Financial Supervisory Service Announces Organizational Restructuring and Consumer Protection Improvement Roadmap

Establishment of a 'Consumer Protection Supervisory Division' Directly Under the Governor

Shifting the Focus of Consumer Protection

Lee Chanjin, Governor of the Financial Supervisory Service (left), is attending the "Meeting between the Governor of the Financial Supervisory Service and Financial Holding Company Presidents" held on the 10th at the Bankers' Hall in Jung-gu, Seoul. Photo by Dongju Yoon

Lee Chanjin, Governor of the Financial Supervisory Service (left), is attending the "Meeting between the Governor of the Financial Supervisory Service and Financial Holding Company Presidents" held on the 10th at the Bankers' Hall in Jung-gu, Seoul. Photo by Dongju Yoon

The Financial Supervisory Service will establish a new "Consumer Protection Headquarters" reporting directly to the Governor in order to strengthen its financial consumer protection functions. This marks a shift away from the previous focus on post-incident remedies for a small number of victims and toward reinforcing proactive, preventive consumer protection for the broader public. The agency is also moving forward with the introduction of special judicial police (special investigators) to crack down on financial crimes affecting everyday citizens, such as voice phishing.

Establishment of "Consumer Protection Headquarters" Under the Direct Supervision of the Governor

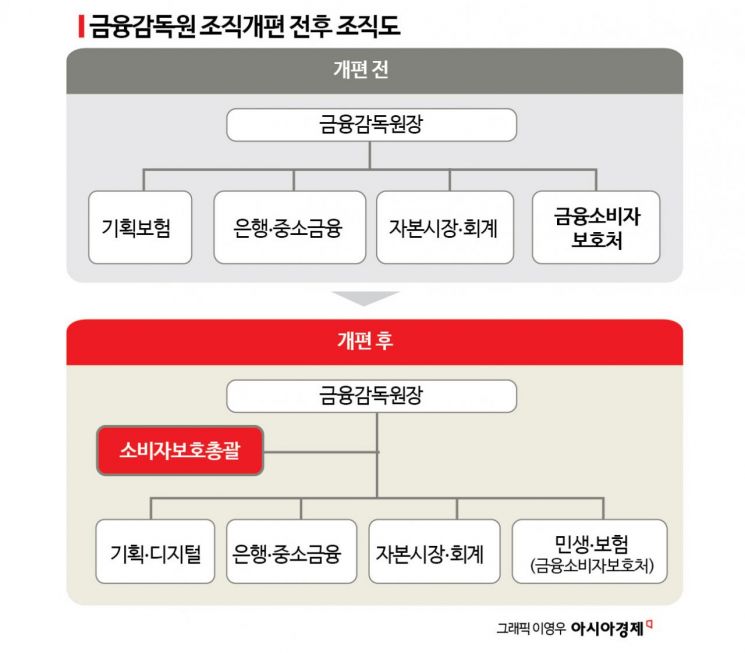

On December 22, the Financial Supervisory Service announced its organizational restructuring plan, which includes the creation of the Consumer Protection Headquarters directly under the Governor, aiming to build a supervisory service system centered on proactive consumer protection.

The Consumer Protection Headquarters will be formed by separating the existing consumer protection division from the Financial Consumer Protection Bureau and granting it comprehensive oversight over all supervisory services. With the expansion of the organization and its direct reporting line to the Governor, the Financial Supervisory Service explained that all of its resources can now be utilized for proactive consumer protection.

This restructuring addresses concerns that the Financial Consumer Protection Bureau, which was responsible for consumer protection within the agency, operated as a separate division and lacked organic cooperation with other departments. In particular, the bureau was seen as having limitations in consumer protection due to its focus on post-incident responses, such as dispute mediation and inspection of financial accidents, rather than on preventive measures.

Under the Consumer Protection Headquarters, new departments will be established, including the Consumer Protection Supervision Bureau, the Consumer Damage Prevention Bureau, and the Supervision Innovation Bureau. The Consumer Protection Supervision Bureau will handle regulations and practices related to consumer protection and responses to infringements on everyday financial life. The Consumer Damage Prevention Bureau will oversee and manage the strengthening of supervision at the stages of financial product manufacturing, design, and review, so that product risks are considered from the consumer's perspective. The Supervision Innovation Bureau will be responsible for supervising the governance of financial companies, addressing key industry-wide issues, and overseeing financial conglomerates.

A new "Consumer Rights Protection Bureau" will also be set up under the Consumer Protection Headquarters, tasked with operating the Financial Dispute Mediation Committee and evaluating the consumer protection status of financial companies. This is a preemptive measure, as the introduction of unilateral binding force to committee decisions is expected to significantly increase the demand for mediation through the committee.

Lee Sehun, Senior Deputy Governor of the Financial Supervisory Service, stated at a briefing that "the core of this restructuring is to strengthen the preventive function of financial consumer protection," and added, "Although there have been some changes in the insurance organization, the name and functions of the Financial Consumer Protection Bureau will be maintained for the time being."

Through this restructuring, the direct dispute mediation function previously handled by the Financial Consumer Protection Bureau will also be transferred to product-specific departments for each sector. This decision addresses concerns that the separation of dispute mediation from the departments responsible for product review and systems made it difficult to respond effectively to disputes between consumers and financial companies. The insurance sector, which has a high volume of dispute complaints, will be transferred under the Financial Consumer Protection Bureau to enable a more proactive approach to dispute resolution.

A Financial Supervisory Service official emphasized, "With this restructuring, a one-stop consumer protection system will be established, allowing each sector to take full responsibility for and manage the entire process from product review to dispute mediation and inspection quickly and efficiently. In particular, by having the same department handle both product review and dispute mediation, we expect synergy effects between these functions, which will help prevent the spread of consumer damage."

Shifting Consumer Protection from Post-Incident Remedies to Preventive Measures

Alongside the restructuring, the Financial Supervisory Service also unveiled its "Consumer Protection Improvement Roadmap," outlining its future plans. The core of this roadmap is to shift the current paradigm of consumer protection, which is centered on post-incident remedies for a small number of victims, to proactive, preventive protection for the entire population.

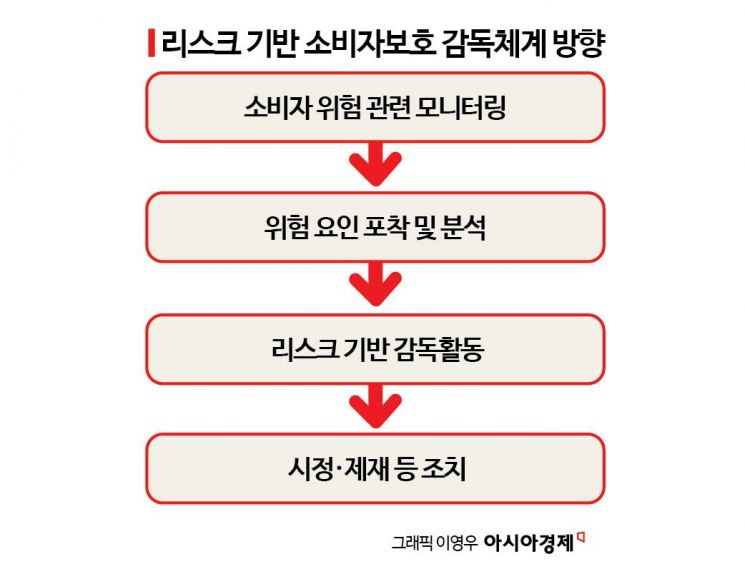

To achieve this, the agency plans to establish a "risk-based consumer protection supervisory system," which will monitor risk factors from a consumer protection perspective, identify risks, respond through supervisory and inspection activities, and then implement corrective measures. In the past, the agency's work focused on post-incident remedies such as dispute mediation after large-scale consumer damage occurred. Going forward, the emphasis will be on preemptively eliminating risk factors through proactive measures.

Additional initiatives will be pursued to further protect consumer rights, such as guaranteeing financial consumers' access to information and their right to choose financial products, as well as improving the convenience of financial transactions. The agency also plans to strengthen consumer guidance to block unfair changes to financial product terms-such as opaque changes to loan interest rates. Measures will be taken to improve consumer notification and alternative issuance procedures when credit cards are discontinued, and to diversify the maturity options for retirement pensions and time deposits, thereby enhancing consumers' choices regarding financial products.

It was also pointed out that, for financial companies, the relatively low level of penalties for failures in consumer protection has led them to focus more on the benefits of sales rather than the costs incurred from consumer damage. Furthermore, while the development of digital technologies has increased the convenience of financial transactions, the establishment of corresponding security systems in the financial sector has not kept pace.

Pursuing the Introduction of Special Judicial Police to Eradicate Financial Crimes Affecting Everyday Citizens

The agency is also pursuing the introduction of special judicial police (special investigators) to eradicate financial crimes that affect everyday citizens. This system grants limited investigative authority to officials of relevant administrative agencies to improve the efficiency of investigations in specialized fields. Currently, the Financial Supervisory Service's special investigators are limited to investigating unfair trading in the capital markets, but the agency plans to expand their scope to include financial crimes affecting the general public, such as voice phishing.

This restructuring follows Governor Lee Chanjin's repeated statements of intent to introduce special investigators for financial crimes affecting everyday citizens. Governor Lee is working to grant the Financial Supervisory Service's special investigators the authority to initiate investigations. This means that investigative agencies can directly detect and actively investigate criminal leads. At present, special investigators at the Financial Supervisory Service can only conduct investigations into cases referred to the prosecution by the Securities and Futures Commission under the Financial Services Commission and only when directed by a prosecutor. Governor Lee argued, "Because the Financial Supervisory Service lacks the authority to initiate investigations, it takes more than two weeks to start investigations into specific cases such as stock price manipulation, during which time evidence can be destroyed."

To facilitate the introduction of special investigators, the agency will establish a Special Investigators Task Force under the Consumer Protection Headquarters' Civil Affairs Response Bureau, and also create a Financial Crime Information Analysis Team to analyze and manage information on financial crimes affecting everyday citizens, including the latest criminal methods and trends. The Special Investigators Task Force will work with the Office for Government Policy Coordination and relevant ministries (such as the Ministry of Justice and the Financial Services Commission) to prepare legislative amendments and seek their prompt passage through the National Assembly.

Senior Deputy Governor Lee stated, "There is no disagreement that financial crimes affecting the general public cause such serious damage that they require a full-scale response. However, practical coordination is needed regarding the authority, scope, and targets of special investigators."

Regarding the authority to initiate investigations, he explained, "While special investigators in the capital markets are limited by the Financial Services Commission's investigative authority, there are no such restrictions for special investigators dealing with crimes affecting the general public, so the authority to initiate investigations is expected to be granted when the system is introduced."

A Financial Supervisory Service official commented, "With the introduction of special investigators, our department responsible for financial crimes affecting everyday citizens will leverage its high level of expertise and vast information resources to identify and apprehend criminal organizations. We will also maximize the effectiveness of enforcement by tracking the flow of criminal funds to prevent and recover criminal proceeds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)