Financial Services Commission Holds Third Meeting on Productive Finance Transformation

New Major Shareholder Eligibility Requirements for GPs

"Enhancing Accountability and Soundness"

Approval for Entry of Specialized Electronic Registration Institutions for Unlisted Stocks

"Expecting More Active Fundraising for Ventures and Startups"

Regulatory reforms are being pursued to significantly strengthen the accountability of institution-only private equity funds (PEFs). A "one-strike-out" rule will be introduced, under which a PEF general partner (GP) can be expelled from the market after a single violation, such as using undisclosed material information or engaging in other serious unfair trading practices. The aim is to prevent negative side effects from short-term profit-seeking and to encourage PEFs to contribute to the long-term value creation of companies.

The Financial Services Commission announced on December 22 that it held the "Third Meeting on Productive Finance Transformation" at the Seoul office of the Korea Exchange in Yeouido, Seoul. The meeting brought together representatives from innovative and venture industries, the financial sector, market infrastructure institutions, and experts who form the capital market's innovation ecosystem. They discussed strategies to foster the capital market as a core platform supporting Korea's innovative economic growth. The agenda included tasks necessary for the efficient operation of capital market infrastructure and the organic connection between the financial sector and innovative companies, introducing the government's policy direction.

Introduction of 'One-Strike-Out Rule' for GPs... "Enhancing Accountability and Soundness"

First, the regulatory framework for PEFs will be aligned with global standards. Introduced in 2004 to foster domestic capital after the foreign exchange crisis, PEFs have grown rapidly over the past 20 years. The total PEF commitment, which was only 9 trillion won in 2007, has increased to 153.6 trillion won as of 2024. However, concerns are mounting that PEFs are overly focused on short-term gains, undermining the long-term value of companies and increasing market volatility.

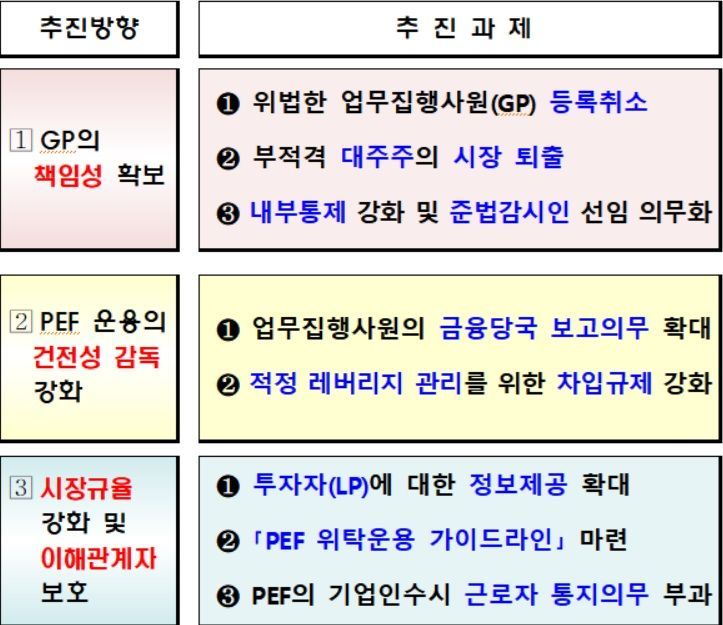

To address these issues, the Financial Services Commission aims to enhance the accountability and soundness of PEFs while ensuring their positive functions are not diminished. In particular, regulations will be revised to meet global standards and prevent adverse effects such as regulatory arbitrage with overseas PEFs.

To ensure GP accountability, oversight will be strengthened. Currently, grounds for GP registration cancellation are somewhat limited, such as repeated similar violations. The new plan is to establish a legal basis for canceling a GP's registration after a single serious legal violation, such as unfair trading practices involving undisclosed material information (the one-strike-out rule).

Additionally, unlike financial companies, GPs currently do not have eligibility requirements for major shareholders, making it difficult to prevent unqualified individuals from participating. Furthermore, the obligation to establish internal control standards has been limited to "conflict of interest management," which is insufficient for regulating sound management. Going forward, GPs will be required to meet major shareholder eligibility criteria equivalent to those for financial companies as a registration condition. GPs will also be obligated to establish internal control standards at the level of financial companies. For medium and large-sized GPs, it will become mandatory to appoint a compliance officer responsible for overseeing internal control-related work.

In addition, to enhance the soundness of PEF management, the reporting system to supervisory authorities will be significantly improved, and the scope of information provided will be expanded so that investors can closely monitor and oversee GPs' management status. Lee Eogwon, Vice Chairman of the Financial Services Commission, emphasized, "We will strengthen oversight to ensure GP accountability and further expand the supervisory functions of both regulatory authorities and the market over PEF management."

The Financial Services Commission plans to submit a proposed amendment to the Capital Markets Act, which includes these PEF system improvements, within this year (as a legislative proposal by lawmakers) and actively participate in National Assembly discussions with the goal of passing it in the first half of next year.

Allowing Entry of Specialized Electronic Registration Institutions for Unlisted Stocks... "Expecting Improved Fundraising for Ventures and Startups"

From a market infrastructure perspective, specialized electronic registration institutions for unlisted stocks will be permitted to ensure the safe trading of venture and startup shares. Since the implementation of the Electronic Securities Act in September 2019, electronic registration businesses have operated under a licensing system. While electronic registration has become established in large, standardized investment markets such as listed stocks and bonds, there have been concerns about the low uptake of electronic registration for non-standardized and unlisted stocks. In response, the government plans to allow specialized electronic registration institutions for unlisted stocks, introducing competition into the securities electronic registration market, which is currently monopolized by the Korea Securities Depository.

Starting this month, the Financial Services Commission, together with the Ministry of Justice and other relevant agencies, will begin preparations for the operation of new specialized electronic registration institutions for unlisted stocks. In the first half of next year, the government will work with the Ministry of Justice and other relevant ministries and agencies to establish detailed licensing review standards (manuals), supplement the Electronic Securities Act to provide a legal basis for delegated licensing reviews, and proceed with related licensing procedures, such as holding briefings in the second half. Authorities expect that if tailored electronic registration for unlisted stocks becomes more widespread, transparency and convenience in trading and management will be enhanced. It is also expected that the likelihood of related disputes will decrease and that fundraising opportunities for small and venture companies will expand.

Vice Chairman Lee Eogwon stated, "By allowing specialized electronic registration institutions for unlisted stocks, we will introduce competition into the securities electronic registration market," adding, "Through customized electronic registration for non-standard and unlisted stocks, we will improve the convenience of stock trading and management, making it easier for ventures and startups to raise capital."

Meanwhile, large securities firms such as Korea Investment & Securities, Mirae Asset Securities, Hana Securities, Shinhan Investment Corp., and Kiwoom Securities, which attended the meeting, announced their intention to actively lead venture capital investments as key financial sector players in the capital market innovation ecosystem. To this end, based on the five securities firms, they plan to add a total of 15.2 trillion won in venture capital investments over the next three years to the existing balance of 5.1 trillion won as of the end of September this year, supplying a total of 20.4 trillion won by the end of 2028.

Vice Chairman Lee Eogwon emphasized, "Productive finance should not be limited to changes in financial companies' work or investment targets, but must quickly deliver tangible outcomes that the public can feel," adding, "We will meticulously oversee the policy delivery system to ultimately ensure that finance is something the public can experience and that truly benefits people's lives."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)