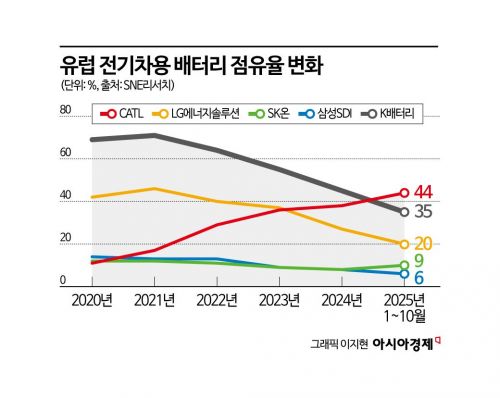

From January to October, South Korean battery makers' share in the European EV battery market fell to 35%?half of what it was four years ago

EU pushes for mandatory local parts sourcing law

Chinese firms may lose price advantage if production moves to Europe

It has been revealed that the market share of South Korean battery companies in the European electric vehicle market has been halved in four years, losing ground to Chinese competitors. Although the European electric vehicle market has seen a recovery this year, K-batteries are still facing a harsh winter. Attention is now focused on whether the Industrial Accelerator Act (IAA), promoted by the European Union (EU), will provide a breakthrough.

According to SNE Research, an energy market research firm, the combined market share of the three major South Korean battery companies-LG Energy Solution, SK On, and Samsung SDI-in the European electric vehicle battery market from January to October this year was 35%. This is 10 percentage points lower than the 45% recorded at the end of 2024. At the end of 2021, the market share of South Korean companies reached 71%, but in just four years, it has been reduced by half.

LG Energy Solution's market share dropped significantly from 27% at the end of last year to 20% this year, a decrease of 7 percentage points. During the same period, SK On (from 10% to 9%) and Samsung SDI (from 8% to 6%) also saw their shares shrink.

The market share lost by South Korean companies was taken over by Chinese companies. Chinese company CATL’s market share increased from 38% at the end of last year to 44%, while BYD (from 3% to 6%) and Farasis (from 1% to 3%) also expanded their presence. By October this year, Chinese-made batteries accounted for 64% of the European electric vehicle battery market.

Chinese companies such as CATL are expanding their presence in the European electric vehicle market not only with lithium iron phosphate (LFP) batteries but also with nickel cobalt manganese (NCM) and nickel cobalt aluminum (NCA) batteries, areas where South Korean companies have been strong, leveraging their competitive pricing.

Although the European electric vehicle market rebounded from last year's sluggishness and grew this year, South Korean battery companies did not benefit as much. The European electric vehicle battery market reached 184 gigawatt-hours (GWh) from January to October this year, a 33.2% increase compared to the same period last year.

SNE Research explained, "In Europe, with carbon dioxide regulations and the policy to ban internal combustion engine sales by 2035 still in place, the previously delayed demand for electric vehicles has been recovering this year." In contrast, the North American electric vehicle market, where South Korean companies are strong, has shown weak growth this year due to reduced subsidies and other factors. This has resulted in a decline in the global market share of South Korean companies.

Amid these developments, expectations are rising among South Korean battery companies as the European Commission is pushing for the Industrial Accelerator Act to strengthen supply chains within Europe. The main points of this bill are to reduce dependence on Chinese supply chains, strengthen the self-reliance and competitiveness of European companies, and expand European market access.

According to foreign media, the bill is expected to require at least 70% of parts for certain items, such as automobiles, to be sourced from Europe. The European Commission had originally planned to release a draft of the bill on December 10, but due to opposition from some countries, it has been postponed to January next year. Industrial powerhouses such as Germany and France support the bill, while countries like the Czech Republic, Estonia, Finland, Ireland, Portugal, and Sweden are concerned that the 'Buy European' policy will increase costs.

Experts believe that if this bill is implemented, it will work in favor of South Korean battery companies. If the proportion of locally sourced parts in Europe increases, Chinese companies will no longer be able to supply inexpensive batteries produced in China and will have to relocate their production facilities to Europe. In this case, Chinese battery companies will have to compete under the same conditions as South Korean companies, making it difficult to maintain their previous price competitiveness.

Oh Ikhwan, Vice President of SNE Research, stated, "The production cost at CATL's Hungary plant is estimated to be about 30% higher than that of its plants in China," and added, "Once the Industrial Accelerator Act is enforced, I believe South Korean companies will be able to compete with China."

Meanwhile, as the EU's 'Buy European' regulations become more tangible, Chinese battery and electric vehicle companies are accelerating their entry into Europe. CATL is already operating a plant in Germany and has completed preparations for production at its Hungary plant. Stellantis has announced a joint venture with CATL to build a plant in Spain. BYD is preparing plants in Hungary and T?rkiye. In South Korea, LG Energy Solution is operating a battery plant in Poland, while Samsung SDI and SK On are running battery plants in Hungary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)