Expansion of Paid Carbon Emission Allowances to 50% for Power Generators

Industrial Sector Faces Additional 3 Trillion Won in Electricity Costs

Manufacturing Industry on Alert Over Increased Carbon Allowance Purchases

Steel Industry Risks L

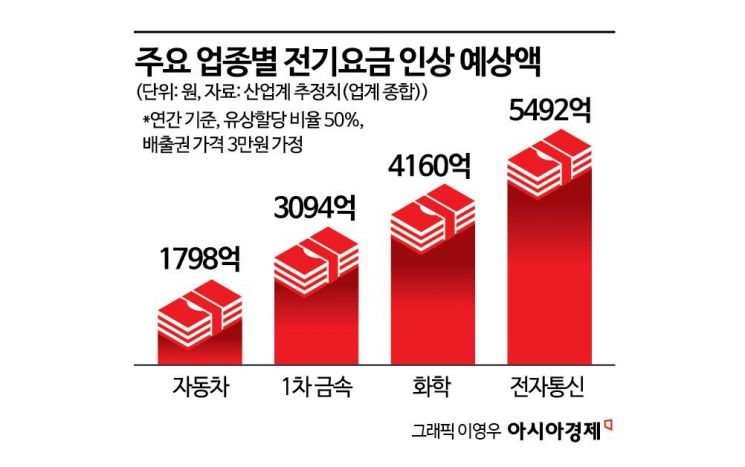

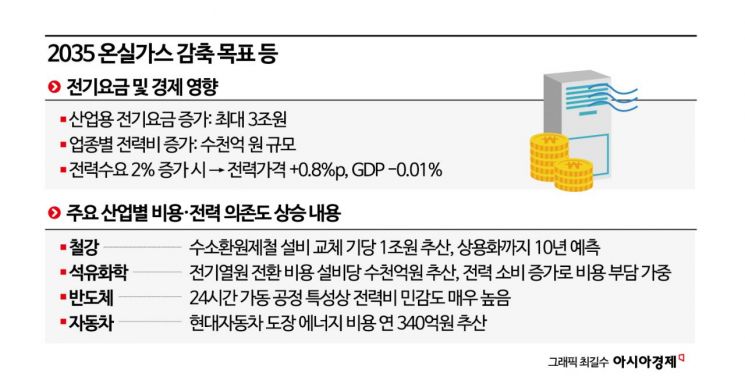

There are projections that, if the government expands the proportion of paid carbon emission allowances in the power generation sector to 50%, the annual burden of industrial electricity rates could increase by up to 3 trillion won. Until now, power generation companies have only been required to purchase and use 10% of their carbon emission allowances, but the government now plans to raise this proportion to 50%. Previously, the government announced its greenhouse gas reduction targets for the industrial sector by 2035 and, as a concrete implementation measure, proposed expanding the proportion of paid emission allowances. However, the industrial sector is pushing back, arguing that increased costs for power generators will inevitably lead to higher electricity rates, which will ultimately harm manufacturing industries. If the cost of emission allowances that power generators must purchase is reflected in power generation costs, the electricity costs for major sectors such as steel, chemicals, and electronics could each increase by several hundred billion won.

According to industry sources on November 13, the petrochemical industry, which is a major energy consumer, is hesitant to replace the heat sources in its naphtha cracking centers (NCCs). More than 70% of the petrochemical sector’s greenhouse gas emissions come from the process of cracking naphtha. To reduce these emissions, preparations are underway to switch heat sources to electricity, but if electricity rates rise, the increased cost burden could disrupt these plans.

If the proportion of paid emission allowances is raised to 50% as per government policy, the cost pressure is expected to intensify further. In the petrochemical industry, total energy costs, including fuel, account for up to 20% of manufacturing costs, indicating a high dependence on energy. Among these, electricity costs are about 3-4%, which is roughly twice as high as in the semiconductor or automotive sectors. The increase in industrial electricity rates last year alone resulted in an additional annual burden of 170 billion won. If the cost of purchasing emission allowances is added, an additional annual burden of about 350 billion won is expected.

The steel industry is also grappling with a structure in which reducing carbon emissions leads to higher electricity costs. To cut greenhouse gases, decarbonization processes such as hydrogen-based reduction steelmaking or electric arc furnaces must be used, both of which are highly dependent on electricity. The steel industry emits about 100 million tons of greenhouse gases annually. To meet government targets, it must reduce emissions by about 25 million tons by 2035, which requires converting blast furnaces to hydrogen-based reduction steelmaking facilities. However, according to industry sources, replacing just one facility costs over 1 trillion won and commercialization will take more than 10 years. One steel industry official said, "Commercializing hydrogen-based reduction steelmaking will take at least another 10 years, but the government’s targets come sooner. If the burden on companies continues to grow like this, the very foundation of production could be shaken."

The steel industry estimates that, if the burden of paid emission allowances becomes significant, additional annual costs could reach 600 billion won. Assuming conservatively that the price of emission allowances rises from the current 10,450 won per ton (as of today) to the 30,000-won range, electricity rates would increase by about 9.41 won per kWh, and for the two major steelmakers, POSCO and Hyundai Steel, the additional annual burden alone would reach 300 billion won. This would erode about 20% of their annual operating profits (based on last year’s figures).

There are also considerable concerns in the electrical and electronics industries that they will be hit hard. Among them, experts predict that companies operating in the semiconductor and display sectors will face a significant burden. Because semiconductor factories must operate 24 hours a day, any increase in electricity rates could cause production costs to skyrocket. In display manufacturing, a large amount of electricity is used during the stage of testing the performance of finished products. An industry insider said, "Right now, demand for domestic artificial intelligence (AI) data centers is rising, and the completion of the Yongin semiconductor cluster is approaching, but there isn’t even a proper plan for electricity supply. With the added issue of decarbonization, the electricity challenge is becoming even more complex."

Previously, the Korea Chamber of Commerce and Industry’s Sustainable Growth Initiative (SGI) predicted in its report, "Analysis of the Effects of Increasing Power Demand and Productivity in the Power Industry," that if the electricity supply network cannot be expanded, every 2% increase in power demand will cause electricity prices to rise by about 0.8 percentage points above the general inflation rate, and gross domestic product (GDP) to decrease by 0.01%. Park Kyungwon, a research fellow at SGI, emphasized, "In electricity-intensive industries such as semiconductors and displays, where the proportion of electricity costs in manufacturing is high and substitution with other energy sources is difficult, the burden of production costs could increase sharply, potentially leading to a contraction in production."

The automotive industry is also struggling with the "painting" process, where color is applied to car bodies. In this stage, high heat of up to 180 degrees Celsius must be applied for about one hour. For Hyundai Motor, carbon dioxide emissions from this process reach about 870 tons, accounting for half of the company’s total manufacturing process emissions. If electricity rates rise, the cost burden will inevitably increase. Currently, Hyundai Motor’s annual energy-related costs for the painting process are estimated at about 34 billion won. The company plans to gradually introduce low-temperature painting processes from next year to reduce costs, but the consensus is that it will be difficult to avoid the increased burden from higher electricity rates. An industry official said, "A high-temperature work environment is essential for ensuring vehicle durability and preventing issues such as discoloration. We are now in a situation where we need to switch to working at temperatures about 20 degrees lower than before in order to reduce electricity costs," he added.

If pressure to raise electricity rates increases, the movement of companies to exit the electricity market is expected to accelerate. In fact, as industrial electricity rates have risen sharply recently, manufacturers are increasingly considering direct power purchase agreements (PPAs) with power producers instead of buying electricity supplied by Korea Electric Power Corporation. There is growing interest in this approach, as not only renewable energy PPAs but also general electricity can be secured at prices lower than the market rate. An industry insider said, "If electricity rates rise further from current levels, not only large corporations but also mid-sized manufacturers will have no choice but to consider switching to PPAs. The structure of the electricity market could fundamentally change."

Going forward, the government plans to support industrial transition by simultaneously implementing carbon contracts for difference (CCfD), green equipment tax credits, and measures to stabilize industrial electricity rates. However, the specific scale and timing of such support have not yet been determined. Some sectors plan to start by improving energy efficiency and optimizing processes, rather than immediately investing in new facilities. POSCO and Hyundai Steel intend to expand by-product gas recycling and heat recovery systems, while the petrochemical industry plans to enhance process control based on smart plants and improve waste heat recovery rates. However, these measures are expected to reduce emissions by only about 10-15% of the total. A representative from the Korea Chemical Industry Council said, "Further detailed adjustments are needed to determine how much each sector should contribute to reductions. It will be challenging, but we will strive to meet the established targets," he said.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)