Dollar Insurance Sales Already Surpass Last Year

Dollar Deposit Balances Rise for Second Consecutive Month

"Could Reach 1,500 Won Next Year"

Long-Term High Exchange Rate Expectations Drive Demand

Sales of dollar-denominated products at major commercial banks have surged. Dollar-based insurance products have already surpassed last year's performance, and dollar deposits have continued to rise for two consecutive months. Even as the won-dollar exchange rate remains in the high 1,400 won range, demand for purchasing and accumulating dollars persists. This trend is interpreted as financial consumers' expectations of a prolonged weak won fueling their appetite for buying dollars.

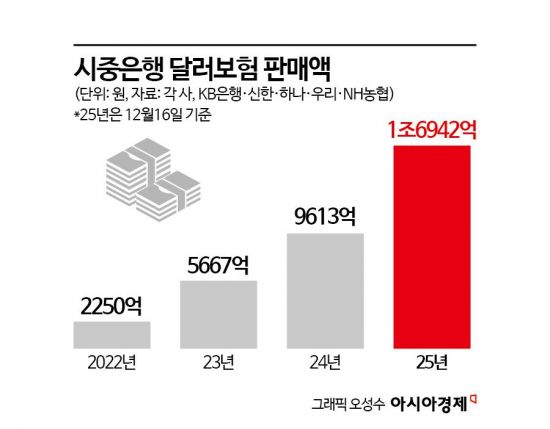

According to the financial sector on December 19, the total sales of dollar insurance products at the five major domestic banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) reached 1.6942 trillion won as of December 16 this year. This figure has already surpassed last year's performance and represents an approximately eightfold increase compared to 2022. Dollar insurance products are those in which both premium payments and insurance payouts are made in dollars. If premiums are paid in won, they are automatically converted to dollars for accumulation and management.

Dollar insurance products sold through bancassurance at commercial banks amounted to only about 225 billion won in 2022, but sales have since grown rapidly. In 2023, sales more than doubled to 566.7 billion won, and last year approached 1 trillion won. Given the current pace of growth, sales are expected to exceed 1.7 trillion won this year.

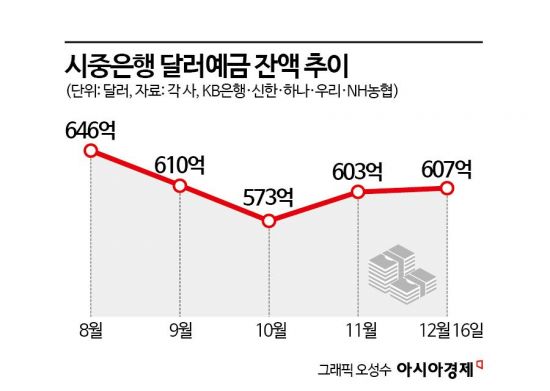

The balance of dollar deposits also hit a low of 57.3 billion dollars in October, then increased for two consecutive months. In November, the balance rose to 60.3 billion dollars, and as of December 16, it further increased to 60.7 billion dollars. This means that demand for dollars has continued to grow even as the won-dollar exchange rate has steadily risen from October through November and December. The average won-dollar exchange rate increased from 1,424.83 won in October to 1,460.44 won in November, and to 1,471.75 won as of December 17. This is a different trend from the usual pattern, where demand for dollars declines as the exchange rate rises due to profit-taking.

The increase in demand for dollar products despite the ongoing high exchange rate appears to be driven by the perception that the weak won, or high exchange rate, could continue. As of December 17, the average annual won-dollar exchange rate for this year stands at 1,422.75 won, making it likely to set a new all-time high. In addition, experts are raising their upper forecasts for next year's exchange rate, with many predicting it could exceed 1,500 won. This has led to a growing sentiment of "let's buy dollar assets before they become even more expensive."

The record-breaking performance of dollar insurance products this year is also analyzed as a result of banks' strategies to increase non-interest income. A banking industry official said, "As regulations on total household debt have tightened, some banks have significantly expanded sales of dollar insurance products, particularly targeting high-net-worth individuals, to boost non-interest income." For dollar deposits, the relatively higher interest rates compared to won deposits, due to the interest rate gap between Korea and the United States, have also contributed to increased demand.

However, there are points to be cautious about. If the exchange rate falls at the time of realizing profits, actual returns may be lower than expected. The cost of converting won to dollars during a high exchange rate period is also a burden. In particular, dollar insurance products are long-term holdings, typically around ten years, and differ from short-term foreign exchange investment products. As the exchange rate rises, the burden of insurance premiums can also increase. A financial industry official said, "Before signing up, it is important to thoroughly consider exchange costs and the impact of exchange rate fluctuations on returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)