Bank of Korea Releases December Business Survey Index and Economic Sentiment Index (ESI)

Year-End Effects Boost Non-Manufacturing, U.S. Facility Investment Drives Manufacturing Improvement

However, Index Remains Below 100... Too Early for Optimism

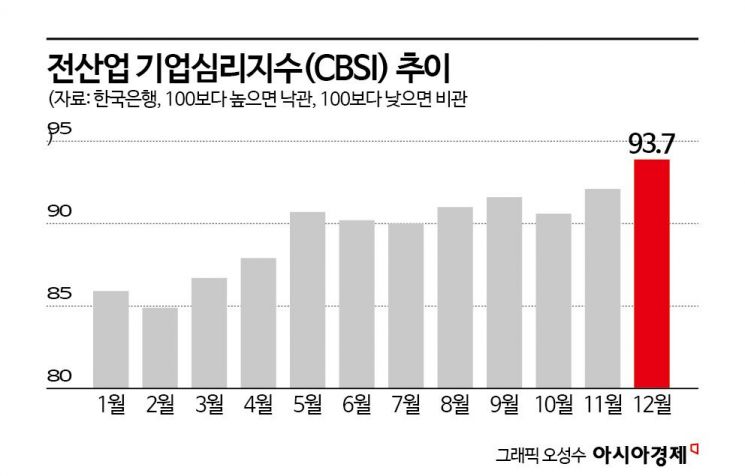

In December, business sentiment among companies rose for the second consecutive month, reaching its highest level since July of the previous year. The year-end seasonal effect, particularly in the non-manufacturing sector, contributed to this improvement, while the manufacturing sector also saw gains due to factors such as improvements in industries related to U.S. facility investment. However, as the index remains below the long-term average of 100, experts caution that it is too early to be optimistic about the situation.

According to the "December Business Survey Index (BSI) and Economic Sentiment Index (ESI)" released by the Bank of Korea on the 30th, the Composite Business Survey Index (CBSI) for all industries this month stood at 93.7, up 1.6 points from the previous month. This is the highest figure since July of last year (95.5). The CBSI is a business sentiment indicator calculated using key indices from the Business Survey Index (BSI). A reading above 100 indicates that companies are more optimistic about the economic situation compared to the past, while a reading below 100 indicates pessimism. Lee Hyeyoung, Head of the Economic Sentiment Survey Team at the Bank of Korea's Economic Statistics Department 1, explained, "Year-end seasonal factors had a particularly positive effect on the non-manufacturing sector, and the manufacturing sector also improved, especially in areas such as metal processing and other machinery and equipment related to U.S. facility investment." She added, "However, since the index is still below the long-term average, it is difficult to say that the situation is favorable yet."

This month, the manufacturing CBSI recorded 94.4, up 1.7 points from the previous month. In the manufacturing sector, factors such as financing conditions (up 0.9 points) and production (up 0.4 points) were the main contributors to the increase. Manufacturing performance this month improved mainly in metal processing, other machinery and equipment, and automobiles. Metal processing benefited from increased orders for U.S. facility-related parts and domestic offshore wind power structures. Other machinery and equipment improved due to increased demand related to U.S. facility investment and higher demand in downstream industries such as semiconductors, shipbuilding, and automobiles. The automotive sector was positively impacted by increased sales resulting from year-end promotions and the scheduled end of individual consumption tax reduction benefits.

The non-manufacturing CBSI rose by 1.4 points to 93.2. In the non-manufacturing sector, sales (up 0.6 points) and financing conditions (up 0.5 points) were the main drivers of growth. This month, non-manufacturing performance improved mainly in professional, scientific and technical services, wholesale and retail trade, and information and communications. In professional, scientific and technical services, year-end order performance increased in areas such as legal services and social overhead capital (SOC) design. In wholesale and retail trade, sales in the distribution industry improved due to Black Friday sales and an increase in Chinese tourists. The information and communications sector was positively affected by increased demand for IT consulting, such as system integration, and higher software sales.

Although the high exchange rate in December had some impact, it was not a major factor. Lee stated, "The proportion of exchange rate issues among business difficulties increased in both manufacturing and non-manufacturing compared to the previous month, but the share remained below 10% for both sectors." She added, "Both manufacturing and non-manufacturing companies cited sluggish domestic demand (25.9% and 23.0%, respectively) as the most significant business difficulty."

The business sentiment outlook for next month was surveyed at 89.4, down 1.7 points from the previous month. While the manufacturing sector is expected to rise by 1.9 points to 93.6, the non-manufacturing sector is expected to decline by 4.1 points to 86.6. Lee explained, "There is a tendency for the index to rise in December due to year-end seasonal effects, especially in the non-manufacturing sector, but it tends to fall again in January."

The outlook for manufacturing in January improved mainly in rubber and plastics, other machinery and equipment, and automobiles. The non-manufacturing outlook worsened, particularly in wholesale and retail trade, professional, scientific and technical services, and construction.

The Economic Sentiment Index (ESI), which combines the BSI and the Consumer Sentiment Index (CSI), fell by 1.0 point from the previous month to 93.1. The cyclical component, which removes seasonal factors, rose by 0.7 points to 94.9 compared to the previous month.

Meanwhile, this survey was conducted from the 11th to the 18th of the month, targeting 3,524 corporate entities nationwide. Of these, 1,824 were manufacturing companies and 1,431 were non-manufacturing companies, with a total of 3,255 responses (92.4%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)