CVCs Face Fewer Fund Maturity Constraints, Enabling Long-Term Investment in Innovative Sectors

"U.S. Giants Like Google and Microsoft Foster Promising Startups Through CVCs"

Fair Trade Commission Signals Regulatory Revisions for Holding Company

With the Lee Jaemyung administration placing a strong emphasis on transitioning to "productive finance," there are growing expectations that corporate venture capital (CVC) will play an even more significant role in the venture investment industry this year. The Financial Services Commission has identified "promoting capital supply" as a key task under its productive finance policy, while the Fair Trade Commission has also begun revising regulations on CVCs owned by general holding companies. The market is closely watching whether CVCs will emerge as "core funding sources" rather than merely "supplementary participants" in the venture investment market.

According to the investment banking (IB) industry on January 2, expectations are rising that the easing of CVC regulations for domestic general holding companies will spur early-stage investments by large corporations in 2026.

CVCs refer to venture capital firms established by large corporations to invest in promising startups and ventures. While traditional venture capitalists (VCs) primarily attract funds from external limited partners (LPs) with the main goal of financial returns, CVCs mainly utilize parent company or affiliate funds to pursue strategic objectives such as securing innovative technologies and entering new business areas, in addition to financial gains.

"Korean CVC Investments Have Limited Impact on Venture Capital Inflows"

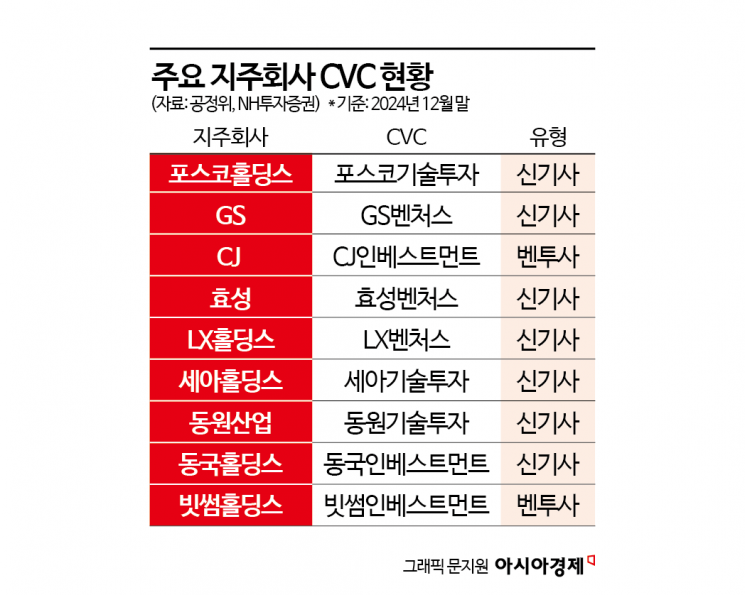

Originally, under the principle of separating finance and industry in Korea, general holding companies were not allowed to own VCs, leading these companies to establish CVCs overseas. While overseas CVCs could avoid regulations under the Fair Trade Act, they were not eligible for domestic venture investment tax benefits. It was only after the Fair Trade Act was revised at the end of 2021 that holding companies were allowed to own CVCs. However, there have been ongoing criticisms that strict regulations-such as a 40% cap on external funding, a borrowing limit of 200% of equity capital, and a 20% cap on overseas investments relative to total assets-have not sufficiently encouraged private capital inflows into the venture investment market.

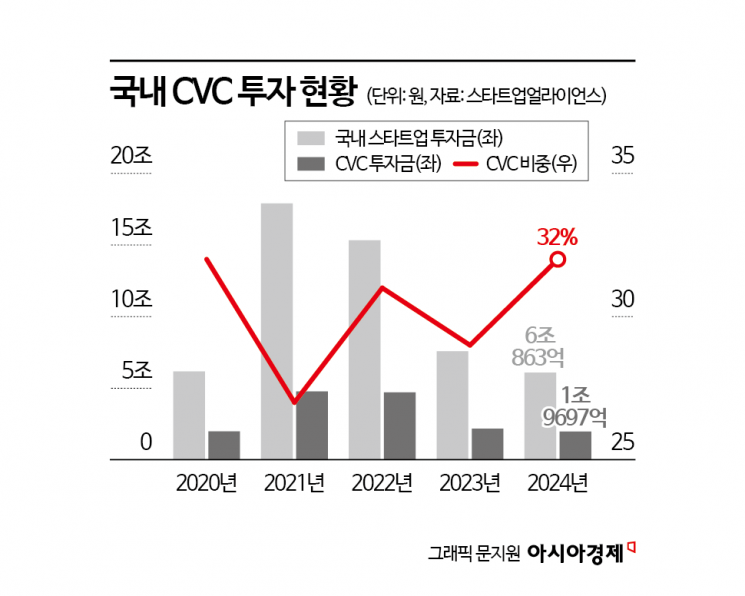

According to Startup Alliance, in 2024, domestic CVC investment amounted to 1.9697 trillion won, accounting for 32% of total startup investments. Unlike the gradual recovery seen in global and U.S. CVC investments, domestic CVC investments continued to decline, falling by 9% compared to the previous year.

Startup Alliance noted, "Since the legal amendment, there have not been many cases of independent CVCs outside of holding companies converting to general holding company CVCs, as various regulations have become burdensome for companies." The organization added, "Since independent CVCs can already be established and operated outside of the general holding company system, it is necessary to review the effectiveness of investment restrictions on general holding company CVCs."

Kim Hyun-yeol, a researcher at the Korea Institute of Finance, also stated at a seminar in early December, "CVCs can drive business innovation by discovering startups that possess technologies and business models needed by their parent companies." He added, "Given that CVCs are more suitable for scale-up stage investments than for seed stage, regulatory relaxation is necessary to enhance strategic synergies."

"U.S. CVCs Are Core Players in Venture Investment... Flexible Exit Strategies"

In contrast, overseas CVCs have already established themselves as core players in venture investment. In particular, the United States does not impose separate licensing or investment limit regulations on CVCs, but manages risks through transaction-level reviews focused on competition and security. Since VCs are excluded from financial regulations, financial institutions-including bank holding companies-can also operate CVCs.

According to a recent report by the Korea Capital Market Institute titled "Analysis of the U.S. CVC System and Operational Status," the total deal value involving U.S. CVCs in 2021 (deal value and total funding raised in participating investment rounds) reached $174.9 billion (about 253 trillion won), a 5.9-fold increase compared to 2014. Even after a period of adjustment in 2022-2023, the figure remained high at $107.5 billion (about 156 trillion won) in 2024.

Han Areum, Senior Research Fellow at the Korea Capital Market Institute, stated, "CVCs face relatively fewer constraints regarding short-term returns or fund maturity, allowing for flexible exit strategies." She added, "Even during economic downturns, CVCs can continue investing in sectors with high long-term value, and have served as a buffer for market liquidity even as the VC market contracted due to rising interest rates and valuation adjustments."

Researcher Kim emphasized, "Global companies such as Google, Microsoft (MS), and BMW have discovered and nurtured promising startups like Uber, Airbnb, and Blue Bottle through CVC operations." He continued, "CVC investments are highly likely to develop as a pathway to mergers and acquisitions (M&A). In Korea, 66% of M&A transactions were preceded by CVC-related investments, and in 22% of cases, the parent company directly acquired the startup after CVC investment."

CVCs Emerge as 'Growth-Stage Investors' Focusing on AI and Large Rounds

In response to these issues, the Fair Trade Commission announced in November last year through its "Key Work Plan" that it would improve the CVC system for general holding companies to revitalize venture investment. The commission also proposed raising the external funding cap per fund to 50% and increasing the overseas investment cap relative to total assets to 30%.

However, there are also calls for additional "discipline" to be introduced alongside these improvements for CVCs. One researcher suggested, "It is necessary to refer to the U.S. CVC system, operational methods, and governance structures when designing the domestic CVC model."

He added, "U.S. CVCs attribute their success to clear alignment with corporate strategy, professional talent, and a certain level of independent decision-making structures." He concluded, "The fact that CVC operations are evaluated based on composite performance indicators suggests that domestic CVCs should not be designed solely for profit, but should serve as strategic entities that drive innovation in large corporations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)