hy achieves in 6 months what Coupers has accomplished in sales pace

New product proves market penetration as slow-aging and low-sugar trends converge

In the domestic liquid fermented milk market, which has entered a stagnation phase, "low-spec" products that minimize sugar and fat are emerging as a new growth driver. As consumer interest in health management and slow aging increases, demand is rising for products that reduce the burden of sugar and fat intake compared to traditional fermented milk.

According to hy on December 15, its sugar-free fermented milk "Yakult XO," launched in April, surpassed a cumulative sales volume of 15 million units within just six months of release. In terms of monthly sales, this is on par with hy's long-standing brand "Coupers."

The sales pace of "Yakult XO" is considered faster than expected even within hy. Despite the overall growth of the fermented milk market slowing down and the prospects for new products becoming less promising, the product has demonstrated sufficient market penetration in a short period. A representative from hy stated, "The combination of a preference for reduced-sugar products and the slow-aging trend appears to have led to the spread of sales."

Some also interpret the results as being supported by product competitiveness and changing consumer trends. "Yakult XO" eliminates sugar, sweeteners, and fat entirely, while maintaining flavor through hy's long-term fermentation technology and patented probiotic methods. The product achieves zero sugar by consuming the sugars present in the raw materials through a natural fermentation process, and each bottle contains approximately 50 billion CFU of five types of probiotics. The rapid expansion of consumers seeking to minimize sugar intake is believed to have driven the sales momentum.

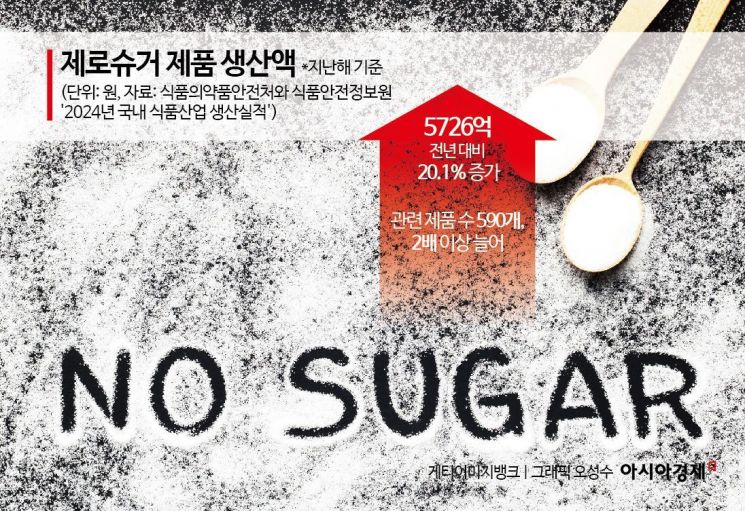

The low-spec trend is spreading across the entire food market. According to the "2024 Domestic Food Industry Production Performance" report released by the Ministry of Food and Drug Safety and the Food Safety Information Service, the production value of zero-sugar products with reduced sugar content reached 572.6 billion won last year, up 20.1% from the previous year. The number of related products more than doubled to 590.

hy is also accelerating the expansion of its low-spec lineup focused on low sugar and low fat. The company was the first in the industry to launch a "Sugar Reduction Campaign" in 2014, cutting a total of 8,072 tons of sugar by 2017. Through its subsequent "To more low, Tomorrow" campaign, hy has set a goal to further reduce processed food sugar by 1,600 tons by this year.

This strategic shift is closely related to the company's recent performance trends. hy's sales increased from 1.519 trillion won in 2023 to 1.6826 trillion won last year, but operating losses also widened from 27.3 billion won to 64.5 billion won over the same period. Sales from its core fermented milk business reached 1.1734 trillion won last year, accounting for around 70% of total sales. However, as the market itself has entered a mature stage, there are growing concerns that simply expanding new products has its growth limits. Indeed, according to the Ministry of Agriculture, Food and Rural Affairs, per capita liquid fermented milk consumption decreased from 8 kg in 2022 to 7.2 kg in 2023,㎏ and further to 6.8 kg last year.

An industry insider commented, "With the fermented milk market stagnating, it has become increasingly important for manufacturers to decide where to focus their technology investments. The current trend is clearly leaning toward low-spec, and this is expected to lead not just to simple product development but to a long-term structural transformation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)