An overseas direct purchase proxy seller who defrauded buyers by passing on taxes has been caught.

The Incheon Regional Customs Office of the Korea Customs Service announced on the 18th that it had apprehended several Korean proxy sellers residing overseas on suspicion of violating the Customs Act and referred them for prosecution without detention.

The apprehended proxy sellers are suspected of smuggling over 2,500 items, including branded clothing and bags, from Germany and other parts of Europe between 2019 and this year. They are accused of embezzling 3 billion won in customs duties and value-added tax (VAT) that they had collected in advance from buyers.

According to Incheon Customs, a married couple acting as proxy sellers and residing in Germany smuggled 1,642 branded clothing and bag items from Germany to Korea between September 2019 and April last year. They then made 47,014 false declarations by underreporting the value of the goods, thereby defrauding buyers of 3 billion won in customs duties and other taxes collected in advance.

Another proxy seller residing in the United Kingdom smuggled 874 fashion accessories and other items from the UK between March 2020 and October last year. This individual is suspected of making 1,283 false declarations by underreporting the value of goods, thereby embezzling 30 million won in customs duties and other taxes collected in advance from buyers.

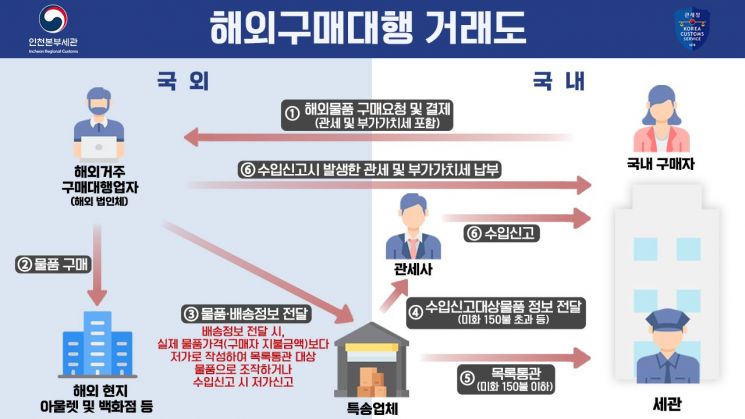

These proxy sellers purchased items directly from luxury stores or outlets while residing overseas, and then sold them to Korean consumers through domestic open markets using a proxy purchase model.

In this process, buyers were encouraged to make advance payments that included customs duties and other taxes as part of the product price. However, the proxy sellers disguised the transactions as exports from the local country and received VAT refunds in the name of local corporations (with an actual VAT refund rate of 15% after deducting fees).

To maintain price competitiveness, they forfeited margins on sales prices but effectively treated the refunded VAT obtained during the export process as profit.

In addition, the apprehended sellers made false low-value declarations to evade customs duties and VAT, thereby gaining additional illicit profits.

Current customs law stipulates that 'taxes imposed on imported goods are calculated based on the price including all costs incurred up to the point of arrival in Korea.' In proxy purchase transactions, the taxable value is determined based on the amount paid by the consumer to the proxy seller.

However, those apprehended exploited the list clearance system (which exempts self-use goods valued at $150 or less from formal import declarations and customs duties/VAT) by falsely declaring goods at low values to avoid customs declarations and receive tax exemptions.

Even when they did file import declarations, they falsely reported lower values than the actual price, thereby evading the payment of customs duties and other taxes that buyers had already paid in advance along with the product price.

This criminal activity was uncovered during Incheon Customs' analysis of crime information related to the abuse of overseas direct purchase channels.

An official from Incheon Customs stated, "Smuggling and customs duty evasion by overseas direct purchase proxy sellers not only causes national fiscal losses but also deceives domestic consumers. Customs authorities will rigorously crack down on transnational illegal activities that exploit the small-amount duty-free system for overseas direct purchases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)