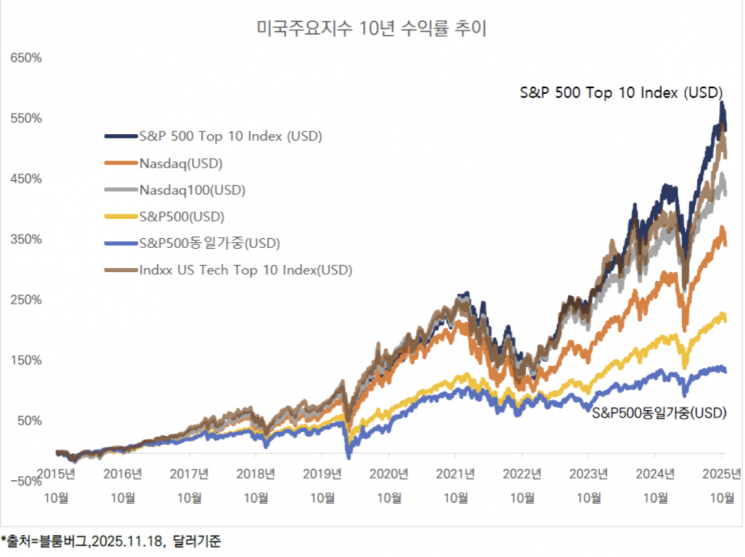

An analysis of the performance of major U.S. indices over the past ten years shows that the 'S&P500 Top 10' index, which consists of the ten largest mega-cap technology stocks by market capitalization, has delivered the highest returns and risk-adjusted returns. This result is attributed to the continued structural growth led by mega-cap technology companies in sectors such as artificial intelligence (AI) and semiconductors, with a concentrated portfolio yielding higher returns.

KCGI Asset Management announced on the 28th that, as of the 18th, a comparison of the returns of six major U.S. indices-S&P500 Top 10, Indxx US Tech Top 10, Nasdaq 100, Nasdaq, S&P500, and S&P500 (Equal Weight)-showed that the S&P500 Top 10 outperformed the others.

The S&P500 Top 10 index is composed of the ten largest companies by market capitalization among the constituents of the U.S. S&P500. Its one-year return was 27.1%, and its cumulative ten-year return reached 526.1%.

The Indxx US Tech Top 10 index, which tracks the top ten U.S. technology companies, posted a one-year return of 24.4% and a ten-year return of 486.9%.

The S&P500 (Equal Weight) index had the lowest ten-year return among the indices analyzed, at 134.7%. The effect of diversification, with investments spread evenly across a variety of stocks, resulted in relatively lower performance in the market's current 'winner-takes-all' environment.

Experts analyzed that the recent 'concentration on mega-cap technology stocks' phenomenon has been a key factor widening the performance gap between indices. The rapid surge in earnings by major technology companies such as Nvidia, Apple, Microsoft, and Google in AI infrastructure, semiconductors, and cloud sectors has significantly strengthened their market dominance, which in turn has greatly influenced index performance.

A representative from KCGI Asset Management explained, "As leading technology companies continue to invest heavily in data centers and compete in AI models, their market dominance will strengthen, further expanding their influence within the indices." The representative added, "For investors, it is advisable to consider the efficiency of a concentrated portfolio that reflects structural market trends, rather than relying solely on simple diversification."

In a comparison of the Sharpe ratios, which measure risk-adjusted efficiency, indices centered on the top ten stocks also stood out. The S&P500 Top 10 index recorded the highest ten-year Sharpe ratio at 0.95, followed by the Indxx US Tech Top 10. This indicates that, at the same level of risk, these indices delivered higher returns than the Nasdaq (0.82) and the S&P500 (0.75).

A KCGI Asset Management representative noted, "The S&P500 Top 10 includes some non-technology companies such as Berkshire Hathaway, which results in lower volatility compared to the Tech Top 10. As long as these structural factors persist, the dominance of mega-cap technology stocks is unlikely to weaken in the near future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)