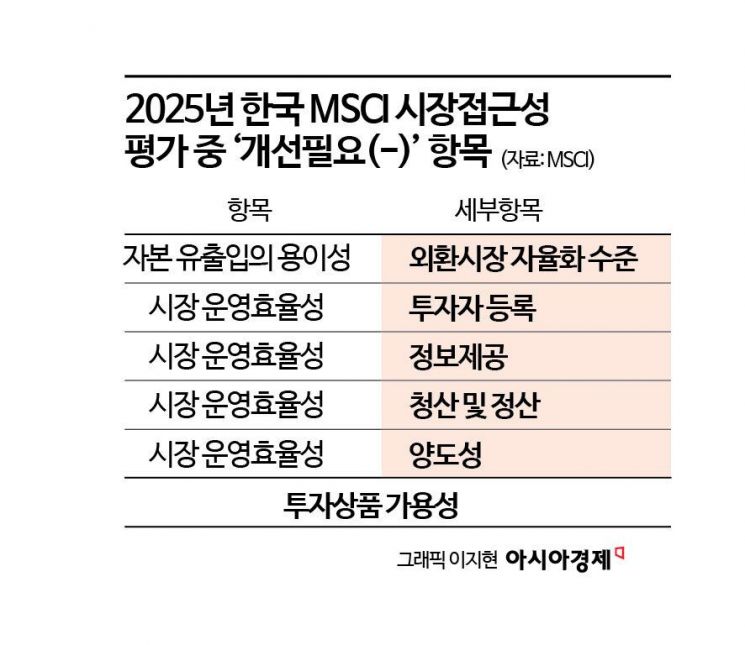

The roadmap devised by the Lee Jaemyung administration to achieve inclusion in the Morgan Stanley Capital International (MSCI) Developed Markets Index during its term focuses on improving foreign investors' accessibility, primarily through measures such as opening the foreign exchange market for 24-hour trading. Among experts, there is positive feedback that the roadmap specifically addresses the issues previously highlighted by MSCI. However, there are also concerns that without a more consistent and relaxed approach to short selling regulations, it will be difficult to build trust among foreign investors.

Experts: "Opening the Foreign Exchange Market for 24-Hour Trading Is the Most Significant Progress"

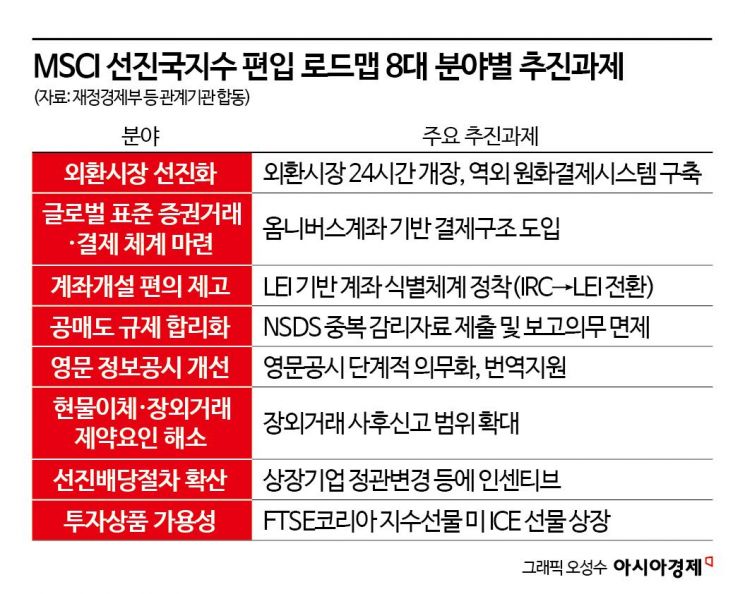

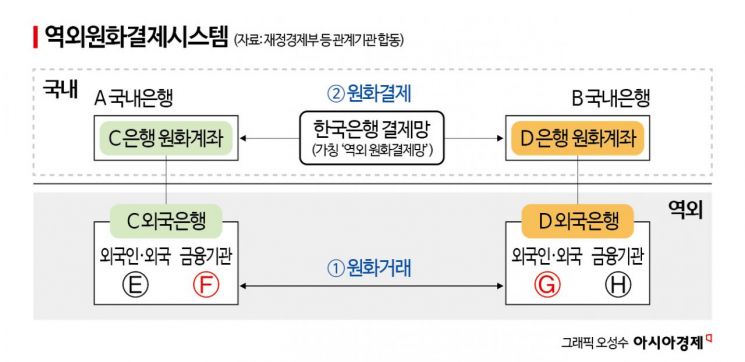

According to the financial investment industry on January 12, multiple capital market experts interviewed by The Asia Business Daily pointed to the opening of the foreign exchange market in July as the most meaningful advancement in the "Comprehensive Roadmap for Foreign Exchange and Capital Markets to Join the MSCI Developed Markets Index," which was jointly released by relevant ministries on January 9. The roadmap includes not only the 24-hour opening of the foreign exchange market and the establishment of an offshore won settlement system, but also improvements to the practical omnibus account system, enhanced English-language disclosures, and advanced dividend procedures. The focus is on upgrading areas that MSCI previously rated as "insufficient" to meet global standards. If Korea succeeds in being added to the watch list in June, this could pave the way for an announcement of inclusion in the Developed Markets Index in 2027 and actual inclusion in 2028.

Lee Hyoseop, Senior Research Fellow at the Korea Capital Market Institute, stated, "The most important aspect of this roadmap is the advancement of the foreign exchange market, including opening it for 24-hour trading. If it functions well, it will be highly significant. Achieving watch list status, the step before full inclusion in the Developed Markets Index, is certainly within reach." Specifically, Lee noted, "Issues raised by foreign investors regarding omnibus accounts have also been well addressed." Previously, Korea received a rating of "insufficient" from MSCI because, although the use of omnibus accounts was allowed, settlements still had to be carried out by the final investor's ID. In response, the government has shifted from the current system of opening separate settlement accounts for each final investor to an integrated management system at the asset management company or global custodian bank (GC) level.

Lee Namwoo, Chairman of the Korea Corporate Governance Forum, also gave a positive assessment of the roadmap, which contains detailed plans in eight areas, stating, "A great deal of detailed preparation has been done. Inclusion in the Developed Markets Index will reduce capital market volatility." A senior executive at a foreign securities firm, who requested anonymity, also commented, "The opening of the foreign exchange market is the most positive aspect," and added, "It is also desirable to expand advanced dividend procedures that allow investors to know their dividends in advance." Until now, most Korean companies have only disclosed confirmed dividends after the ex-dividend date and have not provided expected dividend amounts, making investment decisions difficult for foreign investors.

Criticism Remains: Need for Improved Investor Protection and Regulatory Predictability

However, many experts also pointed out that the current roadmap alone is not enough for Korea’s capital market to be recognized as a "developed market" globally. Since inclusion in the MSCI Developed Markets Index is based on feedback from major global institutional investors, it is essential that these key players genuinely perceive the Korean market as being at a developed level. Lee emphasized, "Many foreign investors feel they have been misled by Korea over the past 20 to 30 years. Alongside governance improvements, ensuring investor protection is crucial to building trust." He explained that this requires maintaining a consistent investor protection policy, providing English-language disclosures on policies and legislation, and consistently strengthening one-on-one communication with major foreign investors.

A senior executive at a foreign asset management company, referred to as B, also commented, "The roadmap alone is insufficient. While it is positive that it includes the opening of the foreign exchange market, we need to see if it can actually be implemented," taking a cautious stance. Prior to the roadmap’s release, Peter Stein, CEO of the Asia Securities Industry & Financial Markets Association (ASIFMA), pointed out in an interview with The Asia Business Daily, "In Korea, frequent changes in short selling policy in recent years, combined with excessive fines and criminal penalties, have undermined regulatory predictability and policy stability."

In particular, foreign stakeholders have specifically noted that the roadmap lacks sufficient detail regarding short selling regulations. The only mention under the "rationalization of short selling regulations" is a brief note that participants in the real-time naked short selling detection system (NSDS) will be exempt from the obligation to submit duplicate supervisory materials. Regarding this, executive A stated, "One of the main concerns for foreign investors is the government's stance on short selling, and Korea has yet to gain persuasive power or trust in line with global standards. The NSDS introduced last year was not a relaxation but rather a tightening of regulations, as it amounts to real-time monitoring of accounts." Foreign stakeholders and investors generally agree that urgent regulatory easing, in line with global standards, is needed in both the level and method of sanctions.

They also pointed out that, although the government has decided to establish an account identification system based on the Legal Entity Identifier (LEI), complex paperwork requirements remain. The LEI is an international standard registration ID used to identify legal entities in global financial transactions. Until now, LEIs were only required when opening new accounts, while foreign investors who had invested in Korea previously used the IRC ID, registered in advance with the Financial Supervisory Service. Executive A noted, "Regarding local custodian banks (LCs), each fund must have its own LEI, so the procedural complexity remains unchanged."

A government official stated, "Pursuing inclusion in the MSCI Developed Markets Index is a key task for fundamentally improving the structure of Korea’s capital market and establishing a stable, long-term demand base. We will systematically review the progress of each improvement task at least once per quarter through a task force comprising relevant agencies, ensure effective implementation, and support a swift transition. We will also actively communicate with MSCI and global investors to enhance their perception of the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)