Import Prices Hit Hard by Rising Exchange Rate

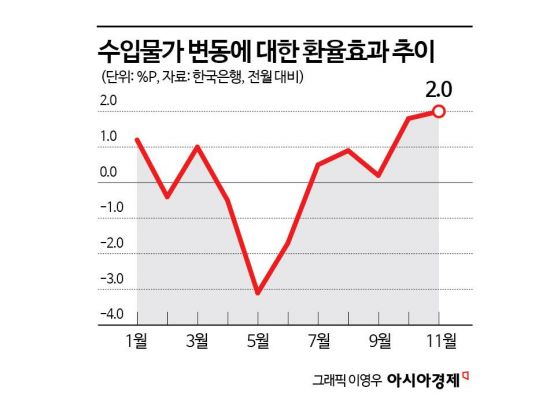

Exchange Rate Effect: -0.21% (Jan-Sep) to 1.9% (Oct-Nov)

Impact on Domestic Prices with 1?3 Month Lag

"Petroleum Products Already Affected"

"Impact May Not Be as Significant as Feared"

The steady rise of the won-dollar exchange rate for over two months has been exerting upward pressure on import prices. The impact of the exchange rate on import prices began to expand significantly in October and reached its highest level of the year in November. Import prices, with at least a one-month time lag, can translate into increased price burdens for domestic businesses and households. Petroleum products such as gasoline have already been affected by the rise in the exchange rate.

According to the Bank of Korea on December 17, the exchange rate effect on import prices was calculated at 2.0 percentage points in November. This means that exchange rate fluctuations raised import prices by 2.0 percentage points. Last month, import prices in won terms rose by 2.6% compared to the previous month. When calculated based on the contract currency used at the time of import contracts, import prices rose by 0.6% during the same period. In other words, without exchange rate fluctuations, import prices would have increased by only 0.6%.

The influence of the exchange rate on import prices has been increasing since October. The won-dollar exchange rate has remained in the 1,400 won range since October and has not fallen, continuing to rise steadily. While the exchange rate fluctuated within an average range of -0.33 percentage points from January to September, the fluctuation widened to 2.4% over the two months since October. As a result, the exchange rate effect, which averaged only -0.21 percentage points from January to September, expanded to 1.9 percentage points over the two months since October.

By industry, the impact was most significant on coal and petroleum products. In November, import prices for coal and petroleum products in won terms rose by 1.6% compared to the previous month. In contrast, when calculated based on the contract currency, they actually fell by 0.8%. The exchange rate effect, reflecting this difference, was calculated at 2.4 percentage points. Considering that most petroleum products are contracted in dollars, this is also attributed to the rise in the won-dollar exchange rate. In other words, although these products could have been imported at lower prices, higher exchange rates led to increased costs.

The increase in import prices due to the rising exchange rate will, after a time lag, exert upward pressure on domestic prices as well. The Bank of Korea generally estimates that there is a one- to three-month lag before these effects are reflected in consumer prices. The head of the price trends team explained at last month's economic outlook briefing, "We estimate that a 1% rise in the won-dollar exchange rate leads to a 0.03% increase in consumer prices." The Monetary and Credit Policy Report released in September also cited research by American economist Hakan Yilmazkuday, noting that "when the domestic currency is in a weak phase (exchange rate rising), the pass-through rate of the exchange rate to prices is more than twice as high as during a strong phase."

In fact, petroleum products are already affecting domestic prices. In November, the price of petroleum products in the consumer price index rose by 5.9% year-on-year, up from 4.8% in October. Compared to the previous month, prices increased by 3.5%, the highest rate among major items. Since most petroleum products are imported and settled in dollars, it is assessed that the increase in import prices due to the rise in the won-dollar exchange rate has been transmitted to domestic prices.

However, some experts predict that the impact of rising import prices on consumer prices may be limited. Baek Seokhyun, a researcher at Shinhan Bank, stated, "If we consider that companies are absorbing some of the cost increases by accepting lower margins, the effect of rising import prices due to exchange rate increases on inflation may not be as significant as we perceive." A Bank of Korea official also explained, "The pass-through rate can vary depending on how sharply the exchange rate rises or falls, and on the degree of domestic demand pressure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)