Main Bid Closes, Old Tom Capital Emerges as Leading Candidate

If Preferred Negotiator Is Selected and Terms Are Finalized,

F&F Must Decide on Acquisition Within 14 Days

The sale process for TaylorMade, one of the world’s top three golf equipment brands, has entered its final stages. As Old Tom Capital, a leading US golf-focused investment firm, emerges as a strong contender, market attention is now focused on F&F, which holds the right of first refusal.

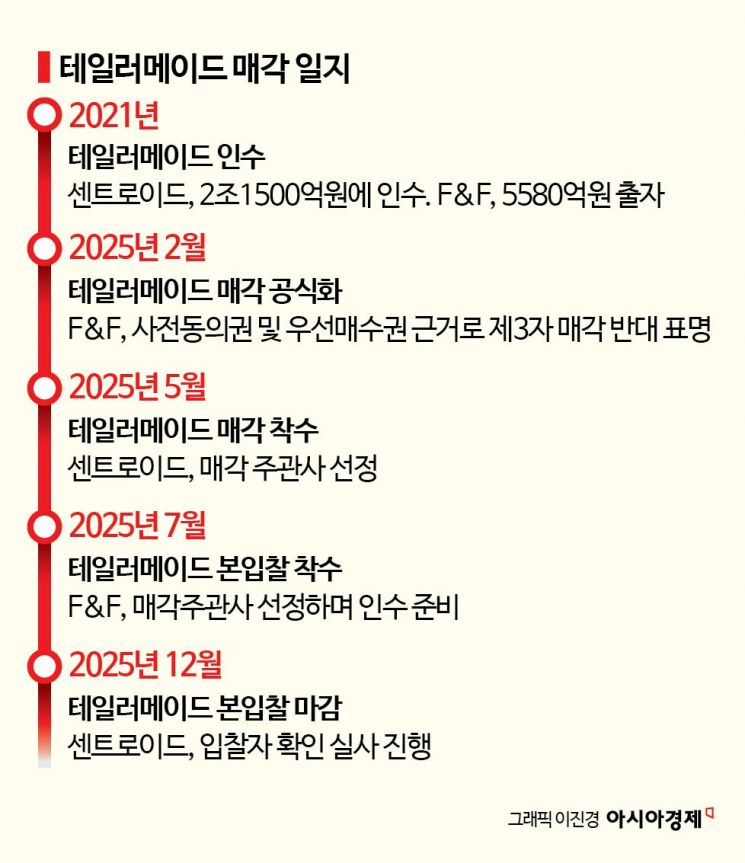

According to the investment banking industry on December 17, Centroid Investment Partners (Centroid PE) is currently conducting confirmatory due diligence based on the results of the recent main bidding round, reviewing the bidders’ funding structures and the likelihood of completing the transaction.

It is reported that Old Tom Capital submitted a bid exceeding 4.4 trillion won in the main auction. The firm is considered more stable than competing bidders, not only in terms of price but also in financial capacity and the likelihood of closing the deal. Old Tom Capital is an investment firm specializing in the golf industry, headquartered in Denver, Colorado.

Confirmatory due diligence typically takes one to two months. Accordingly, a preferred negotiating partner could be selected as early as the end of the year. However, Centroid PE is thoroughly examining the bidders’ funding structures, so there is a possibility that the due diligence period may be longer than usual. Given that F&F holds the right of first refusal, Centroid PE is focusing on whether the deal can proceed to actual closing after the signing of the stock purchase agreement (SPA).

F&F participated as the largest strategic investor when Centroid PE acquired TaylorMade for approximately 2.1 trillion won in 2021, contributing 558 billion won in exchange for the right of first refusal. Once Centroid PE selects a preferred negotiating partner and finalizes the SPA terms, F&F, holding the right of first refusal, must decide within 14 days whether to acquire under the same conditions.

Ultimately, the key variable in the sale of TaylorMade is whether F&F will exercise its right of first refusal. The market expects F&F to exercise this right, as the company has consistently shown interest in management control since the 2021 acquisition. In fact, F&F has reportedly been in contact with securities firms to secure funds for exercising its right of first refusal. In July, the company appointed Goldman Sachs as lead manager in preparation for the acquisition.

The main obstacle is persuading shareholders. If TaylorMade is sold for over 4 trillion won, F&F could realize a profit of nearly 1 trillion won, excluding its original investment, depending on its stake. However, if F&F attempts a direct acquisition, it would need to reinvest all of that financial gain. Due to a recent amendment to the Commercial Act, directors’ duty of loyalty has been expanded to include shareholders. As a result, minority shareholders may oppose the acquisition of TaylorMade, demanding increased dividends or other financial benefits instead.

Nevertheless, if F&F succeeds in acquiring TaylorMade, it is certain to enhance the company’s consolidated value. As of December 16, F&F’s market capitalization stands at 2.94 trillion won, while F&F Holdings is valued at 830 billion won. Acquiring TaylorMade at a valuation in the mid-4 trillion won range would mean owning an affiliate larger than the main company itself.

F&F has stated that acquiring TaylorMade is not merely a financial investment, but a core element of its long-term strategy to drive global growth and enhance corporate value for the F&F brand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)