Budget Reduced by Approximately 153.7 Billion Won from Initial Proposal

Shipbuilding Cooperation Fund Plans Not Yet Finalized, Leading to Cuts

Korea Development Bank Regional Revitalization Fund Scaled Back Due to Poor Performance

Sunshine Loan Interest Rates Down to 9.9% at Most... Budget Increased by 100 Billion Won

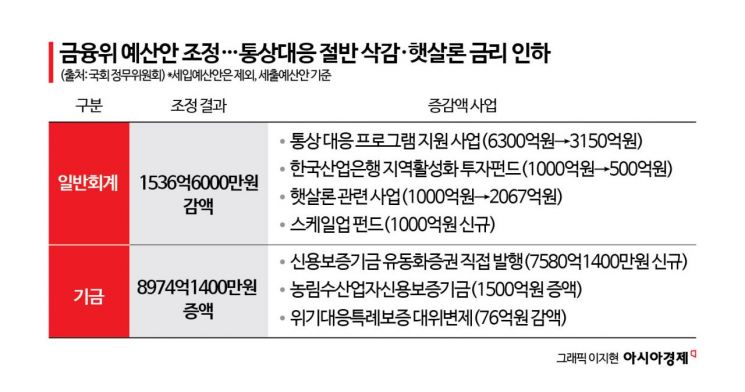

The National Assembly’s Political Affairs Committee has cut half of the budget allocated to the Korea-US tariff negotiation response program under the Financial Services Commission’s budget. In contrast, the budget for the newly restructured Sunshine Loan program has been increased to lower interest rates.

On the afternoon of November 13, the committee held a plenary session at the National Assembly and approved next year’s budget plans and fund operation plans for the Financial Services Commission and other relevant ministries. After a preliminary review of the FSC’s general account expenditure budget, the committee adjusted the budget from the original 5.2961 trillion won to 5.14244 trillion won, a reduction of 153.66 billion won.

The total reduction amounted to 365 billion won, primarily from the trade response program support project (reduced from 630 billion won to 315 billion won) and the Korea Development Bank’s regional revitalization investment fund (reduced from 100 billion won to 50 billion won). The trade response program support project was criticized for lacking detailed business content. This is because the annual fiscal input and investment plans for the Shipbuilding Cooperation Fund will be finalized through consultations with the United States. This project is a new initiative in which the Korea Development Bank invests funds to establish the Shipbuilding Cooperation Fund and other related funds created as a result of the Korea-US tariff negotiations. Such concerns were already raised in the preliminary budget review report. Jeong Myungho, Chief Policy Advisor of the Political Affairs Committee, stated in the report, “Since the basic requirements of the project have not been finalized, it is difficult to discuss the appropriate budget size.”

The Korea Development Bank’s regional revitalization investment fund was also subject to cuts because project selection, sub-fund formation, and investment execution have been extremely sluggish over the past two years, making it possible to continue the project next year with the existing investment budget. This project aims to invest in regional development projects discovered and led by local governments and the private sector.

For nine projects, a total of 211.34 billion won was added. First, in order to lower the interest rate on the Sunshine Loan Special Guarantee, the budget for the Sunshine Loan Special and Sunshine Loan Youth projects was increased by 106.7 billion won. The plan is to lower the interest rate from the current 15.9% to 12.9%, and for socially disadvantaged groups such as basic livelihood security recipients and those in the lower-income bracket, the rate may be reduced to as low as 9.9%. In addition, 100 billion won was newly allocated to create a Scale-Up Fund to provide capital to late-stage venture companies and small- and medium-sized enterprises. This amount will serve as seed money for the growth capital fund and will be invested by the Korea Development Bank. The FSC plans to create a 1 trillion won fund for these companies by combining 200 billion won from the Korea Development Bank’s own resources and 700 billion won in private capital.

Meanwhile, the committee also adjusted the fund operation plans, which are separate from the general account. The budget for the Credit Guarantee Fund’s crisis response special guarantee subrogation project, which supports companies suffering from liquidity shortages due to tariff damages, was reduced by 7.6 billion won. However, 758.014 billion won was newly allocated for a project in which the Credit Guarantee Fund will directly issue asset-backed securities using a trust structure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)