Korea Investors Service and NICE Investors Service Upgrade Outlook to 'Stable' After 1 Year and 10 Months

Securities Firms Also Positive: "Netmarble’s Outlook Bright for Next Year... New Releases Expected to Drive Growth"

Netmarble's credit rating outlook has been upgraded for the first time in approximately one year and ten months. The company’s financial soundness is recovering, driven by the success of new game releases and the effects of cost efficiency measures. The outlook is also positive. Credit rating agencies and securities firms expect the trend of performance improvement to continue next year, supported by the launch of new titles.

According to the financial investment industry on December 15, Korea Investors Service and NICE Investors Service raised Netmarble’s unsecured bond rating outlook from 'negative' to 'stable' on December 8 and 11, respectively. The credit rating itself was maintained at A+.

Korea Investors Service and NICE Investors Service had previously assessed Netmarble’s credit rating outlook as 'negative' in February last year. The outlook has now been upgraded after about one year and ten months. At the time, Korea Investors Service cited several reasons for the negative outlook: a decline in profitability due to the obsolescence of existing games and underperformance of new releases; a rapid increase in borrowing burden due to a decline in operating cash flow and investment expenditures; and limited capacity for significant short-term improvement in profitability and reduction in borrowing burden.

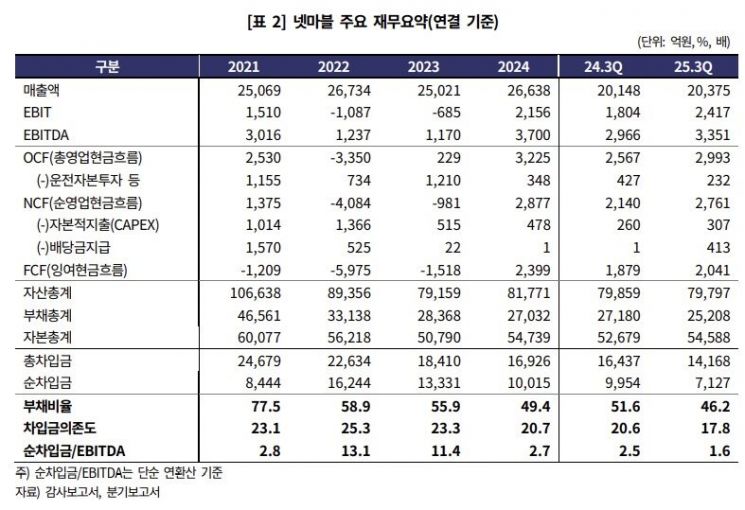

One of the reasons for the upgraded outlook by Korea Investors Service and NICE Investors Service is the success of new game releases. The launch of titles such as 'RF Online Next,' 'Seven Knights Rebirth,' and 'Vampire,' along with the continued success of games released last year, led to improved sales. After recording losses in 2022 and 2023, Netmarble returned to profitability last year. Cumulative consolidated sales for the third quarter of this year reached 2.0375 trillion won, a 1.1% increase compared to the same period last year. Operating profit also rose by 34% to 241.7 billion won.

Additionally, the improvement in the company’s financial structure is another positive factor. As of the end of September this year, Netmarble’s net borrowings stood at 712.7 billion won, a decrease of 288.8 billion won compared to the end of last year. As a result, the debt ratio fell from 49.4% at the end of last year to 46.2% in the third quarter of this year, and the dependence on borrowings dropped from 20.7% to 17.8%.

NICE Investors Service explained, "Financial burdens had increased due to the acquisition of stakes in overseas game companies and Coway, as well as the construction of a new headquarters. However, the company reduced its borrowings by partially selling its stake in HYBE and through the recovery of operating cash flow."

The agency also expects Netmarble to maintain financial stability in the face of upcoming funding needs. Netmarble has planned total expenditures of 365 billion won, including construction costs for its new headquarters and the remaining acquisition payment for the social casino game company SpinX.

Korea Investors Service stated, "Since 2024, the recovery of operating cash generation and the sale of investment stocks such as the HYBE stake have eased the borrowing burden. Considering the effects of new game releases and ongoing cost reduction efforts next year, it is expected that the company will be able to maintain its current level of financial stability based on improved profitability."

Securities firms also expect Netmarble’s performance improvement to continue. This is due to the scheduled release of new titles such as Stone Age: Growth, Solo Leveling: KARMA, and The Seven Deadly Sins: Origin. According to FnGuide, securities firms project Netmarble’s sales and operating profit for next year at 3.0117 trillion won and 411.5 billion won, respectively, representing increases of 7.84% and 18.55% year-on-year.

Lee Jongwon, a researcher at BNK Investment & Securities, commented, "Starting with 'Vampire' in the third quarter, a total of five to seven new titles are scheduled for release through next year. We expect profitability to continue improving next year through new releases, the utilization of proprietary intellectual property, and the economic optimization of the payment system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)