Bank of Korea Releases Preliminary Export and Import Price Index and Trade Index for November

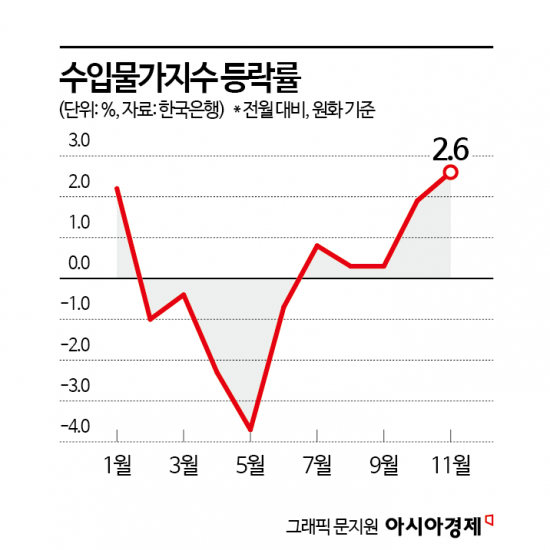

Import Prices Rise 2.6% from Previous Month, Marking Fifth Consecutive Increase

Falling Oil Prices Offset by Rising Exchange Rate... Greater Pressure on Co

Last month, import prices rose by more than 2% compared to the previous month, marking the highest increase in one year and seven months. Despite a decline in international oil prices, the continued rise in the won-dollar exchange rate drove the upward trend. With import prices climbing for five consecutive months, this is expected to put upward pressure on domestic consumer prices after a certain time lag.

According to the "Export and Import Price Index and Trade Index for November 2025 (Preliminary)" released by the Bank of Korea on the 12th, last month’s import price index (based on the Korean won) stood at 141.82 (2020=100), up 2.6% from the previous month. This is the highest figure in one year and seven months since April last year (3.8%). Compared to the same month last year, the index rose by 2.2%.

This was due to the increase in the won-dollar exchange rate, despite the decline in international oil prices. Last month, the average price of Dubai crude oil was $64.47 per barrel, down 0.8% from the previous month ($65 per barrel). In contrast, the average won-dollar exchange rate rose by 2.4%, from 1,423.36 won in October to 1,457.77 won in November.

By category, raw materials rose 2.4% from the previous month, mainly due to an increase in liquefied natural gas (LNG) and mineral products. Intermediate goods climbed 3.3%, led by computers, electronic and optical devices, primary metal products, and chemical products. Capital goods and consumer goods also rose by 1.5% and 1.8%, respectively.

Excluding the exchange rate effect, import prices in contract currency terms rose by 0.6% from the previous month. Lee Moonhee, Head of the Price Statistics Team at the Economic Statistics Department 1 of the Bank of Korea, explained, "Given that the increase in won terms is 2.6%, the difference can be attributed to the exchange rate effect," adding, "Although other currencies such as the euro are included, most contracts are made in US dollars, so the impact of the won-dollar exchange rate was significant."

As the upward trend in the won-dollar exchange rate continues into this month, there is a possibility that import prices will continue to rise in December. Lee added, "From the beginning of this month until the 10th, the won-dollar exchange rate has risen by 0.8% compared to last month's average," but cautioned, "However, due to significant uncertainties in conditions, we need to monitor exchange rate fluctuations through the end of the month."

With import prices having risen for five consecutive months since July, they are expected to put additional pressure on consumer prices. It is generally known that import prices are reflected in consumer prices with a time lag of one to three months.

Last month, export prices rose by 3.7% from the previous month as the won-dollar exchange rate increased and prices for computers, electronic and optical devices climbed. Compared to the same month last year, export prices rose by 7.0%.

By item, prices of agricultural, forestry, and fishery products rose by 0.9% from the previous month. Industrial products, led by computers, electronic and optical devices, as well as coal and petroleum products, rose by 3.7%. In contract currency terms, export prices increased by 1.5% from the previous month and by 2.1% compared to the same month last year.

The export volume index, which indicates changes in export and import activity, rose by 6.8% compared to the same month last year, driven by increases in computers, electronic and optical devices, and transportation equipment. The export value index climbed by 9.1%.

During the same period, the import volume index rose by 4.3% due to increases in primary metal products and chemical products. The import value index rose by 0.7%.

The net barter terms of trade index for November rose by 5.8%, as export prices (up 2.1% year-on-year), led by semiconductors, increased, while import prices (down 3.4%) fell, mainly due to declines in mineral products such as crude oil and natural gas. The income terms of trade index rose by 13%, as both the net barter terms of trade index and the export volume index increased.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)