Toss Bank to Launch Foreign Currency Remittance Service in January Next Year

Kakao Bank Becomes First Internet Bank to Enter Retirement Pension Market

Striving to Reduce Dependence on Interest Income

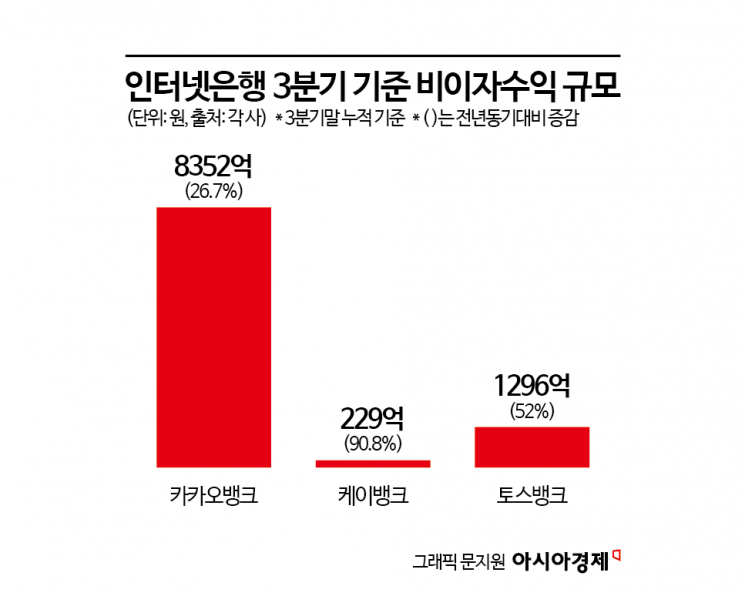

Internet banks that have grown through household lending are accelerating the expansion of their business portfolios to increase non-interest income. This shift comes as the new administration has strengthened regulations on household loans, making it difficult to maintain profitability with existing business models. In response to the slowdown in lending profitability, internet banks are working to reduce their reliance on interest income and diversify their revenue streams by expanding into various sectors.

According to the financial sector on December 18, Toss Bank plans to launch its foreign currency remittance service starting in January next year. Until now, Toss Bank has only offered foreign currency accounts, but on December 2, it revised its special terms for foreign currency accounts, completing preparations for the launch of the remittance service. Previously, transactions were only possible between users of foreign currency accounts, but starting next month, direct remittances to bank accounts in major overseas countries will be available.

A Toss Bank representative explained, "We have been considering ways to increase non-interest income beyond household lending, and the launch of the foreign currency remittance service is closely related to this objective."

The government's overhaul of overseas remittance policies, including the abolition of the "designated transaction bank" system, is intensifying competition in the foreign currency remittance service market. Previously, remittances of over $5,000 had to be processed through a single bank, but with the abolition of the system, customers can now remit up to $100,000 annually through banks and other remittance service providers. As a result, consumers can compare and choose financial institutions with lower fees, and competition among banks is expected to intensify. In response, K Bank has announced that it will temporarily reduce its foreign currency account remittance fee from 8,000 won to 4,000 won from January to June next year.

Internet banks are expanding their business portfolios not only in foreign currency services but also into areas such as joint loans, retirement pensions, and loans for sole proprietors. While they have grown in size thanks to the expansion of household lending, particularly mortgage loans, the new administration's strengthened household debt management policy to curb the flow of funds into real estate has had a significant impact.

In fact, as of the third quarter, the combined loan balance of the three major internet banks (Kakao Bank, K Bank, and Toss Bank) stood at 78.6 trillion won, an increase of only 4.8 trillion won compared to the same period last year. This is just half the increase recorded during the same period last year (9.3 trillion won), indicating a significant slowdown in growth.

Kakao Bank launched a retirement pension time deposit product this month, becoming the first among the three major internet banks to offer a retirement pension product. This product is a defined benefit (DB) type time deposit, and the bank plans to expand its lineup to include defined contribution (DC) and individual retirement pension (IRP) products in the future. Since Kakao Bank is entering the retirement pension market later than its competitors, it is leveraging its competitive interest rates. The interest rate for Kakao Bank's retirement pension time deposit is 2.95%, higher than the rates offered by the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup), which range from 2.69% to 2.76%.

Industry insiders believe that Kakao Bank's launch of a retirement pension product will not only expand its non-interest income and deposit portfolio but also serve as a bridgehead for entering the retirement pension service provider market in the future. In the third quarter, Kakao Bank's interest income was 518.8 billion won, down 5.1% from the previous year, while non-interest income rose 19.7% to 272.5 billion won over the same period. In particular, cumulative fee and platform income for the third quarter increased by 4.7% year-on-year, driven by the growth of loan comparison and investment platforms. Given the bank's ongoing large-scale recruitment of personnel for retirement pension services, there is speculation that it may enter the retirement pension service provider market in the future.

In addition, internet banks are seeking new business opportunities through joint loans. Kakao Bank has launched "Together Loan," a product in which it shares loan amounts equally with Jeonbuk Bank, while K Bank has introduced a joint credit loan product with Busan Bank. Toss Bank is also preparing to launch a joint loan product with Gyeongnam Bank.

An internet bank official stated, "Although the entire financial sector is facing challenges due to household loan regulations, internet banks, given their scale and other factors, face even greater pressure. We are focusing all our efforts on discovering new business opportunities that can maximize our platform capabilities, which are the core strengths of internet banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)