Exchange Rate Decline Eases Financial Pressure on Banks

Postponement of ELS and LTV Fines Also Positive for Earnings

With the government’s aggressive intervention, the sharp drop in the won-dollar exchange rate at the end of the year is expected to somewhat ease concerns about banks’ fourth-quarter earnings. The financial authorities’ fines for the misselling of Hong Kong H-Index (Hang Seng China Enterprises Index, HSCEI) equity-linked securities (ELS), as well as the Fair Trade Commission’s fines related to the collusion on the loan-to-value (LTV) ratio for mortgages-both initially expected to be imposed in December-have also been postponed to next year, reducing the financial burden on banks.

Exchange Rate Drop Eases Banks’ Financial Burden

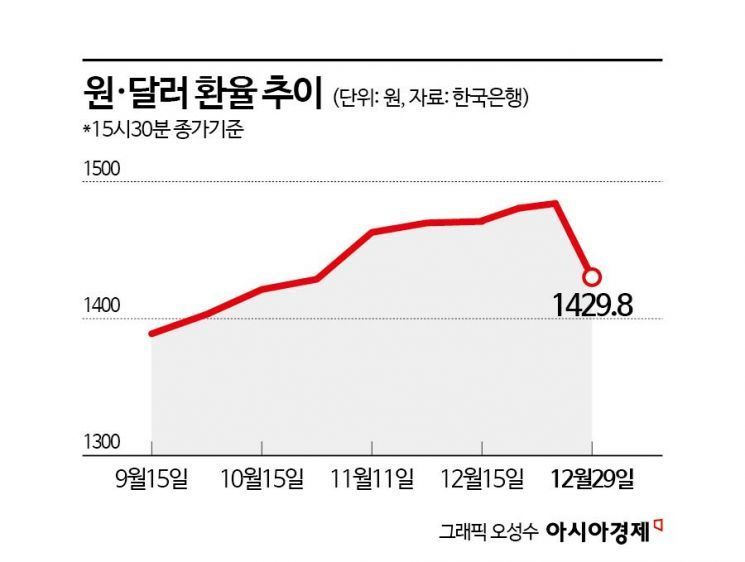

According to the financial sector on December 31, the won-dollar exchange rate closed at 1,483 won on December 23, nearing its yearly high, but has since dropped by about 50 won to the 1,430 won range. The sharp decline in the exchange rate over the past week is attributed to continued strong government intervention, including the National Pension Service’s strategic currency hedging and the Ministry of Economy and Finance’s exemption of capital gains tax on overseas stock investments.

The rapid decline in the exchange rate is expected to have a positive impact on the financials of financial holding companies and banks. When the won-dollar exchange rate rises, the risk-weighted assets (RWA) of banks denominated in dollars increase, which worsens net profit and financial stability. Conversely, a drop in the exchange rate helps ease financial burdens. In the third quarter of this year, the won-dollar exchange rate hovered in the 1,300 won range, but concerns grew in the fourth quarter as it rose to the 1,400 won range, potentially negatively impacting banks’ performance and financial soundness.

However, as the exchange rate fell to the low 1,400 won range at year-end, market concerns are expected to subside somewhat. The market expects the effects of government policy to continue into the first half of next year, with the exchange rate likely to remain around 1,400 won for the time being. Moon Daun, a researcher at Korea Investment & Securities, said, “Due to government measures, the exchange rate will likely attempt to enter the upper 1,300 won range in the first half of next year. However, since the weak won could be a structural phenomenon, the exchange rate may rise again in the second half of next year.”

An official from the banking sector explained, “A falling exchange rate has a positive effect on banks’ earnings and financial structure,” but added, “Since the exchange rate remained relatively high throughout the fourth quarter, financial stability may still be lower compared to the third quarter.”

Postponement of ELS and LTV Fines Reduces Earnings Variables

The postponement of the financial authorities’ fines for the misselling of Hong Kong ELS and the Fair Trade Commission’s fines for LTV collusion-both of which were expected to be imposed on major banks in the fourth quarter-also has a positive impact on banks’ earnings.

The Financial Supervisory Service convened a disciplinary review committee (the “sanctions review”) on December 18 regarding the Hong Kong ELS issue to determine the scale of fines for banks, but failed to reach a conclusion. Previously, the Financial Supervisory Service had considered fines totaling around 2 trillion won, but since the banks have already completed voluntary compensation, there is a possibility that the sanctions review will reduce the amount of the fines. The Financial Supervisory Service is expected to hold an additional sanctions review in the first half of next year to make a final decision on whether to impose fines and their scale.

Similarly, at the end of last month, the Fair Trade Commission’s sanctions review regarding banks’ LTV collusion also failed to reach a conclusion on the amount of fines, so the matter is expected to be carried over into the new year. The Fair Trade Commission believes that the four major banks colluded by sharing LTV information. The banking sector estimates that the fines could reach at least several hundred billion won.

However, even though the imposition of fines has been postponed, banks may still recognize related costs as provisions in their fourth-quarter earnings. Hana Securities estimated that KB Financial Group would reflect about 500 billion won in fourth-quarter expenses related to LTV and ELS fines, while Shinhan Financial Group and Hana Financial Group would each reflect about 250 billion won. Choi Jungwook, a researcher at Hana Securities, explained, “A decrease in fourth-quarter profits for financial holding companies by the estimated amounts is inevitable, but even after accounting for this, fourth-quarter profit and loss is unlikely to deteriorate significantly compared to previous years.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)