The New York stock market closed lower overnight as concerns over excessive investment in artificial intelligence (AI)-related technology stocks resurfaced.

Seo Junghoon, a researcher at Samsung Securities, explained on December 18, "In the case of Oracle, which recently experienced a significant stock price correction due to mounting debt burdens, it was reported that a long-standing partner investor decided not to participate in the construction of a new data center for OpenAI in Michigan."

He added, "Oracle stated that it is currently in final negotiations with another investor. However, in the market, suspicions have been growing that the company's ability to raise funds has deteriorated compared to before, due to the sharp increase in debt."

He emphasized, "Oracle's stock price recorded a decline of over 5%. Other companies in the AI infrastructure and platform services sectors also could not avoid a simultaneous downturn."

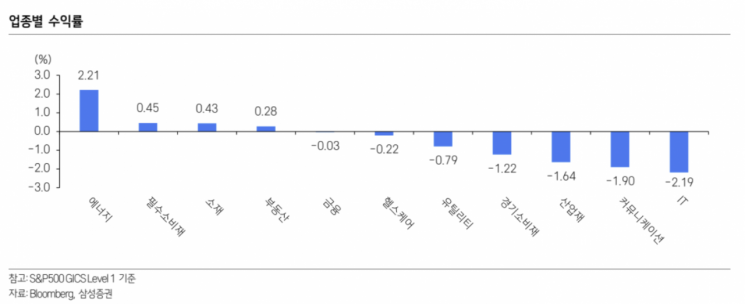

Seo analyzed, "While the IT, communication, and industrial sectors showed notable weakness in the New York stock market, the energy sector, which had recently stagnated, rose by 2.21% thanks to a rebound in oil prices." He continued, "Consumer staples, materials, and real estate sectors also ended the session on an upward trend."

He further stated, "Market interest rates remained steady," and introduced, "Christopher Waller, who is reportedly scheduled to meet with President Donald Trump as a candidate for the next Chair of the Federal Reserve, made remarks in support of additional rate cuts." He explained, "This did not create a significant reaction in the market. The two-year Treasury yield, which is sensitive to policy rate outlooks, closed at 3.49%, unchanged from the previous day."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)