Hana Institute of Finance Report

Record-High Foreign Currency Deposits

Individual Investors Taking High Risks Centered on U.S. Stocks

"Government Should Prevent Illegal Investment Advisory Chat Rooms and Stabilize Foreign Currency Supply and Dema

With individual investors’ overseas stock investments reaching an all-time high, the trend of expanding investments centered on the United States is expected to continue for the time being. As a result, there are calls for stronger investor protection and measures to stabilize the foreign exchange market.

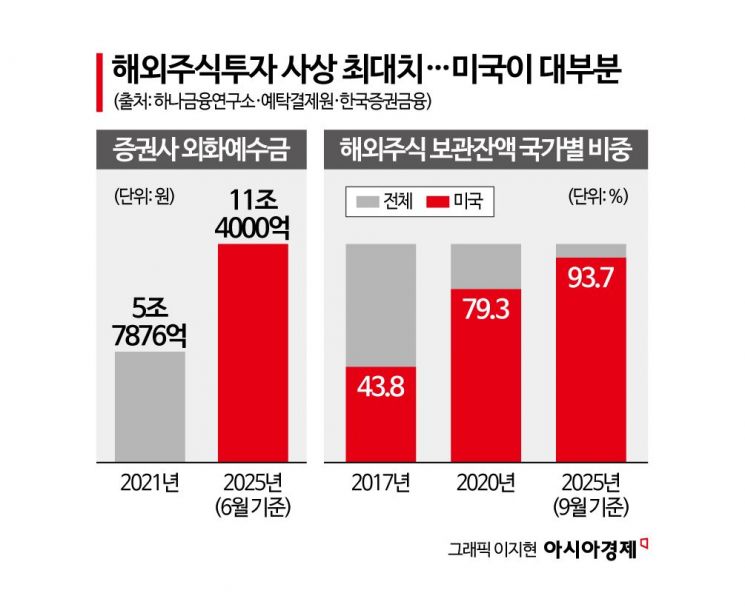

Lee Jaewan, a research fellow at Hana Institute of Finance, stated in a recent report titled "The Unstoppable Run of Seohak Ants" that "in order for overseas stocks to become a means for individual investors to build mid- to long-term assets, it is necessary to establish a mature investment culture." According to Lee, overseas stock investment has shown rapid growth and has become a major investment destination for individual investors. Data from the Korea Securities Depository shows that the amount of overseas stock trading increased nearly tenfold, from $40.99 billion (approximately 6.0135 trillion won) in 2019 to $530.84 billion last year, and $466.19 billion as of September this year. As more investors seek opportunities to buy overseas, foreign currency deposits have also reached record highs, rising from 578.76 billion won in 2021 to 1.14 trillion won as of June this year-more than doubling. Foreign currency deposits refer to funds that investors deposit in securities accounts for overseas stock investments.

Lee explained that individual investors are building portfolios centered on the United States and are not hesitant to pursue high-risk investments. As of September this year, U.S. stocks accounted for 93.7% of all overseas stocks held by individual investors, up from 43.8% in 2017 and 79.3% in 2020. The balance of high-risk stocks held increased from $190 million in 2020 to $12.03 billion as of September this year. There is also a noticeable concentration in certain stocks. Individual investors favor major technology stocks, particularly the so-called Magnificent 7 (Tesla, Nvidia, Meta, Amazon, Microsoft, Alphabet, and Apple). The proportion of major technology stocks among individual investors’ overseas holdings was 34.4% at the end of 2020, 41.2% at the end of last year, and 35.5% as of September this year.

Lee cited several reasons for the surge in overseas stock investment: trust in the U.S. market, the growing perception of U.S. tech stocks as "symbols of growth," regulatory differences, and improved trading convenience. Over the past five years, the average index returns of major stock markets were 14.2% for the S&P 500 and 20.9% for the Nasdaq, outpacing the Nikkei (11.8%) and KOSPI (3.7%), further strengthening the preference for U.S. assets. He also pointed out that the empirical belief that U.S. tech stocks guarantee high returns is being reinforced through social networking services (SNS). In addition, domestic regulations such as minimum deposit requirements, mandatory online education, leverage ratios, and stock composition do not apply to overseas-listed exchange-traded funds (ETFs), and the convenience of trading through mobile trading systems (MTS) has also increased.

Lee predicted that the trend of expanding overseas stock investments centered on U.S. tech companies will continue for some time. This is because the U.S. government is increasing support for semiconductors and technology infrastructure, which will further improve the profitability of U.S. companies. He argued that the government should strengthen investor protection by preventing illegal investment advisory chat rooms and stabilizing foreign currency supply and demand. Since there is a proliferation of illegal investment solicitation content, such as overseas stock advisory chat rooms and YouTube channels, he stressed the need for stricter monitoring and enforcement. He also suggested that as the expansion of overseas stock investment could exacerbate imbalances in foreign currency supply and demand, measures to stabilize the foreign exchange market should be considered. Lee emphasized that individual investors should avoid concentrating on specific stocks or high-risk leveraged investments, and instead approach overseas stock investment with a focus on risk diversification and long-term strategy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)