Mirae Asset Venture Investment Hits Lower Limit, While Mirae Asset Securities Rises for Four Days

Mirae Asset Venture Investment Soars First on SpaceX IPO Expectations

Stock Trend Reverses as Analysts Say "Mirae Asset Securities Is the Real Beneficiary"

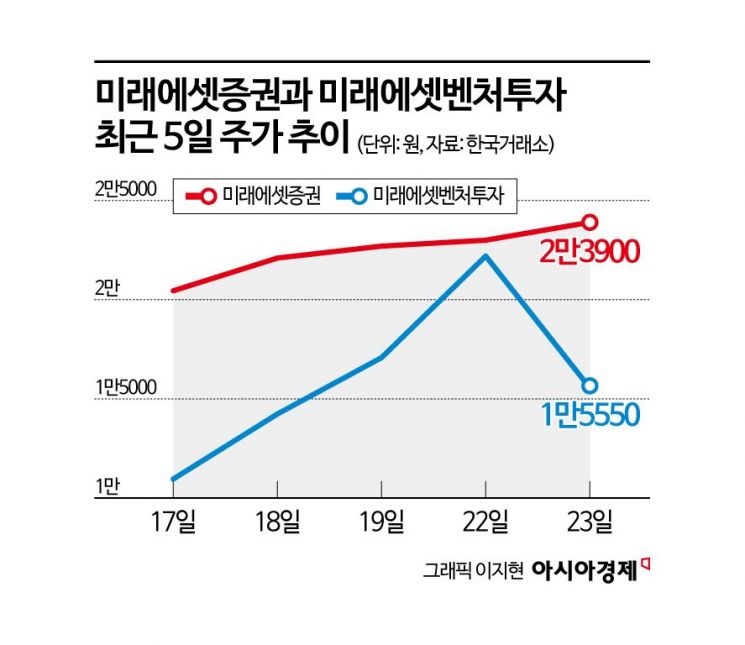

As news emerged that SpaceX, the space company led by Elon Musk, is pursuing an initial public offering (IPO), Mirae Asset Securities and Mirae Asset Venture Investment have been highlighted as potential beneficiaries. However, while Mirae Asset Venture Investment hit its lower trading limit, Mirae Asset Securities continued its upward trend, reflecting a divergence in their stock performances. This is due to analysts' views that Mirae Asset Securities stands to benefit more significantly from SpaceX's IPO.

According to the Korea Exchange on December 24, Mirae Asset Venture Investment closed at 15,550 won on the previous day, down 29.95% from the previous session, marking a reversal after five days. Over the past four days, Mirae Asset Venture Investment had surged by 113.67%, including hitting the upper trading limit on two occasions, but it recorded the lower limit on this day.

In contrast, Mirae Asset Securities maintained its upward momentum for four consecutive days, rising 16.87% over that period.

SpaceX is reportedly planning to go public next year, aiming to raise $30 billion (approximately 44 trillion won). Jeong Huihun, a researcher at Eugene Investment & Securities, stated, "Recently, SpaceX was valued at $800 billion in private stock transactions, surpassing OpenAI's $500 billion valuation, making it the most valuable unlisted company in the world. If SpaceX goes public in the second half of next year, its valuation is expected to range from $1 trillion to as much as $1.5 trillion, and it plans to raise about $30 billion through this IPO."

With SpaceX's IPO expected to set a new record, market attention has focused on related beneficiary stocks, and Mirae Asset Venture Investment, an investor in SpaceX, soared past 20,000 won for the first time ever. However, as Mirae Asset Venture Investment's investment amount is minimal and securities firms project that Mirae Asset Securities will be the main beneficiary, the two stocks have shown diverging trends.

Hana Securities analyzed that, considering the actual investment structure and scale, the substantial benefits will be concentrated on Mirae Asset Securities. Ko Yeonsu, a researcher at Hana Securities, explained, "Mirae Asset Group invested in SpaceX twice in 2022, with the group's total investment estimated at $278 million. This investment was made by Mirae Asset Capital establishing a fund, with affiliates including Mirae Asset Securities and retail investors participating as limited partners (LPs). Of this, Mirae Asset Securities' contribution is about 200 billion won (116.4 billion won in the Mirae Asset Global Space Investment Association No.1 and about 88.5 billion won in the Mirae Asset Global Sector Leader Investment Association No.1). Including investments by its overseas subsidiaries, Mirae Asset Securities is believed to account for more than half of the total SpaceX investment," she said. She added, "Mirae Asset Venture Investment's investment is estimated at only about 4 billion won, which is negligible, so the valuation gains from SpaceX's rising corporate value will be meaningfully reflected in Mirae Asset Securities' performance."

Mirae Asset Securities is expected to see additional valuation gains related to SpaceX regardless of the IPO. Ko further noted, "As of August this year, SpaceX was estimated to have a corporate value of about $440 billion, and by December, estimates have reached at least $800 billion. Therefore, regardless of whether SpaceX goes public, there is a high likelihood of additional valuation gains, and investments in other innovative companies such as artificial intelligence (AI) and space will also act as long-term upside factors for performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)