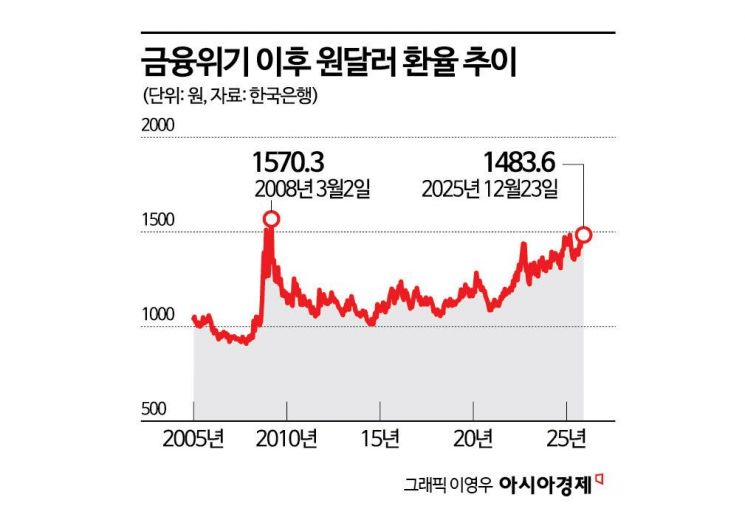

'Year-End Exchange Rate' Surges Past 1,480 Won for Second Consecutive Day

Tax Support Measures Announced for Domestic Investment and Foreign Exchange Stabilization

The government is moving to reduce capital gains tax for individual investors who repatriate funds from overseas stocks and make long-term investments in domestic equities, and to expand tax exemptions for profits repatriated from overseas subsidiaries. By providing greater tax support to individual investors bringing capital back to Korea and to export companies engaged in reshoring, the aim is to induce the return of funds to the domestic capital market and increase dollar liquidity.

Jiyoung Choi, Director General for International Economic Affairs at the Ministry of Economy and Finance (center), is explaining the tax support measures for domestic investment and foreign exchange stability at the Ministry of Economy and Finance press room in the Government Complex Sejong on the 24th. On the left is Honggi Park, Director of Income and Corporate Tax Policy, and on the right is Kwangwook Byun, Director of International Tax Policy. Photo by Yonhap News

Jiyoung Choi, Director General for International Economic Affairs at the Ministry of Economy and Finance (center), is explaining the tax support measures for domestic investment and foreign exchange stability at the Ministry of Economy and Finance press room in the Government Complex Sejong on the 24th. On the left is Honggi Park, Director of Income and Corporate Tax Policy, and on the right is Kwangwook Byun, Director of International Tax Policy. Photo by Yonhap News

On December 24, the Ministry of Economy and Finance, the Financial Services Commission, and the Financial Supervisory Service released the "Tax Support Measures for Domestic Investment and Foreign Exchange Stability." First, a new "Return-to-Domestic Market Account (RIA)" will be established to support individual investors returning to the domestic market. For individual investors who sell overseas stocks held as of December 23, convert the proceeds into Korean won, and purchase domestic stocks or equity funds, capital gains tax on overseas stock sales will be reduced within a certain limit. For example, if an individual invests up to 50 million won from the sale of overseas stocks in the domestic stock market for more than one year, a temporary one-year tax exemption will be provided.

If the funds are repatriated in the first quarter of next year, a 100% exemption will apply; in the second and third quarters, the exemptions will be 80% and 50%, respectively, meaning that the earlier the return to the domestic market, the greater the capital gains tax benefit. Jiyoung Choi, Director General for International Economic Affairs at the Ministry of Economy and Finance, explained, "This measure is intended to support the return of individual overseas investors, thereby stabilizing the foreign exchange market and revitalizing the capital market at the same time."

Major securities firms will also introduce forward contract sell products for individual investors, and a new measure will allow capital gains tax deductions when hedging foreign exchange risk. If an investor hedges currency risk while holding overseas stocks, additional income deductions will be allowed when calculating capital gains tax. Based on the average annual balance, a certain percentage of the amount invested in hedging products, up to a limit of 100 million won, will be recognized as an income deduction. From the investor's perspective, this allows them to minimize foreign exchange losses from future exchange rate declines without directly selling their overseas stocks, while in the foreign exchange market, the immediate increase in the supply of dollars and other foreign currencies is expected to contribute to exchange rate stability.

The won-dollar exchange rate surpassed 1,480 won, showing the highest level since April 9, when the U.S. tariff shock occurred (1,487.6 won). On the 24th, the dollar purchase price was displayed at the currency exchange booth in Terminal 2 of Incheon International Airport. 2025.12.24 Photo by Kang Jinhyung

The won-dollar exchange rate surpassed 1,480 won, showing the highest level since April 9, when the U.S. tariff shock occurred (1,487.6 won). On the 24th, the dollar purchase price was displayed at the currency exchange booth in Terminal 2 of Incheon International Airport. 2025.12.24 Photo by Kang Jinhyung

The tax exemption rate (non-taxable income ratio) for dividends received from overseas subsidiaries will be raised from the current 95% to 100%. The non-taxable income ratio for dividends means that, to avoid double taxation, dividends from overseas subsidiaries that have already been taxed abroad are not included in the parent company's taxable income in Korea. This measure is intended to encourage companies to repatriate dollar funds accumulated overseas. The expanded non-taxable income ratio will apply to dividends received after January 1 next year.

The authorities are announcing a series of comprehensive measures to stabilize exchange rates, including easing foreign exchange regulations. Previously, they introduced measures such as expanding forward position limits for Standard Chartered Korea and Citibank Korea, reducing the burden of foreign currency liquidity stress tests, and expanding the scope of foreign currency loans permitted for export companies. The policy focus is shifting from managing the outflow of domestic capital-such as individual investors and the National Pension Service-to attracting foreign capital back to Korea and increasing dollar liquidity. The authorities believe that not only overseas investments by individual investors, but also corporate overseas direct investments and the $350 billion invested in the United States, are contributing to market instability. The Ministry of Economy and Finance is also considering coordinating the timing and amount of annual investments in the United States, which total about $20 billion per year, with the U.S. Treasury Department.

The authorities are currently focused on lowering the exchange rate ahead of the year-end closing of the foreign exchange market. In the market, there are growing concerns about further increases in the exchange rate, with some forecasts suggesting it could surpass the year's high of 1,484.1 won set in April. The closing exchange rate on December 30, when the market closes for the year, will serve as the basis for financial soundness and credit ratings for companies and banks. A financial investment industry official explained, "Companies and banks convert their foreign currency assets and liabilities into Korean won based on the weighted average exchange rate posted on December 31, calculated from trading on the market's closing day, December 30. Since most export-dependent Korean companies have more foreign currency liabilities than assets, a rise in the exchange rate leads to a sharp increase in total liabilities and higher interest payment burdens." A high debt ratio could result in lower credit ratings or a negative outlook in the future.

Meanwhile, with only three days left before the year-end closing of the won-dollar exchange rate, the authorities intervened verbally as the market remained volatile. On this day, Kim Jaehwan, Director General for International Finance at the Ministry of Economy and Finance, and Kyungsoo Yoon, Director General for International Affairs at the Bank of Korea, issued a strong verbal intervention, stating, "An excessive weakening of the won is undesirable" and "You will soon see that the government has prepared the situation to demonstrate its strong will and comprehensive policy execution capabilities." On this day, the won-dollar exchange rate opened at 1,484.9 won, up 1.3 won, threatening the year's high, but after the authorities' verbal intervention, it fell sharply, dropping to as low as 1,458.60 won during the morning session.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)