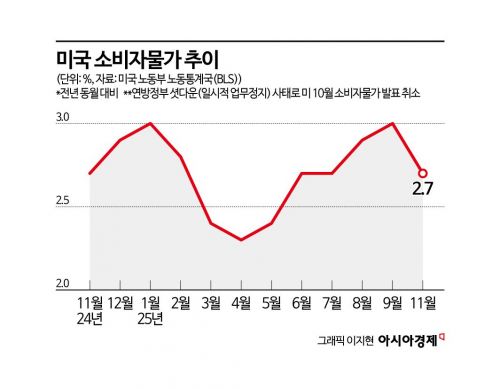

November CPI Rises 2.7%

Lowest Increase in Over Four Years

Shutdown Data Gaps Raise Reliability Concerns

The U.S. consumer price index (CPI) for November rose by 2.7%, marking the lowest increase in over four years. However, according to reports from the Financial Times (FT) and CNN, concerns have been raised on Wall Street regarding the reliability of the data itself.

The U.S. Bureau of Labor Statistics (BLS) announced on December 18 (local time) that the November CPI increased by 2.7% year-on-year, falling short of the 3.1% forecast by Dow Jones-surveyed experts. This is the lowest level since March 2021. The core CPI, which excludes volatile food and energy prices, also rose by 2.6% year-on-year, a slower pace than September’s 3.0% increase.

White House spokesperson Caroline Levitt stated in a press release that day, “As President Donald Trump has mentioned, inflation continues to fall while wages are rising,” adding, “The United States is heading toward a historic economic boom.” Kevin Hassett, Chairman of the White House National Economic Council (NEC) and a candidate for the next Federal Reserve (Fed) Chair, also commented, “It’s not time to declare victory over inflation, but this CPI report is surprisingly good.”

Contrary to the Trump administration’s positive assessment, doubts were raised about the credibility of the statistics released by the U.S. government that day. Economists warned that the November report may have been distorted due to missing data as a result of the recent government shutdown (temporary suspension of work), according to multiple foreign media outlets.

This report was released after data collection had been suspended for about six weeks due to the recent government shutdown. As a result, the BLS canceled the release of the October price index and had to estimate a significant portion of prices instead of using actual survey data.

FT specifically pointed out that the BLS may have effectively treated the inflation rate as “zero” for periods when data collection was impossible. If such distortions occurred in the housing cost category, which accounts for about one-third of the CPI, the impact on the overall index would have been significant. There is also speculation that, after the resumption of surveys at the end of January, the effects of Black Friday discounts may have been reflected, causing the inflation rate to be reported lower than it actually was.

Diane Swonk, Chief Economist at KPMG US, said, “It’s hard to take these numbers at face value,” diagnosing, “Things that should have gone up went down, and things that should have gone down went up, resulting in a confusing picture that doesn’t align well with the actual observed price trends.”

John Hill, Head of U.S. Inflation Strategy at Barclays, also noted, “The market does not trust this data,” adding, “There is insufficient explanation of how the BLS made its decisions, so it’s difficult to accept the numbers as they are. Investors are reluctant to make aggressive bets.”

Michael Hanson, Chief Economist at JP Morgan, stated, “It’s possible the BLS kept prices that couldn’t be collected in October fixed,” adding, “There is a significant downward bias in the current figures. This means that once normal price collection resumes, the numbers could be revised upward.”

This stronger-than-expected inflation report is expected to provide President Trump with justification to pressure the Fed to accelerate the pace of interest rate cuts. President Trump has also warned that he will select a candidate who “supports rate cuts” as the next Fed Chair.

This year, the Fed lowered its benchmark interest rate to the lowest level in three years at the December Federal Open Market Committee (FOMC) meeting. On this day, the Chicago Mercantile Exchange (CME) FedWatch Tool projected a 72.3% probability that the Fed would keep rates unchanged at the January FOMC, while the probability of a rate cut was estimated at 27.7%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)