8.952 Trillion Won in Capital Securities Issued by Insurers Last Year

'Basic Capital K-ICS' to Be Introduced in 2027, Increasing Capital Burden for Insurers

Falling Asset Management Yields and Rising Interest Expenses Compound the Challenges

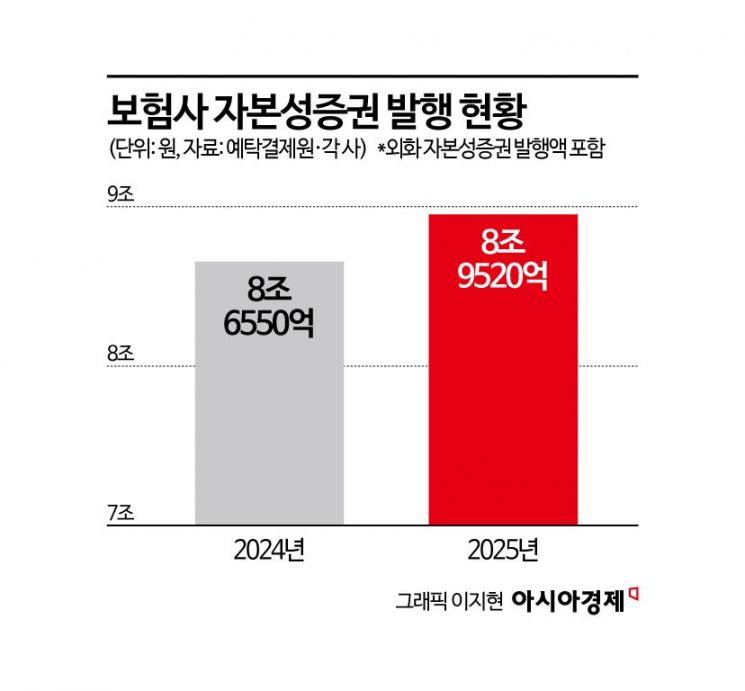

Last year, the amount of capital securities issued by insurance companies approached 9 trillion won, setting a new all-time high for the second consecutive year. However, as the financial authorities are expected to soon announce new regulations on the basic capital solvency ratio (K-ICS), the issuance of capital securities this year is likely to slow down.

According to the Korea Securities Depository and the insurance industry on January 6, the capital securities issued by insurance companies last year totaled 8.952 trillion won (including subordinated foreign currency bonds). This surpassed the 2024 issuance amount of 8.665 trillion won, marking a record high for the second year in a row. Since the adoption of the International Financial Reporting Standards (IFRS17) in 2023, the management of K-ICS, a key financial soundness indicator for insurers, has become increasingly important. As a result, insurance companies issued large volumes of capital securities to bolster their K-ICS ratios.

Capital securities, which include hybrid securities and subordinated bonds, are recognized as capital under accounting standards. Typically, capital securities come with a provision that allows the issuer to exercise a call option (the right to repurchase) after five years. While the decision to exercise the call option is at the issuer’s discretion, investors generally expect the issuer to redeem the securities after five years. Insurance companies have traditionally adhered to the unwritten rule of ‘early redemption after five years’ by issuing capital securities to match the maturity of bonds coming due, except in special circumstances.

However, going forward, insurance companies are expected to face greater pressure regarding early redemption. This is because the financial authorities are preparing to introduce the ‘basic capital K-ICS’ regulation. The core of this regulation is to assess insurers’ financial soundness based on stable capital such as common equity and retained earnings, rather than supplementary capital like capital securities. Financial authorities recently convened life and non-life insurers to explain the outline of the basic capital K-ICS regulation. After additional industry feedback, the regulation is expected to be announced soon, followed by a one-year grace period and implementation around the first quarter of next year. The recommended standard for the basic capital K-ICS is currently expected to be 80%, with the regulatory threshold likely set at 50%.

Insurance companies are expected to shift their financial strategies toward increasing basic capital rather than issuing more capital securities. Major methods for managing basic capital include paid-in capital increases by major shareholders, accumulation of retained earnings, and issuance of basic capital hybrid securities. To reduce the required capital, which serves as the denominator for the basic capital K-ICS, insurers are also expected to focus on measures such as co-reinsurance and duration gap management.

However, if insurers neglect basic capital management and fall short of the recommended standard, early redemption of capital securities will be restricted. Currently, for an insurance company to redeem subordinated bonds early, the K-ICS ratio after redemption must exceed the recommended level (130%) or at least meet the regulatory threshold (100%), along with several stringent conditions. It is highly likely that the basic capital K-ICS regulation will also include early redemption conditions for basic capital hybrid securities. As insurance companies are already compelled to reduce capital securities issuance to manage basic capital, the requirements for early redemption are set to become even more stringent. If insurers fail to meet these early redemption requirements, they risk losing investor trust, which in turn could create a vicious cycle by making it more difficult to raise additional funds. The ‘Heungkuk Life Insurance call option incident’ in 2022 is a prime example of this risk.

The situation is even more concerning because a large volume of call options on previously issued capital securities by insurers is set to mature soon. Korea Ratings estimates that the amount maturing will be about 3 trillion won this year and about 5 trillion won next year. Previously, insurance companies were able to ‘roll over’ capital securities, but with the introduction of basic capital regulations, this approach has become more difficult, adding to the burden of large-scale redemptions. The decline in asset management yields due to base rate cuts and the interest burden on bonds issued at higher rates in the past are also weighing on insurers. An industry official said, “Although the authorities have pledged to support the phased introduction of basic capital regulations, a uniform approach without distinguishing between large and small insurers could lead to unintended side effects,” adding, “Additional measures, such as further easing of surrender value reserves, should also be considered.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)