MBK Slows Down, Global PEFs Gain Prominence

Domestic PEFs Focus on Mid- and Small-Sized Deals

Homeplus Incident Sparks Debate Over PEF Responsible Management

Financial Authorities Take Action with 'One-Strike Out' Policy

In 2025, trillion-won "big deals" in the domestic mergers and acquisitions (M&A) market led by private equity fund (PEF) managers became the stage for global PEFs. This was influenced by the slowdown of MBK Partners, the largest PEF in Asia, due to various controversies. Instead, domestic PEFs turned their attention to the middle market, leading a range of deals both large and small.

Global PEFs Drive Trillion-Won Big Deals, Domestic PEFs Focus on the Middle Market

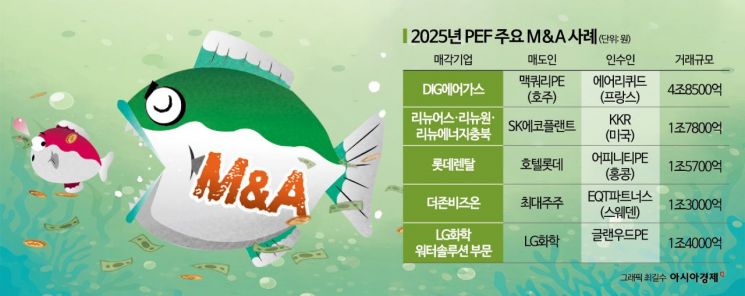

According to the investment banking (IB) industry on December 29, there were five trillion-won big deals led by PEFs this year. Of these, four were dominated by global PEFs.

The largest M&A deal this year was the sale of DIG Airgas, a global industrial gas manufacturer. Macquarie PE sold the company to French gas firm Air Liquide for 4.85 trillion won. Previously, Macquarie PE had acquired DIG Airgas from MBK Partners for 2.8 trillion won in 2020.

In addition, KKR acquired 100% of the shares in SK Ecoplant’s environmental subsidiaries-Renewone, Renewus, and Renew Energy Chungbuk-for 1.78 trillion won. EQT Partners acquired a 22.29% stake in software company Douzone Bizon from Chairman Kim Yongwoo for 1.3 trillion won, and earlier this year, Affinity Equity Partners acquired Lotte Rental, the number one company in Korea’s rental car industry, for 1.5729 trillion won.

Among domestic PEFs, Glenwood PE was the only one to successfully close a trillion-won deal. Glenwood PE acquired NanoH2O (formerly LG Chem’s water solutions division) for 1.4 trillion won.

Other domestic PEFs were active in the middle market M&A sector. Notable deals included VIG Partners’ acquisition of LG Chem’s aesthetics division (200 billion won), Stick Investment’s acquisition of Cleantopia (600 billion won), Well to Sea Investment’s acquisition of SIFLEX (430 billion won), and Affirma Capital’s acquisition of waste management company CEK (400 billion won).

'PEF Responsible Management' Under the Spotlight Amid Homeplus Incident

The most disruptive event in the domestic capital market this year was the Homeplus incident involving MBK Partners. Beyond a simple restructuring failure, the issue of responsible management by PEFs came under scrutiny, intensifying negative perceptions toward PEFs.

MBK Partners faced a crisis year. While Homeplus, which entered corporate rehabilitation proceedings, remains at a crossroads, a hacking incident at Lotte Card-where MBK Partners is the largest shareholder-sparked further controversy. In addition, the dispute over management control at Korea Zinc between Chairman Choi Yoonbum and the alliance of Young Poong and MBK Partners continues.

JKL Partners also faced challenges. After the M&A contract for bakery brand London Bagel Museum, suspicions arose over an employee’s death from overwork. Although this incident was not directly related to JKL Partners, ESG (environmental, social, and governance) risks surfaced, potentially stalling sales growth and putting JKL Partners’ crisis management capabilities to the test.

In the wake of these incidents surrounding PEFs this year, financial authorities moved to strengthen regulations on PEFs. First, a one-strike-out policy will be introduced, allowing for the cancellation of registration for management companies (GPs) after a single major legal violation. In addition, PEFs will be required to regularly report the assets, liabilities, and liquidity status of acquired companies to the financial authorities. The authorities aim to propose the relevant legal amendments within the year, targeting passage in the first half of next year.

Trillion-Won Deals Lined Up for 2026

Although the PEF industry faced a difficult year, expectations are rising as several trillion-won big deals are anticipated for next year.

First, as early as January, the fate of golf brand TaylorMade-expected to fetch around 4 trillion won-will likely be decided. In the main bidding process led by Centroid Investment, U.S. golf-focused investment firm Old Tom Capital emerged as a leading candidate for preferred bidder status, offering about $3 billion (approximately 4.4 trillion won). If a preferred bidder is selected, F&F, which holds preemptive rights, must decide whether to match the terms and acquire TaylorMade within 14 days.

SK Microworks Solutions, estimated to be worth 2 trillion won, has also recently begun its sale process. The largest shareholder, Hahn & Company, has selected UBS and a major domestic accounting firm as sale managers, seeking overseas buyers while also pursuing a dual-track strategy by contacting domestic strategic investors (SIs). Classys, in its fourth year under Bain & Company, is also on the market, with the sale price expected to be in the 3 trillion won range.

An IB industry official stated, "This year, the M&A market contracted due to high interest rates and policy uncertainty, leading many trillion-won deals to briefly surface before disappearing again. While next year’s market conditions may not be easy, some of the issues that dampened the market are being resolved, which gives us hope."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)