The investment performance of top-tier retirement pension investors showed a stark contrast compared to that of general subscribers. The top-performing group achieved an average annual return of nearly 40% over the past year. High returns were driven by performance-based products and domestic theme-based ETFs.

According to the "Korea Retirement Pension Investment White Paper II" released by the Financial Supervisory Service on November 26, the top-tier retirement pension group recorded an average return of 38.8% over the past year and an average annual return of 16.1% over the past three years, significantly outperforming the overall subscriber averages of 4.2% for one year and 4.6% for three years.

As of June this year, the Financial Supervisory Service selected defined contribution (DC) subscribers who have maintained their accounts for more than three years and have a balance of at least 10 million won at representative banks, securities companies, and insurance firms. These selected subscribers were then divided into five age groups, and the top 100 performers in each group were chosen based on their returns, resulting in a total of 1,500 individuals designated as the top-tier retirement pension group.

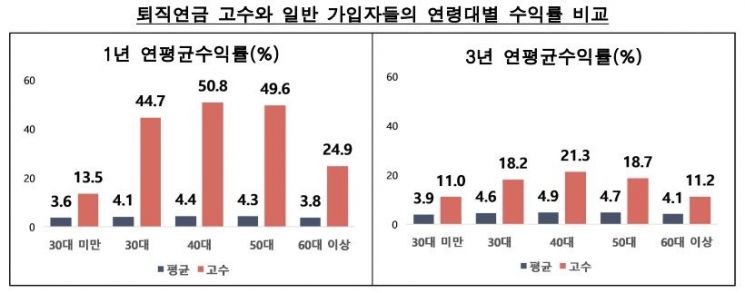

By sector, securities companies posted the highest average annual three-year return at 18.9%, followed by banks at 15.1% and insurance firms at 13.1%. By age group, those in their 40s achieved the highest returns at 21.3%. In contrast, younger workers under 30 and those over 60 nearing retirement tended to allocate a larger proportion of assets to stable investments, resulting in lower returns.

Additionally, these top investors allocated a very high proportion-79.5%-of their portfolios to performance-based products such as funds and bonds. The proportion of idle funds was also relatively high at 8.6%. The Financial Supervisory Service analyzed that these investors maintain liquid assets to respond quickly to changing market conditions.

A closer look at the details of domestic fund investments showed a strong concentration in theme-based products such as shipbuilding, defense, and nuclear power. These sectors have been actively incorporated into investment strategies, as they are expected to benefit in the stock market following the inauguration of the Trump administration in the United States this year. For overseas funds, investments were mainly focused on U.S. big tech stock-related funds.

By type of collective investment securities, exchange-traded funds (ETFs) accounted for 75.1%, while public offering funds made up 24.9%. In fact, eight out of the top ten most popular collective investment products among top performers were ETF-type products. Target date funds (TDFs), which are generally preferred for long-term investments, were not favored by these aggressive investors.

By age group, young top performers displayed distinct investment patterns. Those under 30, who typically have less investment experience, allocated most of their portfolios to U.S. index ETFs such as the Nasdaq and S&P 500. Investors in their 30s and older actively managed their portfolios with theme-based ETFs in sectors like shipbuilding and defense, or with funds related to blue-chip companies such as Tesla. Among those over 60, theme-based ETFs still accounted for a high proportion of their portfolios, but there was also a trend toward a more balanced portfolio by increasing allocations to high-dividend and China-related funds.

The Financial Supervisory Service commented, "Most workers may find it difficult to manage their retirement pension portfolios as actively as top-tier investors. However, it is advisable to pay attention to market changes and manage your funds more proactively than now. When necessary, actively utilizing products offered by financial companies and experts can also be a good strategy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)