2026 Global Financial Market Outlook and Investment Strategy

Semiconductor-Led Export Growth Drives Economic Expansion

Room for Improvement in Domestic Demand and Investment

Average Exchange Rate at 1,430 Won... "Weak Won Is the New Normal"

'N

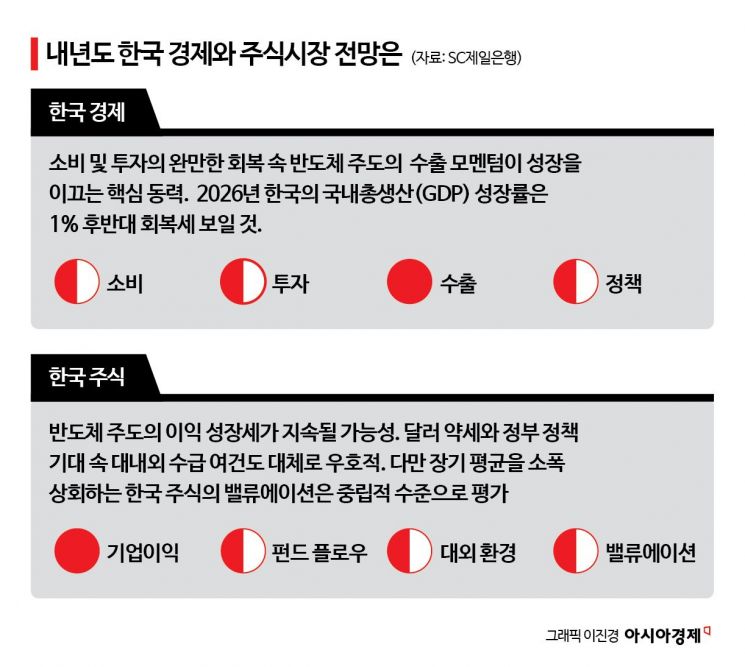

SC First Bank has forecast South Korea's economic growth rate for next year to be in the upper 1% range. The bank expects a moderate recovery in consumption and investment, with strong growth momentum in the first half of the year driven by semiconductor exports. However, it projects that the growth rate will slow in the second half. Regarding the sharp rise in the Korean stock market this year, SC First Bank maintained a 'neutral' investment opinion, citing reasons such as the weak Korean won.

According to the financial sector on the 26th, SC First Bank, together with global investment strategy experts from its parent company Standard Chartered (SC) Group, made these statements in its "2026 Global Financial Market Outlook and Investment Strategy" report.

SC First Bank forecasts that South Korea's growth rate next year will recover to the upper 1% range, stating, "In the first half of next year, we expect solid growth driven by a moderate recovery in domestic demand and strong export momentum led by semiconductors." However, the bank noted that, given the increased dependence on semiconductors, the growth rate in the second half will likely be linked to the trend in semiconductor exports. Accordingly, the bank expects South Korea's economic growth next year to show a "high in the first half, low in the second half" pattern.

The bank also expects the export growth led by semiconductors to continue next year. In particular, as demand for high-bandwidth memory (HBM) remains strong, and as companies concerned about supply shortages and further price increases concentrate their demand on general-purpose semiconductors, semiconductor exports are expected to increase in the first half. Although export conditions excluding semiconductors are relatively weak, the bank anticipates a gradual recovery due to factors such as the resolution of U.S. tariff uncertainties (automobiles) and a boom in orders (shipbuilding).

Regarding domestic demand next year, SC First Bank assessed that "the pace will slow, but the recovery path remains valid." Since policies aimed at improving domestic demand, such as the issuance of consumption coupons, have been concentrated this year, the pace of consumption recovery may gradually slow. However, the bank expects that continued expansionary fiscal policy and the delayed effects of monetary easing will provide sufficient potential for recovery. In terms of investment, the bank expects overall sluggishness. However, the resumption of corporate facility investment due to eased tariff uncertainties and a rebound in construction investment due to base effects are seen as positive factors.

The bank forecasts the average won-dollar exchange rate next year to be around 1,430 won. It diagnosed that the weak won is becoming a "new normal" due to the expansion of overseas investment by domestic residents since the COVID-19 pandemic and increased outbound investment by companies under the Trump administration in the United States, which has intensified dollar outflows. Additionally, the bank highlighted that annual net outflows of 20 billion dollars (about 29 trillion won) due to investment agreements with the United States are another burden.

SC First Bank maintained a neutral opinion on investment in the Korean stock market. The bank cited the burden from this year's sharp stock price increases and the rapid rise in the won-dollar exchange rate due to the Korean won's depreciation against major currencies. Therefore, the bank emphasized the importance of diversified global asset allocation rather than excessive concentration in Korean stocks. However, the bank also noted that global capital flows resulting from a weaker U.S. dollar could lead to increased foreign investment in the Korean stock market, and that the government's expansionary fiscal policy is likely to have a positive impact on the stock market, making it more likely for the index to rise in the first half than in the second half.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)