Korea Federation of SMEs Releases Survey Results on Exchange Rate Fluctuations

55% of Respondents Say "Unable to Reflect Increased Costs in Sales Prices"

Appropriate Exchange Rate for Profitability: "1,362.6 Won"

Recently, the rise in exchange rates has also become a burden for export-oriented small and medium-sized enterprises (SMEs). As raw material prices have increased alongside the exchange rate, these companies are not seeing clear benefits from the higher rates. In particular, most SMEs are not utilizing risk management tools to hedge against exchange rate fluctuations, leaving them fully exposed to the resulting burdens.

The Korea Federation of SMEs announced the results of its "Survey on Foreign Exchange Fluctuations Affecting Small and Medium Enterprises" on the 22nd. This survey was conducted from December 1 to December 19, targeting 635 SMEs engaged in export and import activities, in order to comprehensively assess the impact of recent sharp exchange rate fluctuations on SME management.

The results of the "Survey on the Actual Conditions of Small and Medium Enterprises Regarding Exchange Rate Fluctuations" announced by the Korea Federation of SMEs on the 22nd. Korea Federation of SMEs

The results of the "Survey on the Actual Conditions of Small and Medium Enterprises Regarding Exchange Rate Fluctuations" announced by the Korea Federation of SMEs on the 22nd. Korea Federation of SMEs

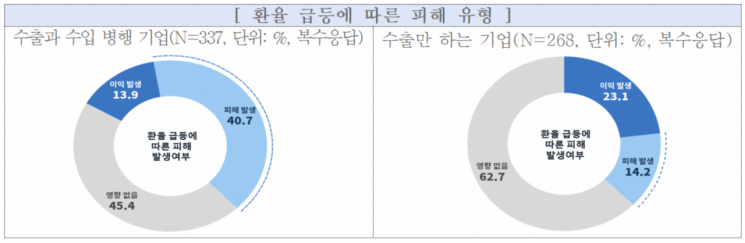

The survey found that SMEs engaged in both export and import activities are clearly feeling the negative impact of the recent sharp rise in exchange rates. 40.7% of respondents said they "suffered losses" due to the surge in exchange rates, far exceeding the 13.9% who reported "gains." Among companies engaged only in exports, the most common response was "no impact" (62.7%), and the gap between those reporting "gains" (23.1%) and "losses" (14.2%) was not significant.

The Korea Federation of SMEs interpreted these results as showing that a rise in exchange rates no longer directly translates into profits for export companies, and that for SMEs importing raw materials for processing and export, higher exchange rates are instead increasing management burdens.

Regarding the types of damage suffered due to the sharp rise in exchange rates (multiple responses allowed), the most common were ▲increase in the price of imported raw and subsidiary materials (81.6%), ▲increase in foreign currency settlement costs (41.8%), and ▲rise in sea and air freight rates (36.2%). Regarding the increase in the cost of imported raw materials due to the higher exchange rate, the most common response was a "6-10% increase" compared to last year, cited by 37.3% of respondents.

55% of SMEs responded that they have been unable to reflect the increased costs caused by higher exchange rates in their sales prices at all. As a result, the burden of higher costs is directly leading to deteriorating profitability. In addition, 87.9% of all respondent companies said they are not using any foreign exchange risk management tools to hedge against exchange rate fluctuations. The reasons cited were ▲lack of necessity (55.9%) ▲lack of professional personnel or related knowledge (33.9%) ▲absence of suitable products (13.8%).

Regarding next year's exchange rate outlook, the most common response was that it would be "in the range of 1,450 to 1,500 won" (41.9%). The average exchange rate considered appropriate to achieve target operating profit was found to be 1,362.6 won.

Chu Moonkab, Head of the Economic Policy Division at the Korea Federation of SMEs, stated, "Given that the Korean won continues to weaken even amid the recent weak dollar phase, it is highly likely that the won-dollar exchange rate in the 1,400-won range will become the new normal." He added, "Considering the reality that there are far more importers than exporters among domestic SMEs, it is urgent to promote the activation of the supply price indexation system and to implement policies focused on alleviating cost burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)