Economic Outlook Report "House View"

Fed's Resolution of Yield Curve Inversion

Ironically Signals Imminent Recession

Signs of Downturn Detected in Financial Markets,

Corporate Investment, and Auto Loan Delinquencies

There is an analysis suggesting that the US economy could enter a recession within the next year as economic instability spreads. This view is based on a recession probability model using the yield curve, which shows that the recent "normalization" phase, where the Federal Reserve resolved the yield curve inversion, has historically appeared just before the onset of a recession.

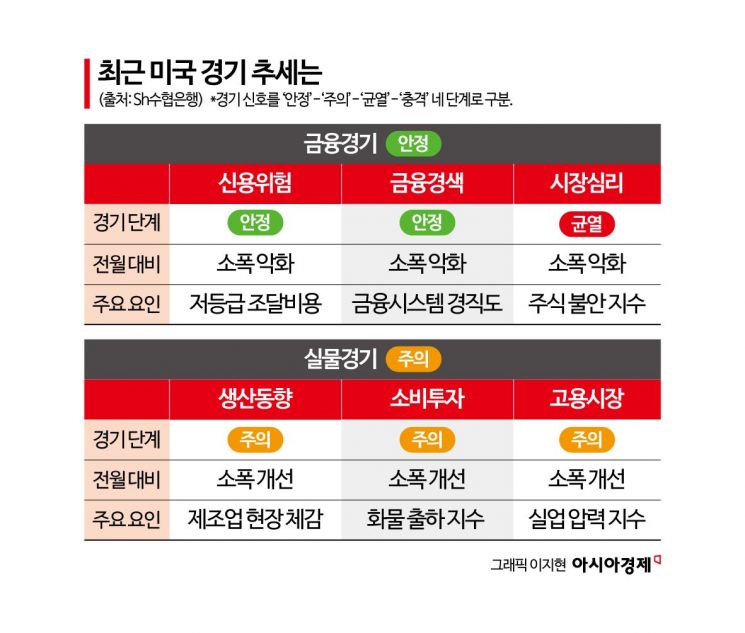

According to the financial sector on the 29th, Sh Suhyup Bank stated this in the inaugural issue of its economic outlook report, "House View." Suhyup Bank used a one-year recession probability model based on the yield spread between the 10-year and 3-month US Treasury bonds, as published by the Federal Reserve Bank of New York, and divided the economic cycle into four stages (Stable, Caution, Crack, Shock) to forecast the likelihood of a recession within the next year. A score of 0-30 indicates Stable, 31-50 is Caution, 51-70 is Crack, and 71-100 is Shock.

Currently, the US economy scores 31.8 points, corresponding to the Caution stage, but the outlook is for it to enter the Crack stage with a projected score of 52 points. Yield curve inversion refers to a situation where the policy rate (short-term rate) is higher than the long-term rate, indicating excessive monetary tightening. Suhyup Bank explained, "As the 3-month short-term rate has fallen more rapidly than the 10-year long-term rate, the yield curve inversion has been resolved, and the economy has entered a normalization phase. Historically, the Crack stage accompanied by normalization has corresponded to the period just before entering a recession."

In addition, Suhyup Bank noted that recession signals are being detected in areas such as financial and credit conditions, corporate investment trends, and auto loan delinquency rates. While the financial market appears stable on the surface, there are underlying signs of instability. The Financial Stress Index published by the Federal Reserve stood at -0.54 at the end of October, remaining in negative territory, which indicates low financial stress. However, Suhyup Bank pointed out that the spread of high-yield bonds is widening again, meaning that credit risk is gradually accumulating beneath the appearance of a stable financial environment.

Suhyup Bank also analyzed that while overall corporate investment in the US is on the rise, this is primarily driven by large-scale investments from big tech companies such as Google, Microsoft, and Amazon. Investments amounting to hundreds of billions of dollars are boosting the overall capital expenditure indicators, but at the same time, investment concentration is intensifying. In particular, while investments are being focused on specific sectors like data centers, investments in traditional industries, including manufacturing, are actually declining. Suhyup Bank evaluated, "The increase in investment centered on data centers may improve indicators in the short term, but it is limited in generating employment and boosting household income, so it is uncertain whether this will lead to sustainable growth across the broader economy."

The worsening of auto loan delinquencies in the US was also identified as a recession signal. Automobiles are essential means of transportation for US households, and auto loans are considered the last type of debt that households would default on. Suhyup Bank emphasized, "Auto loan delinquencies have reached unprecedented levels." In order to offset the surge in vehicle prices, the share of ultra-long-term loans exceeding six years is increasing, and delinquency rates are rising sharply not only among subprime borrowers but also among prime borrowers. The number of vehicle repossessions last year reached 1.73 million, a level similar to that during the 2009 global financial crisis (1.77 million), which is also cited as a risk factor. Suhyup Bank warned that this trend could become a "trigger" for a recession, leading from household credit deterioration to a sharp decline in consumption, a slowdown in the real economy, and a spillover into the financial sector.

Meanwhile, Suhyup Bank currently diagnoses the US financial economy as being in the "Stable" stage, while the real economy is in the "Caution" stage. The overall financial economy is showing a gradual downward trend within the stable stage, while the real economy is seeing some improvement in certain sectors, but overall, caution is still warranted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)