Accelerating Competition in Advanced Industries as AI Investments Surge

Regulations in Korea: Banking-Commerce Separation, Treasury Shares, and Dual Listing

As SK hynix begins reviewing a potential listing of American Depositary Receipts (ADR) in the United States, the funding environment for domestic companies is once again under scrutiny. With investment in advanced industries such as artificial intelligence (AI) and semiconductors expanding, concerns are being raised that capital-raising options for companies in Korea are narrowing due to a combination of regulations, including the separation of banking and commerce, mandatory treasury share cancellation, and restrictions on dual listings.

According to industry and financial investment sources on December 11, SK hynix stated in a response to a disclosure inquiry the previous day, "We are reviewing various measures to enhance corporate value, but nothing has been finalized yet." The company added, "We will make another announcement either when specific details are finalized or within one month." While there has been speculation that approximately 17.4 million treasury shares could be utilized, the company emphasized that it is still in the review stage. Some analysts suggest that this move is aimed at addressing both the issue of domestic undervaluation and expanding the overseas investor base.

This disclosure inquiry follows reports that SK hynix is considering listing its treasury shares on the US stock market as ADRs. Depositary Receipts (DRs) are substitute securities issued to enable a company's shares to be traded on overseas markets. When a company deposits its original shares with a domestic custodian, an overseas depositary institution, such as a local bank, issues DRs backed by those shares, allowing them to be traded in foreign markets. When issued in the United States, these are called ADRs. Industry experts believe that if ADRs are traded in the US market, SK hynix could be revalued at a level comparable to competitors such as Micron.

Within the industry, SK hynix's consideration of an ADR listing is viewed not as the decision of a single company, but as a symbolic event that exposes the limitations of the domestic capital market structure. While affiliate listings and the use of treasury shares are restricted in Korea, the US market is actively seeking to attract advanced industry companies.

Companies also express expectations that they could be valued higher in the US than at home. Above all, investor interest in the AI and semiconductor sectors is high in the US, making it more likely that issuing ADRs could enhance corporate value. As competition in advanced industries intensifies, there is a growing call for regulatory reforms to expand the capital market options available to companies.

SK hynix has conveyed to the government that it is difficult for a single company to secure the funds and infrastructure needed for large-scale investments, emphasizing the need for regulatory reform. At a presidential office briefing, SK hynix CEO Kwak Nohjung said, "It is difficult to secure large-scale funding, so regulatory easing is necessary," pointing out the limitations of a structure where mega-investments are concentrated in a single company. SK hynix plans to invest approximately 600 trillion won in stages to expand its fab facilities and introduce advanced equipment at the Yongin Semiconductor Cluster, and has also announced plans to invest 42 trillion won in Cheongju over the next four years.

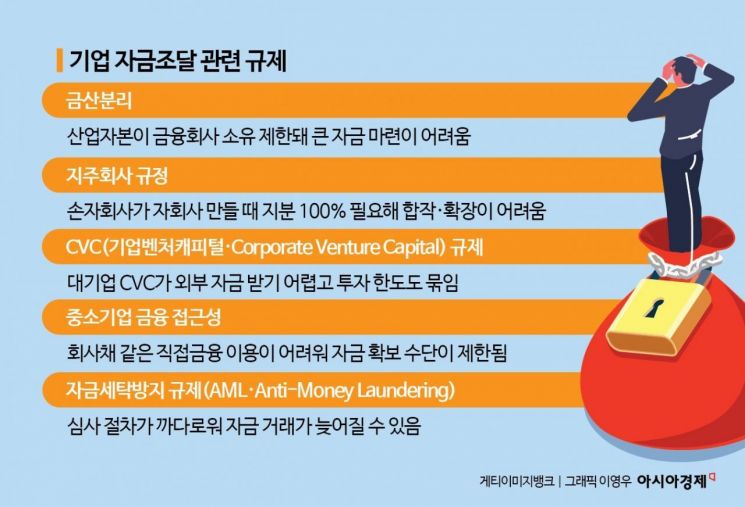

This trend is closely linked to the reality that companies' capital flexibility is severely restricted by holding company regulations and the separation of banking and commerce. Relevant ministries are reportedly preparing to announce measures as early as this week to adjust some aspects of these regulations. The explanation is that, with the scale of strategic industry investment increasing, the existing regulatory environment makes it difficult to supply the funds needed for large-scale business expansion.

The government is considering relaxing the current rule that requires a holding company's grandchild company to own 100% of its domestic great-grandchild company to a 'more than 50%' threshold. While the 100% rule is intended to curb excessive control by founding families, in the context of advanced industry investment, the cost of establishing new subsidiaries has become excessive, hindering business expansion. SK hynix and LG Energy Solution are cited as representative cases affected by this regulation.

There is also discussion of allowing general holding companies to own financial leasing companies. Under the current system, which applies the separation of banking and commerce principle, general holding companies cannot operate financial or insurance businesses. However, if financial leasing is permitted, companies could reduce initial costs by leasing equipment and facilities. Utilizing special purpose companies (SPCs) to attract investors could also become possible, which is expected to expand financing methods for advanced industries.

Meanwhile, criticism has persisted that domestic regulations are failing to keep pace with the speed of investment. This is because the scale of investment by global technology companies has grown to levels that Korean companies find difficult to match. TrendForce forecasts that major AI companies such as Google, Amazon, Meta, and Microsoft will spend 520 billion dollars (approximately 764 trillion won) in capital expenditures next year. The construction cost for a single semiconductor fab is also expected to exceed 100 trillion won.

Nevertheless, there is criticism that strategic capital utilization is being constrained in Korea due to ongoing discussions about mandatory treasury share cancellation and regulations such as the separation of banking and commerce and dual listing restrictions. A survey by the Korea Chamber of Commerce and Industry found that 62.5% of companies opposed mandatory treasury share cancellation, and 79.8% suggested fairer disposal of newly acquired treasury shares as an alternative.

An executive at a large corporation said, "It is difficult to cope with the era of advanced industries, which requires repeated investments of tens of trillions of won, under the current system." Another executive commented, "The more we grow, the greater the regulatory burden becomes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)